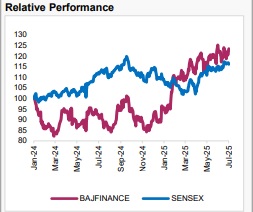

Buy Bajaj Finance Ltd for the Target Rs. 1,050 - Axis Securities Ltd

Delivering Strong Growth While Navigating Headwinds

Summary

FY25 was marked by yet another consistent and strong performance delivery by BAF across operational parameters. The company resumed its growth trajectory post the lifting of the restrictions on 2 of its products (eCOM and InstaEMI) in early FY25 (May’24). AUM growth was strong across segments, while the company did not shy away from holding back growth in segments where elevated stress was visible. Asset quality challenges were present owing to unfavourable macros and customer over-leveraging. However, BAF was able to navigate these challenges and deliver pristine asset quality performance during the year. BAF continues to strengthen its presence in the lower-risk secured segments, while ensuring profitable growth delivery. BAF delivered a strong RoA/RoE of 4.6/19.4% in FY25.

Key Highlights

• Financial Performance: BAF added 18 Mn (+25% YoY) new customers during FY25, increasing the total customer base to 102 Mn (+22% YoY). New loan bookings stood at 43 Mn, growing at a healthy pace of 20% YoY. Consequently, AUM growth was robust at 25% YoY in FY25, with growth visible across segments. Risks emerged in the Rural B2C segment, and the company consciously decided to wind down the captive 2/3 Wheeler business, resulting in the company slowing down growth in these segments. It is gradually increasing its presence in secured segments and has also terminated its co-branded credit card partnership with DBS and RBL, with the intention to maintain a balanced mix of secured vs unsecured loans. The company maintains a strong pipeline of new product introductions for FY25. NII growth was slower compared to AUM growth due to NIM compression of ~49 bps over FY25. Non-interest income growth was healthy at 28% YoY, driven by strong traction in fee income (+14% YoY). Opex grew by ~21% YoY. With operating leverage gradually kicking in, the C-I Ratio improved to 33.2% vs 34% in FY24. PPOP grew by 25.5% YoY. Provisions grew by ~72% YoY, with credit costs at 2.2% compared to 1.6% YoY. This growth was due to the strengthening of the ECL model and emerging stress in certain segments. Earnings growth remained healthy.

• Asset Quality: BAF has maintained pristine asset quality with GNPA at sub-1% levels, despite visible stress in the rural B2C business, captive financing business, and macro headwinds due to customer over-leveraging. The company made a conscious effort to curtail lending and tightened credit filters in this segment. Apart from the Rural B2C business, all other segments continue to exhibit healthy asset quality. GNPA/NNPA stood at 0.96%/0.44% in FY25 vs. 0.85%/0.37% in FY24.

• Operational Review: Risk-weighted assets (RWA) stood at Rs 3,89,981 Cr (+24% YoY), constituting ~83.7% of total assets, flat YoY. Tier I/CRAR stood at 21.9/21.1%. The company continued to strengthen its distribution franchise and was present in 4,263 locations across the country, including 2,681 locations in rural/smaller towns and villages. During the year, BAF continued to expand its product offering for customers with new launches including (i) Vehicle leasing for corporates, (ii) Industrial equipment financing, (iii) Solar financing, (iv) Commercial vehicles financing, and (v) Bharat mortgages.

Key Competitive Strengths: (a) Strong distribution, (b) Omni-channel strategy augmenting market positioning, (c) Deep understanding of both rural and urban markets, (d) Diversified portfolio, (e) Strong cross-sell franchise, and (f) Best-in-class Asset Quality. Growth Drivers: (a) Improving share of NBFCs in overall credit to GDP (%), (b) Strong growth runway for retail credit backed by expectations of improving share of retail credit to GDP (%), (c) New Product launches in-line with successful execution of the Long Range Strategy (LRS), enabling BAF strengthen its market position, (d) Strong Capital Adequacy to fuel medium term growth without dilution, and (e) Strong risk management framework to keep asset quality under check and support earnings growth.

Outlook & Valuation

We expect BAF to continue its strong and consistent growth trajectory, while reporting a 25% CAGR in AUM growth over the medium term, with contribution from the core existing products and a further push from the scale-up of the new products. We expect BAF to deliver a strong AUM/NII/Earnings growth of 25/26/25% CAGR over the medium term, driven by (i) Steady to marginally improving NIMs, (ii) Operating leverage driving cost ratio improvement, and (iii) positive outlook on asset quality keeping credit costs under control. We expect BAF to deliver a RoA/RoE of 4.4-4.6%/19-21%, broadly in line with the management’s long-term guidance. We reiterate our BUY recommendation on BAF, valuing the stock at 4.9x FY27E ABV to arrive at a target price of Rs 1,050/share, implying an upside of 14% from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633