Buy Equitas Small Finance Bank Ltd For Target Rs. 81 - Centrum Broking Ltd

NII print came in at Rs8.3bn (+6% YoY/+1% QoQ) was were below our expectations due to change in advances mix. Resultantly, going ahead as well Yields on advances are expected to be under pressure in spite of as bank having 89% fixed book. We have baked in marginal dip in NIMs for FY26. Opex at Rs7.4bn (+14% YoY/+3% QoQ). As per the management, most of the large investments on product/tech front are behind and additional investments in these should be nominal. PPoP came in at Rs3.1bn (-17% YoY/-7% QoQ). Credit costs of Rs2.6bn hit PAT at Rs421mn (down 80% YoY/37% QoQ). The quarterly gross slippage ratio peaked in Q3 (~6.7%) and eased to ~6.1% in Q4. Looking ahead to FY26/27, we bake in better performance, supported by: 1) uptick in MFI cycle; 2) leverage on comfortable LDR positioning; and 3) CoF is expected to come down after a few quarters as repricing of deposits and lower rates take effect. We believe that bank will increase its PCR from current levels hence have higher credit cost (read 1HFY26) and therefore we foresee a slow recovery in the bank’s return metrics, ~1.0% RoA and 9% RoE in FY26. To factor in these changes, we have cur our estimates for FY26/27. We lower our target price to Rs81 (previously Rs97), applying a 1.3x multiple (earlier 1.5x) to FY27E ABV. We maintain BUY.

Weak earnings amid higher credit cost

NII came in at Rs8.3bn (up 6%/1 YoY/QoQ) below our expectations of Rs7.6bn. Opex for the quarter came in at Rs7.4bn (up 14%/up 3% YoY/QoQ) that is below our expectations of Rs7.7bn Resultantly, CTI for the quarter was at 70.5% vs. 68.5% in 3QFY25 vs. below our expectations of 73.4%. PPoP came in at Rs3.1bn, (down 17% / down 7% YoY/QoQ) vs. our expectations of Rs2.8bn.Credit cost came in higher at Rs2.6bn (+142%/6% YoY/QoQ) vs. our expectations of Rs2.2bn. PAT came in Rs421mn vs. above our expectations of Rs233mn.

Asset quality trend-segmental

Microfinance: SMA 0 saw a QoQ improvement from ~2% to ~1.9%. However, SMA 1/2 ratio continue to climb sharply – from ~1.5%/2.7% in 3QFY25 to ~2.5%/3.4% by 4QFY25. This indicates 1HFY26 would witness elevated credit cost from MFI segment. Non-MFI (secured lending): SMA 0 remained high (around 4%+ through FY25) and SMA 2 stayed low (~1.5–1.7%), reflecting relatively healthy asset quality outside microfinance.

Movement in segmental PCR indicate dip in Non-MFI PCR

MFI’s PCR has been rising – from ~69% in Q1 to ~87% in Q4, reflecting aggressive provisioning. By contrast, SBL and HL PCRs are low (~26–28% down 200/300bps YoY), suggesting limited cushion if their GNPAs rise. VF PCR dipped in H1FY25 but shot up to ~55% in Q4. The NBFC book remains fully covered (100% PCR). However, management has indicated that the credit cost for Non-MFI segment has been 1% in FY25 and is expected to be in that range given it’s a seasoned book, witnessed multiple cycles and it’s BAU in the segment.

Outlook – Advances pivoting towards secured lending

FY27, we believe Bank has many things under better control. To highlight a few, CE in MFI has come back to near normal and expected credit costs should settle down to normal levels by third quarter of FY26. Size of the microfinance book is expected to reduce from the current 12% of loan book to single digit. SBL, used cars and used CV finance continues to grow profitably with credit cost under control. AHF and MSE finance is expected to turn profitable this year. We maintain BUY as business model as transition towards secured book.

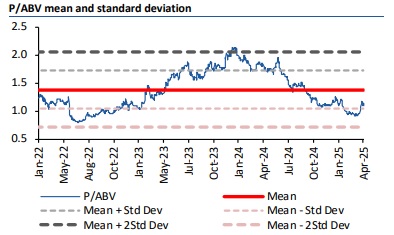

Valuations

We believe that bank will increase its PCR from current levels hence have higher credit cost (read 1HFY26) and therefore we foresee a slow recovery in the bank’s return metrics, ~1.0% RoA and 9% RoE in FY26. To factor in these changes, we have cur our estimates for FY26/27. We lower our target price to Rs81 (previously Rs97), applying a 1.3x multiple (earlier 1.5x) to FY27E ABV. We maintain BUY.

For More Centrum Broking Disclaimer https://www.centrumbroking.com/disclaimer/

SEBI Registration No.:- INZ000205331

.jpg)