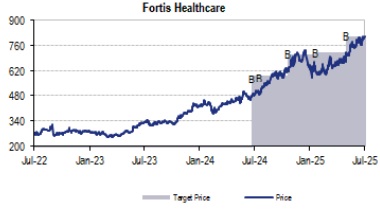

Buy Fortis Healthcare Ltd For Target Rs. 810 By JM Financial Services

Fortis Healthcare has taken a strategic step forward by entering into an O&M agreement with Gleneagles Hospitals, securing the management rights of its five hospitals and 1 clinic across India. This partnership is expected to bring operational synergies and incremental financial benefits to Fortis. Under the terms of the agreement, Fortis will oversee these facilities— which together comprise approximately 700 operational beds (~15% of current operational beds),—in exchange for a 3% management fee based on revenue. This deal represents Incremental EBITDA potential of 1.5% of Fortis’ overall FY25 EBITDA. With Fortis currently trading at valuations in line with industry averages, and with on-going enhancements in both – scale and performance metrics anticipated, the outlook remains positive. We have a BUY rating on Fortis, confident in its capacity for sustainable growth and value creation.

* Management Deal: Fortis Healthcare has entered into an O&M agreement to manage five Gleneagles hospitals in India, for a management fee of 3% of revenue.

* Scope of Hospitals: The agreement covers hospitals with approximately 700 operational beds, excluding the 200-bed Mumbai facility. The hospitals being covered are – Kengeri (Bengaluru, Karnataka), Richmond Road (Bengaluru, Karnataka), Lakdi-Ka-Pul (Hyderabad, Telangana), L.B. Nagar (Hyderabad, Telangana), Perumbakkam – Sholinganallur (Chennai, Tamil Nadu). The clinic is situated in Adyar (Chennai, Tamil Nadu).

* Financial Impact: In FY25, these five hospitals generated INR 7.2bn in revenue, which could translate into an incremental contribution of ~INR 215mn to Fortis' revenue and EBITDA (1.5% of Fortis’ FY25 EBITDA). Given the scale and maturity of these assets, the management fee is slightly lower than the typical 4–5% industry norm.

* Strategic Rationale: Operational Efficiency: In our view, Fortis operates with higher occupancy rates and better EBITDA margins compared to Gleneagles, suggesting potential for improved performance under Fortis management. Geographic Synergy: The deal strengthens Fortis’ presence in key cities where it already operates, enhancing its network advantage. Future Integration: In our understanding, should there be plans to merge sister entities in the future, this agreement positions Fortis with first-hand operational experience of these units.

* Valuation & View: At the current market price, Fortis trades at 26x FY27E and 22x FY28E EBITDA, broadly in line with the industry average. We believe, there is scope for multiple expansion as both operational and financial metrics improve over time. We have a BUY rating on the stock.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361