Buy V-Guard Industries Ltd For Target Rs. 393 By Geojit Financial Services Ltd

Stable performance...margin to improve

V-Guard Industries Ltd. (VGIL) is one of the leading players in the electrical consumer durables space. Major product segments include Stabilizers, Cables & Wires, UPS, Pumps and Electrical Appliances.

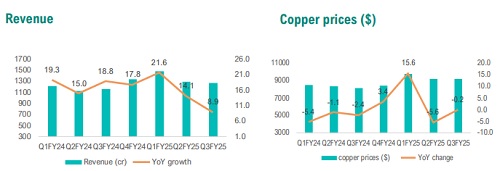

* In Q3FY25, VGIL reported a stable 9% YoY revenue growth led by the electronics segment. However, wires & consumer durables were impacted by higher inventory in channels, volatility in copper prices, and muted consumer demand.

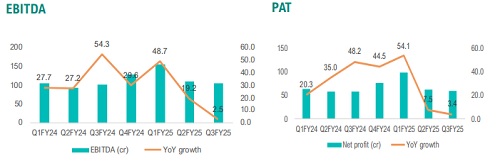

* Despite a 230bps YoY improvement in gross margins, EBITDA margin declined by 50bps YoY to 8.2% due to higher employee & other expenses.

* Given lower operating performance and higher depreciation expenses, reported net profit grew by a modest 3.4% YoY.

* We anticipate recovery starting from Q4, led by strong summer demand leading to better scale and improved margin performance.

* We anticipate FY26 to see better growth led by a pick-up in government spending, healthy demand from the construction sector, and summer products that will drive growth in the near term.

Outlook & Valuation

We anticipate a revival in the electrical segment as RM prices stabilize and the inventory situation improves. Strong summer sales and revival construction demand will drive growth. VGIL’s long-term outlook is improving, given its increasing share of manufacturing, penetration in non-South markets, strong cash flow, and healthy balance sheet. We value VGIL at a P/E of 34x on FY27E and upgrade to BUY from Accumulate, given a healthy earnings outlook of 28% CAGR over FY25E-27E with a target price of Rs.393.

*over or under performance to benchmark index

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345