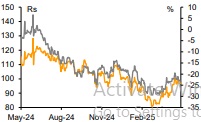

Buy Canara Bank Ltd Fpr Target Rs. 120 By Emkay Global Financial Services Ltd

Canara Bank posted a 20% beat on earnings at Rs50bn/1.3% RoA, mainly aided by treasury gains/recovery from written-off loans and provision reversal on SR investments. Credit growth outpaced expectations at 12.6% YoY/2.5% QoQ, while deposit growth was strong at 11% YoY/6.4% QoQ. This, coupled with higher loan yields, led to nearly flat NIMs at 2.7% after a steady fall for the past two quarters, akin to BOB/PNB. The bank’s headline asset quality continues to improve, with GNPA ratio down by 40bps QoQ to 2.9% due to higher write-offs, while specific PCR surged by 258bps QoQ to 77%. We revise up FY26-28E earnings by 5-7%, while we expect the bank to deliver a healthy 0.9-1.1% RoA over FY26-28E We retain BUY with unchanged TP to Rs120, valuing the standalone bank at 0.9x Mar-27E ABV and subs at Rs6/sh.

Healthy business growth with steady margins

Canara Bank posted healthy credit growth of 12.6% YoY/2.5% QoQ (owing to strong retail growth). Due to recent changes in PSL guidelines, the bank has reclassified some agri gold loans to retail gold loans and could thus reduce PSL outflow in future. However, commission rates have gone up on agri PSL due to lower supply and may thus not have much of an impact on PSLC fees, which are otherwise a healthy source for Canara Bank and Indian Bank. Deposit growth too was healthy, at 11% YoY/6.4% QoQ, with CASA ratio improving by 94bps QoQ to 28.5% (primarily led by robust 64% QoQ growth in CA). This, coupled with higher loan yields and interest on excess liquidity deployed with the RBI/inter-bank money markets, led to nearly stable NIMs at 2.7%. Going forward, the bank expects gross advances growth of 10-11% and deposit growth of 9-10%.

Asset quality, PCR continues to improve

Gross slippage was slightly higher QoQ at Rs27bn/1.2% of loans due to slight uptick in SME NPAs on technical grounds, but higher write-offs led to reduction in GNPA ratio by ~40bps QoQ to 2.9%. The overall SMA book too improved a bit, to Rs103bn/1% of gross advances (vs Rs120bn/1.14% of gross advances in Q3), but remains elevated vs peers, primarily due to inclusion of two government a/cs and one corporate a/c, aggregating to Rs70bn. The management endeavors to maintain its GNPA/NNPA ratio below 2.5%/0.6%, respectively, in FY26.

We retain BUY on the stock

We raise earnings for FY26-28E by ~5-7%, factoring in the better treasury gains/NPA recoveries and lower LLP. Thus, we expect the bank to deliver 0.9-1.1% RoA over FY26- 28E. We retain BUY, with an unchanged TP of Rs120, valuing the standalone bank now at 0.9x FY27E ABV and subsidiaries at Rs6/share. Key Risks: Slowdown in growth, lower margins due to macroeconomic challenges, and higher-than-expected increase in provisioning due to the ensuing ECL impact.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354