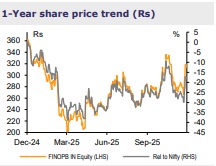

Add Fino Payments Bank Ltd for the Target Rs.330 By Emkay Global Financial Services Ltd

The RBI has granted in-principle approval to Fino PB for its conversion into a Small Finance Bank (SFB), which should positively ease restrictions on deposits (mobilization of SA of >Rs0.2mn and Term Deposits) and, most importantly, build a full-fledged lending business (MSME, LAP/mortgage), apart from continuing with its existing payment business. Though broad conditions of the license and business transition plan are yet to be revealed, per earlier interactions, the bank targets a lending AUM of Rs50bn over FY28–30, which is likely to contribute 20-25% of revenue by the end of 3Y of SFB operations. This transition is expected to materially improve the bank’s margin, RoA, and RoE profiles, given its low-cost advantage and replacement of low-yielding investment book by loans. However, in the interim (over FY26-27E), higher opex to transition into SFB, discontinuation of the BC business, and continued cannibalization of its remittance/MATM/AEPS business by rising adoption of digital payments could keep RoA under pressure. We believe that unlike existing SFBs, Fino could emerge as a differentiated SFB with a payments business (spearheaded by the DPS business), stronger liability/CASA (a challenge for most SFBs), and a healthy secured lending (mortgage, etc) business (given cost advantage), thereby leading to higher RoE in the long term (~17% in FY28E as an SFB from 13-14% now). We retain ADD on Fino while raising our TP by 10% to Rs330 from Rs300 earlier, now valuing it on 2.6x Dec-27E ABV and 18x P/E.

SFB model to ease restrictions on the deposit and lending businesses As an SFB, Fino will need to maintain promoter (Holdco) shareholding of at least 40% for the initial 5Y (to be reduced to 26% within 15Y), adhering to a 26% cap on individual voting rights, obtaining RBI approval for any stake acquisition of 5% or more, and ensuring 60% of its ANBC qualifies as PSL. The shift to an SFB model will remove deposit restrictions (cap of Rs0.2mn on SA shall be lifted and mobilization of TD shall be allowed), while enhancing its target customer segment, including salaried and self-employed customers in urban/metro areas. Additionally, the bank will be able to offer loans instead of just investing its funds in G-Secs and other banks under the PB model, thereby leading to better margins and boosting RoA/RoE in the long run.

Fino to emerge as a unique SFB with a payment (fee) cum lending business Per its strategy, Fino would remain a payment-dominated bank in the initial years of its transition and gradually build the lending business tied to its existing customer base, to ensure portfolio quality and profitability. The bank aims to steadily build a lending AUM of Rs50bn over FY28-30, comprising 65-70% MSME loans and 30-35% LAP/mortgages, contributing 20-25% of total revenue by the end of 3Y of SFB operations. We believe that initially, the loan portfolio will carry a higher blended yield, given the MSME loans, while a strategic shift toward secured lending will lead to some yield moderation, partly offset by reduction in funding cost. We estimate the bank’s loan AUM CAGR at ~125%, from Rs10bn in FY28E to Rs50bn in FY30E; NIM would improve ~6% from 3% and drive up a long-term sustainable RoE (>16-17%).

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354