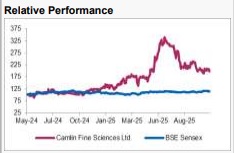

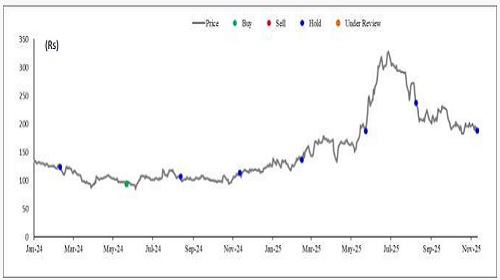

Hold Camlin Fine Sciences Ltd For Target Rs. 195 - Axis Securities Ltd

Margin Recovery Still Distant

Est. Vs. Actual for Q2FY26: Revenue: Largely INLINE; EBITDA: MISS; PAT: MISS

Change in Estimates post Q2FY26

FY26E/FY27E: Revenue: 1%/1% ; EBITDA: -37%/-21%; PAT: -121%/-21%

Recommendation Rationale

* Accelerating Growth in the Blends Segment: The Blends division reported a healthy performance across major markets, led by strong traction in the CFS Vitafor portfolio. Segment revenue increased 6% YoY to Rs 239 Cr (vs Rs 226 Cr in Q2FY25). Management remains optimistic about the division’s growth prospects, projecting a ~20% CAGR over the next 2–3 years, supported by network expansion, deeper geographic reach, improved order visibility, and potential inorganic opportunities.

* Healthy Volume Growth in Vanillin; Realisations Under Pressure: Vanillin revenues grew 41% QoQ, driven by a strong 35% increase in volumes, while realisations remained under pressure. The segment reported revenue of Rs 79 Cr in Q2FY26, supported by steady customer demand despite inventory overhang and tariff-related challenges. Management expects Vanillin volumes to sustain their upward momentum, with margin recovery anticipated as pricing and tariff pressures normalise.

* Outlook for H2FY26 – Margin Recovery and Strategic Expansion: The company remains focused on margin recovery through a higher contribution from value-added blends and aroma ingredients. Growth in H2FY26 is expected to be driven by continued momentum in the Blends segment, deeper penetration across key international markets, and gradual realisation recovery in Vanillin once tariff conditions stabilise.

Sector Outlook: Cautiously Optimistic

Company Outlook & Guidance: Management reiterated confidence in achieving 20% annual growth in the Blends business, projecting FY26 revenue in the range of Rs 2,000–2,100 Cr. For FY27, Vanillin sales volumes are expected to reach ~4,000 tonnes, while Blends revenue is anticipated to sustain ~20% growth. The Aroma business is likely to progressively ramp up capacity utilisation to full levels over the next two years. EBITDA margins are guided to expand meaningfully in the coming quarters, supported by operating leverage and improved efficiencies.

Current Valuation: 20x Sept’27E (Earlier: 20x FY27E)

Current TP: Rs 195/share (Earlier TP: 215/share)

Recommendation: We maintain our HOLD rating on the stock.

Financial Performance: CFS reported revenue of Rs 460 Cr in Q2FY26, up 9% YoY and QoQ, broadly in line with our estimate of Rs 448 Cr. EBITDA stood at Rs 33 Cr, down 23% YoY but up 76% QoQ, below our estimate of Rs 42 Cr due to higher-than-expected employee and other expenses. EBITDA margin contracted 296 bps YoY but improved 277 bps QoQ to 7.3%. The company reported a net loss of Rs 14 Cr after accounting for discontinued operations.

Outlook: Post the closure of its European and Chinese facilities, the company has refocused on driving cost efficiency and sustainable growth across core businesses. Margin improvement is anticipated as discontinued losses subside and key segments ramp up. Capacity utilisation in Vanillin continues to improve with rising volumes; however, elevated tariffs in the US are keeping realisations subdued, potentially restricting near-term profitability expansion.

Valuation & Recommendation: We have rolled forward our estimates to FY28E and value the stock at 20x Sept’27E, factoring in improved profitability from a higher contribution of high-margin Blends, healthy Vanillin volume growth, and operating leverage benefits. Our revised target price stands at Rs 195/share (earlier Rs 215/share), implying a 4% upside from the CMP. Accordingly, we maintain our HOLD rating on the stock, reflecting a balanced risk-reward profile amid ongoing operational transition and medium-term margin recovery potential.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633