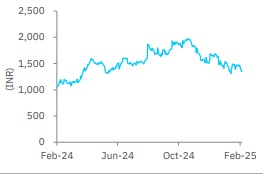

Reduce Torrent Power Ltd For Target Rs. 1,397 By Elara Capital Ltd

Robust quarter on higher merchant sales

Torrent Power (TPW IN) Q3FY25 revenue grew 2.1% YoY to INR 65bn, driven by higher merchant power and LNG sales despite a seasonally weak quarter with lower power demand. EBITDA rose 6.5% YoY to INR 11.0bn, while depreciation and interest cost increased 8.2% YoY and 17% YoY, respectively. Other income surged due to a one-time INR 770mn investment gain and higher treasury income. Reported PBT grew 23% YoY to INR 6.3bn while adjusted PBT rose 8% YoY to INR 5.5bn. PAT increased 31% YoY to ~INR 4.9bn. Generation revenue fell 10% YoY and RE revenue declined 6% YoY due to lower plant load factor (PLF) across wind, solar, and gas plants. TPW plans to scale up its renewables portfolio to 4.6GW, with 2,966MW renewable projects under development at an estimated INR 184bn. It is also advancing 8.4GW of pumped storage projects in Maharashtra & Uttar Pradesh (UP) and nearing completion of a pilot green hydrogen blending project in UP, with an allocated production capacity of 18 KTA. We revise Reduce with a higher TP of INR 1,397.

Reported PBT increases 23% YoY; adjusted PBT up 8%:

TPW posted revenue of INR 65bn, up 2.1% YoY, in Q3FY25. Higher contribution from the sale of merchant power and LNG sales drove earnings in Q3. Employee cost increased 6.4% YoY to INR 1.7bn. EBITDA rose 6.5% YoY to INR 11bn. Depreciation went up 8.2% YoY to INR 3.7bn. Interest surged 17% YoY to INR 2.7bn. Other income climbed to INR 1.7bn vs INR 535mn in the past year. Other income jumped on one-time gain of INR 770mn from sale of investment of cable and higher treasury income. Reported PBT was up 23% YoY to INR 6.3bn. PBT adjusted from one-time non-recurring item rose 8% YoY to INR 5.5bn. Reported PAT went up 31% YoY to ~INR 4.9bn.

Price chart

Source: Bloomberg

Seasonally weak quarter on lower power demand:

Revenue from generation fell 10% YoY to INR 14bn. T&D revenue was stable at INR 58bn. RE revenue shrank 6% YoY to INR 2.1bn. Lower RE revenue was on account of reduced PLF from existing wind power projects due to lower wind speed and less contribution from capacity of 300MW per renewal plant commenced during the quarter. PLF for Unosugen fell to 14% vs 17% in the past year. PLF for Sugen was 13% vs 26% in the past year. Dgen posted a PLF of 4% vs 5% in the past year. Overall PLF for gas plants was at 9% in Q3. PLF for Amgen fell to 74% vs 79% in the past year. PLF for wind plants was 17.3% vs ~19.1% in the past year. PLF for solar plants was ~15.3% vs ~17.9% in the past year.

Plans to scale up the renewables portfolio to 4.6GW:

The company currently has 2,966MW of RE capacity in pipeline with a total expected project cost of INR 184bn. It has identified 8.4GW of pumped storage projects, which is in the planning stage across Maharashtra and UP. A pilot hydrogen blending green hydrogen project in UP is nearing completion. TPW has been allocated 18 KTA of green hydrogen production capacity.

Revise to Reduce with a higher TP of INR 1,397:

We revise to Reduce from Sell on 21% stock price correction. We raise our SOTP-based TP to INR 1,397 from INR 1,324 on healthy project pipeline, huge capex plan and foray into new businesses, such as green hydrogen and pumped storage.

Please refer disclaimer at Report

SEBI Registration number is INH000000933