Buy Vedanta Ltd For Target Rs. 525 By Emkay Global Financial Services Ltd

HZ productively balancing growth and shareholder returns

We visited Hindustan Zinc’s Rampura Agucha mine, and interacted with the management. Hindustan Zinc (HZ) contributes 40% to profits and is a key segment for Vedanta (VEDL). The company recently announced its plan to expand capacity to 2mt by the end of this decade, from 1.1mt now. HZ is positioned in the first quartile of the global zinc cost curve, and the business has generated through-cycle EBITDA margins of ~50%. We estimate (as part of VEDL coverage) HZ’s EBITDA at Rs170bn and free cash flow of Rs100bn in FY26E/27E, based on zinc LME of USD2,600/t and silver price of USD36/oz. EBITDA is likely to increase to Rs200bn, from the 250kt capacity expansion. We expect steady cash flows to help sustain 4-5% dividend yield, while excess cash could be used to fund expansion.

To embark on a significant growth phase ahead

The company recently announced its plan to expand capacity to 2mt by the end of this decade, from 1.1mt now. As a first step, the Board approved expansion of 250kt of zinc smelting capacity at Debari with capex of Rs120bn, and a target to complete the project in 36 months. Of the announced capex, Rs62bn is set aside for smelter expansion, Rs10- 12bn for the fumer plant, and the rest for mine expansion. Capex intensity for the smelter is guided to be USD2,500/t vs global standards of USD3,500/t. Concurrently, the mgmt indicated possibility of further announcements of up to 2mt capacity expansion ahead. The company’s peak capex phase is likely to be over FY28-30.

Steady profitability to help retain valuation premium

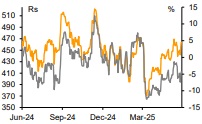

HZ is positioned in the first quartile of the global zinc cost curve with the cost of production at USD1,050/t, and the business has generated through-cycle EBITDA margins of ~50%. We estimate (as part of VEDL coverage) HZ’s EBITDA at Rs170bn and free cash flow of Rs100bn in FY26E/27E, based on zinc LME of USD2,600/t and silver price of USD36/oz. EBITDA is likely to increase to Rs200bn, from the 250kt capacity expansion. We expect steady cash flows to help sustain 4-5% dividend yield, while excess cash could be used to fund expansion. The mgmt also indicated comfort in gearing up from an almost net-debt-free balance sheet, to optimize the capital structure. HZ trades at 9x consensus FY27 EBITDA

Takeaways from the management meeting

We discussed various topics/issues with the mgmt and returned with a positive view on its preparedness in maneuvering challenges, while it keeps its sole focus on shareholder value creation. On mines that are due for re-auction in 2030, the company has the right of first refusal and the mgmt indicated that there are high entry barriers, especially with regard to developing the reserves and setting up smelters. Further, the mgmt is confident that it would retain the mines albeit with some increase in royalty cost. The company is setting up a 1mtpa fertilizer plant, to forward integrate its sulphuric acid by-product. The share of renewable energy is expected to increase to 27% in FY26, from 7% in FY25, with net savings of Rs0.5/unit. The company’s CSR activities on the ground are commendable.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

.jpg)