Add IDFC First Bank Ltd For Target Rs.70 By Emkay Global Financial Services Ltd

IDFCB reported an earnings miss yet again, with PAT at Rs3bn/RoA at 0.4%, mainly due to higher MFI stress that led to lower margins and higher provisions. Credit growth moderated to 20% YoY/4.5% QoQ, due to a meaningful slowdown in the MFI business, though deposit growth remains strong at 26% YoY/6% QoQ. The non-MFI retail portfolio continues to trend well, and the MFI SMA pool has inched up further to 5.1% of loans (vs 4.6% in 3Q). However, the bank expects that MFI stress should ease from 1QFY26 and, accordingly, overall credit costs to decline to ~1.9% (vs 2.5% in FY25). Going forward, the bank expects credit growth to be range-bound (~20%), but opex to materially slow down. We cut FY26E/27E PAT by 11%/8%, factoring in some moderation in margins and the elevated LLP, partly offset by lower opex. We expect FY26-28E RoA at ~0.8–1.2%. We retain ADD while marking up our TP by 7.7% to Rs70 (1.1x FY27E ABV) from Rs65 earlier. We believe the recent capital raise (Rs75bn from Warburg Pincus and ADIA) would support the bank’s growth for the next 12-24 months.

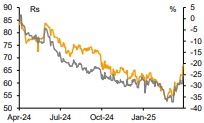

Margin slips further

IDFCB posted moderate credit growth at 20% YoY/4.5% QoQ, mainly due to slowdown in its retail growth, including MFI loans (now 4% of the overall book). However, deposit growth was healthy at 26% YoY/6% QoQ, though CASA ratio slipped by 83bps QoQ to 47%. NIMs slipped by 9bps QoQ to 6%, primarily due to softer loan yields on account of reversal of interest on MFI NPAs and lower LDR. Going forward, the management expects credit growth to remain range-bound (~20%), and deposit growth to be slightly higher (22%). Planned SA/TD rate cuts (relatively sharper in TD) should aid margins in FY26. However, the bank expects opex growth to moderate meaningfully, as it believes that heavy lifting—in terms of people, products, and technology as well as the liability franchisee—is largely behind. The bank expects an exit RoA of 1% in 4QFY26E.

MFI SMA pool inches up in 4QFY25; stress to ease gradually

Despite higher stress in the MFI-JLG book leading to elevated slippages at Rs22bn/4.5% of loans, GNPA ratio slightly improved, by 7bps QoQ to 1.9% of loans, due to higher write-offs. The MFI SMA pool has inched up further QoQ to 5.1% of loans vs 4.6% in 3Q. Credit cost for FY25 stood at 2.5% (1.76%, excluding MFI and one legacy toll account); however, the bank expects the MFI stress to ease from 1QFY26, and accordingly overall credit costs to be ~1.9% in FY26.

We retain ADD while revising up our TP to Rs70 (up 7.7%)

We cut FY26E/27E PAT by 11%/8%, factoring in some moderation in margins and the elevated LLP, partly offset by lower opex. We expect ~0.8–1.2% RoA over FY26-28E; we retain ADD; we revise our TP by 7.7% to Rs70 (1.1x FY27E ABV) from Rs65 earlier. Key risks: Macro slowdown further hurting growth; delay in asset quality/opex improvement.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354