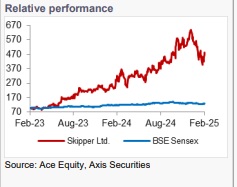

Buy Skipper Ltd for the Target Rs. 570 By the Axis Securites

.jpg)

Recommendation Rationale

Strong Macro Tailwinds: The 9.15 Tr capex over 2023-2032 as per National Electricity Plan through Public-Private-Partnership agreements and through Power Grid’s own balance sheet strength will continue to drive growth for Skipper’s Engineering division. The export market led by the transition towards RE and carbon neutrality offers a broad scope for growth. The demand outlook is strong, and it already has a strong bid pipeline of Rs 18,000-20,000 Cr.

Capacity expansion – a key monitorable: To capitalise on these macro tailwinds, capacity expansion remains critical as currently its Engineering capacity at 300 kt is already operating at 85% utilisation. The 1st plan of 75kt capacity addition, which would add ~Rs 700 Cr to the topline, will now come online by Q1FY26 as against the earlier target of Q4FY25. The 2nd 75kt capacity post the 1st 75kt, which was targeted to go online by the end of FY26, is still at the pre-approval stage. The management remains confident of strong YoY growth over the elevated FY25 revenue base (post strong 9MFY25 numbers). Still, it has now not given a specific growth number (earlier, it had guided 25% revenue CAGR over the FY24 base for the next 3 years). We believe timely capacity addition remains critical for the company to tap topline growth and gain market share.

Strong Order Book: Skipper received new orders totalling Rs 1,318 Cr in Q3FY25, including orders from PowerGrid Corporation of India and from various SEBs. As of Dec’24, the order book stood at Rs 6,354 Cr (Rs 6,590 Cr as of Sep’24). The order book comprises 66% domestic T&D orders, 23% non-T&D orders (Telecom, Railways, Solar, Water EPC & other Steel Structural items) and 11% export orders. All export orders pertain to T&D.

Sector Outlook: Positive

Company Outlook & Guidance: The management expects a strong revenue growth YoY on the elevated FY25 revenue base for next year. The next 4 years capex guidance of Rs 800 Cr (out of which Rs 200 Cr in FY25) is unchanged. Majority of the 75kt capacity expansion would be done by Q4FY25 with some spill over to Q1FY26. Further, the management expects the current EBITDA margins of ~10% to gradually increase YoY, led by higher T&D contribution and better-quality T&D contracts. Capacity addition remains critical to tap the growing market opportunities. We cut our FY27 EBITDA by 4% due to the delay in the 75kt capacity addition.

Current Valuation: 22x on our FY27 EPS estimate (Unchanged)

Current TP: Rs 570/share (Earlier TP: Rs 600/Share)

Recommendation: We maintain our BUY recommendation on the stock.

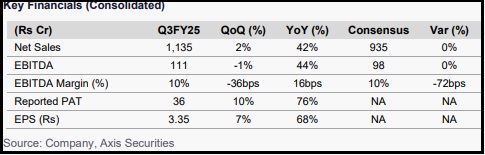

Financial Performance: Skipper reported decent numbers, with revenue and PAT beating the consensus estimates. Consolidated Net sales stood at Rs 1,135 Cr, up 42%/2% YoY/QoQ, a 21% beat on the consensus estimates. EBITDA stood at Rs 111 Cr, up 44% YoY and down 1% QoQ, a 13% beat on consensus estimates. The EBITDA margins stood at 9.8%, up 16bps YoY but down 36bps QoQ. PAT stood at Rs 36 Cr, up 76%/10% YoY/QoQ.

Valuation & Recommendation We assign a target P/E multiple of 22x (unchanged) on our FY27 EPS estimate (unchanged) and arrive at our Mar’26 TP of Rs 570/share from Rs 600/share earlier as we cut our FY27 PAT estimate. We maintain our BUY rating on the stock; our TP implies a potential upside of 18% from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633