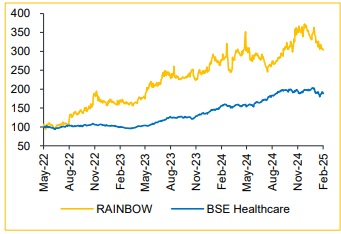

Hold Rainbow Children’s Medicare Ltd For the Target Rs. 1,474 by Choice Broking Ltd

Result came in-line with the consensus estimates and saw a YoY growth on all fronts

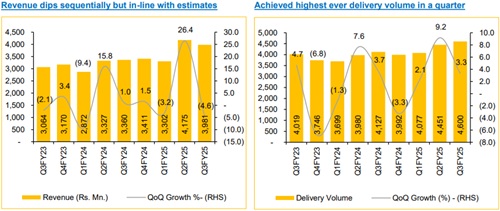

* Revenue came at INR 4.0 Bn (vs. CEBPL est. of INR 4.3 Bn), up 18.5% YoY and down by 4.6% QoQ.

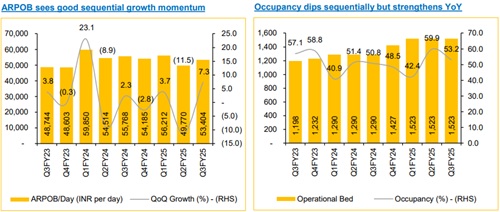

* ARPOB at INR 53,404, down 4.2% YoY and up 7.3% QoQ, while occupancy dropped to 53.2% from 59.9% in the previous quarter.

* EBITDA came at INR 1.3 Bn ( vs. CEBPL est. of INR 1.5 Bn), up by 13.8% YoY and down 8.7% QoQ. EBITDA margin came at 33.8% (vs. CEBPL est. of 35.0%), contracted by 140bps YoY and 148bps QoQ.

* PAT came at INR 0.7 Bn (vs. CEBPL est. of INR 0.8 Bn), up 10.2% YoY and down 12.7% QoQ, with a PAT margin of 17.3% (vs 18.6% in Q3FY24

Strategic network expansion through spokes (hub and spokes model) and new market entry

RAINBOW has expanded its bed capacity by approximately 50% to 1,935 beds over FY20-25. The company plans to further increase capacity by adding around 800 beds by FY28, with significant expansions in Bengaluru (150 beds), Tamil Nadu (130 beds), Andhra Pradesh (100 beds), and Gurugram (400 beds). Gurugram represents a new market entry for the company, with operations expected to commence in 2.5 years, requiring a capital expenditure of INR 4,000 million. We expect that the new facility in Gurugram is expected to cater to patients with more complex medical conditions, supporting higher pricing and revenue potential while also attracting a greater share of international patients.

Focus on tertiary (complex treatments) and quaternary (highly specialized services) which ensures healthy ARPOB

Despite lower occupancy rates of 50-55% compared to 60-70% for multispecialty hospitals, RAINBOW’s ARPOB at around INR 55k is comparable to larger hospital players, because of its focus on high-end tertiary and quaternary care volumes, lower ALOS (2.8 days) leading to a faster turnaround, diversified revenue streams with higher Outpatient revenue contribution. We anticipate that emphasizing tertiary and quaternary care will drive the company's ARPOB to around 60K within the next 2-3 years.

View and Valuation:

We expect growth to be driven by the expansion of IVF services, the continued recruitment of doctors, and the addition of new facilities at mature hospitals. However, the company's performance may be impacted by a decline in the share of international patients, delays in project timelines, an increase in the average length of stay (ALOS), and pressure on EBITDA margins due to the operational drag from newly established hospitals. We project revenue to grow at a CAGR of 17.5% from FY24 to FY27E. The stock has been valued at an EV/EBITDA multiple of 21x based on FY27, arriving at a target price of INR 1,474. Given the current valuation and operational challenges, we have revised our rating to HOLD.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)