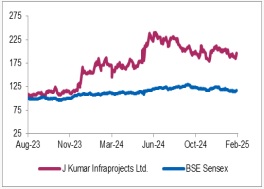

Buy J. Kumar Infraprojects Ltd For Target Rs. 940 by Axis Securities

Robust Order Book & Efficient Execution To Drive Growth

Est. Vs. Actual for Q3FY25: Revenue – BEAT; EBITDA Margin – BEAT ; PAT– INLINE

Change in Estimates post Q3FY25 (Abs.)

FY25E/FY26E – Revenue: 1%/1%; EBITDA: 1%/0%; PAT: 0%/-2%

Recommendation Rationale

* Robust order book to drive revenue growth: As of 31st Dec’24, the company’s order book stood at Rs 20,529 Cr (5x FY24 revenue). The company is L1 in projects worth Rs 5,000 Cr, including two projects for the Maharashtra Expressway and one coastal road project for CIDCO in Mumbai. A healthy and robust order book provides revenue visibility for the next 3-4 years. We expect the company to report a revenue CAGR of 17% over FY24-FY26E.

*Strong bidding pipeline: The company has a strong bidding pipeline of Rs 40,000-47,000 Cr. This includes building projects worth Rs 8,000-9,000 Cr, metro and railway projects around Rs 7,000-8,000 Cr, and elevated corridors of approximately Rs 30,000 Cr. The company aims to win projects worth Rs 6,000-8,000 Cr in FY25.

*Improvement in EBITDA margin: The company anticipates that EBITDA margins will improve in FY26 and exceed 15%, driven by more efficient project execution and the acquisition of additional orders.

Sector Outlook: Positive Company Outlook & Guid

Company Outlook & Guidance: The company has guided for revenue in the range of Rs 5,600- 5,700 Cr in FY25. For FY26, revenue growth is expected to be 15%, with EBITDA margins above 15%. The tender pipeline remains strong, and the company aims to secure a sizeable order intake in FY26.

Current Valuation: 14.5x FY26 EPS (Earlier Valuation: 14.5x FY26E EPS)

Current TP: Rs 940/share (Earlier TP: Rs 950/share)

Recommendation: We maintain our BUY recommendation on the stock

Financial Performance

J Kumar Infraprojects Ltd. (JKIL) Q3FY25 numbers stood above expectations, driven by robust project execution. The company reported revenue of Rs 1,487 Cr (up 22% YoY), EBITDA of Rs 219 Cr (up 22% YoY), and APAT of Rs 100 Cr (up 21% YoY). EBITDA margins stood at 14.7% in Q3FY25 (vs. the estimate of 14.6%), remaining stable compared to 14.7% in Q3FY24

The revenue break-up is as follows:

30% of the total revenue is from elevated corridors/flyovers, 23% from roads and road tunnels, 20% from metro elevated, 14% from metro underground, 9% from civil and others, and 4% from water. Geography-wise, 65% of revenue is from Maharashtra, 30% from NCR, 1% from UP, 2% from Gujarat, and 2% from Karnataka

Outlook:

JKIL remains one of the most established EPC contractors and will continue to benefit from its healthy order book position, strong execution capabilities, and robust financial position. We estimate JKIL to report Revenue/EBITDA/APAT CAGR of 17%/19%/22%, respectively, over FY24- FY26E, supported by its diversified order book, healthy bidding pipeline, encouraging new order inflow, emerging opportunities in the construction space, and execution prowess

Valuation & Recommendation

Currently, the stock is trading at 14x and 11x FY25E and FY26E EPS, respectively. We maintain our BUY rating and value the company’s business at 14.5x FY26E EPS to arrive at a target price of Rs 940/share. The target price implies an upside potential of 27% from the CMP

r More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ00016163

Tag News

Rajasthan CM Sharma praises Union Budget, says it charts path to Viksit Bharat