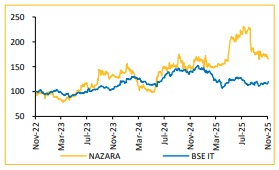

Buy Nazara Technologies Ltd for the Target Rs. 390 By Choice Broking Ltd

Headwinds Ease; Portfolio Reset Anchors Recovery

Portfolio Reset Enhances Earnings Visibility and Upside Potential

We remain constructive on NAZARA as the core growth engine strengthens and the portfolio resets to a cleaner base following the de-subsidiarisation of Nodwin and the one-off impairments on Freaks4U and PokerBaazi. The company’s renewed brand identity, anchored in deeper interactive entertainment and IP-led experiences, aligns well with its expanding global footprint and enhances longterm franchise positioning. With improving user acquisition efficiencies, stronger IP monetisation and widening reach across mobile and console ecosystems, the earnings profile is becoming progressively cleaner and more predictable. We value NAZARA on a SOTP basis (Table below), arriving at a TP of INR 390 up from INR 350 and retain our BUY rating.

Revenue Beat Estimates; Margins Improve, PAT Decline due to One-time Adjustments

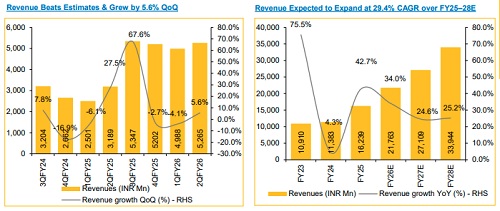

* Revenue for Q2FY26 came at INR 5,265 Mn up 5.6% QoQ and 65.1% YoY (vs CIE est. at INR 4,108 Mn).

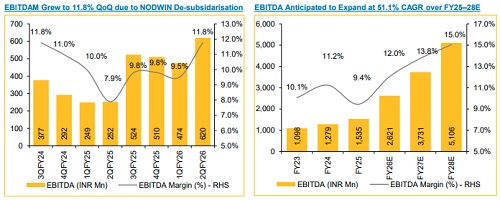

* EBITDA for Q2FY26 came at INR 620 Mn, up 30.7% QoQ and 146.4% YoY (vs CIE est. at INR 452 Mn). EBITDAM stood at 11.8% vs 9.5% in Q1FY26, up 230bps QoQ (vs CIE est. at 11.0%).

* PAT for Q2FY26 stood at INR -239.5Mn, down 154.9% QoQ and 223.2% YoY (vs CIE est. at INR 518 Mn).

Strong Revenue Traction Despite Partial Nodwin Contribution

NAZARA delivered a robust Q2 with revenue up 65% YoY to INR 526.5Mn, despite only a half-quarter contribution from Nodwin following its desubsidiarisation. Growth was broad-based, led by strong execution across Mobile Gaming, PC/Console Publishing and Offline Gaming. Mobile Gaming remained the key driver (+81% YoY), supported by improved UA efficiency, deeper LiveOps and continued strength in global franchise IPs. Console/PC titles such as Human Fall Flat and Wobbly Life delivered steady upside, while Offline Gaming scaled meaningfully through centre additions in Funky Monkeys. Ad-tech also outperformed with sharp growth. With increasing monetisation depth, rising international mix and expanding studio synergies, we see NAZARA entering a more durable growth cycle and expect the platform to sustain mid-20s revenue growth over the medium term.

EBITDAM Improves, One-time Adjustments Mask Core Profitability

EBITDA Margins for the quarter stood at 11.8% up 230 bps QoQ, with core gaming delivering a 23–24% EBITDA margin supported by improving UA efficiencies, operating leverage across studios and strong profitability in PC/Console and Offline Gaming. Reported earnings were distorted by one-off items (1) De-subsidiarisation of Nodwin, which resulted in a fair-value gain of INR 10,980Mn and (2) Impairments on PokerBaazi (INR 9,147 Mn) and Freaks4U (INR 2,063) following regulatory headwinds in India and structural weakness in European esports. With this clean-up largely behind, we expect earnings quality to improve meaningfully from FY27E, aided by scaling global IPs, a stronger publishing stack, sharper cost discipline and accelerating AI-led productivity. Our view remains constructive, with the consolidated business now better positioned for consistent 40–45% growth and margin expansion.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131