Neutral Sun TV Network Ltd for the Target Rs. 630 by Motilal Oswal Financial Services Ltd

Movie segment drives growth; core business remains weak

* Sun TV Network (SUNTV) reported a weak 2QFY26, with ad revenue declining 13% YoY amid weak consumer sentiment and cut back in ad spends by FMCG players on linear TV.

* Reported revenue was boosted by a strong performance at the box-office from SUNTV ’s movie, Coolie. However, higher amortization costs and operating deleverage led to a sharp ~28% miss on EBIT (up by a modest 3% YoY) and adj. PAT (down 10% YoY).

* SUNTV acquired a 100% stake in The Hundred franchise ‘Northern Superchargers’ for GBP100m. We view this as an expensive acquisition, given the current media rights value and competition from other UK sports, which limits the potential for significant long-term improvement in media rights.

* We increase SUNTV’s FY26-27E EBITDA by ~3%, as higher film revenue offsets our ~7-8% cut in advertising revenue. However, we cut our FY26E/27E PAT by 9%/3%, due to the higher amortization of film-related costs and operating deleverage.

* We expect SUNTV’s revenue/EBITDA/PAT to increase by a modest 5%/3%/2% over FY25-28, as weaker ad revenue continues to weigh on core business margins.

* At ~13.2x one-year forward P/E, valuations remain ~16% below historical averages. However, an improvement in the core business’s ad revenue remains key for re-rating.

* We value SUNTV on an SoTP basis: 10x Dec’27 EV/sales for SRH, ~5x EV/EBITDA for the core TV business, 0.5x investments for Northern Superchargers, and 1x for cash/dividends (~INR 78b), for our revised TP of INR630 (implies ~14x Dec’27E P/E). We reiterate our Neutral rating.

Core performance remained weak; ad revenue declined 13% YoY.

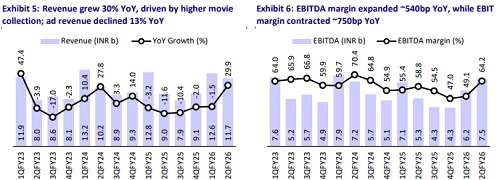

* Overall revenue grew 30% YoY to INR11.7b (16% beat), primarily driven by higher collections from the Coolie movie.

* Domestic advertising revenue at INR2.9b (8% miss) declined 13% YoY (vs. -11% YoY for Zee).

* Domestic subscription revenue at INR4.8b (5% beat) grew 9% YoY (vs. +5.5% YoY for Zee).

* Film revenue came in at INR3.8b, driven by the box-office success of Coolie.

* Operating expenses grew 13% YoY to INR4.2b, led by a 13%/21% YoY surge in programming costs/other expenses.

* Employee expenses rose by modest ~3% YoY.

* EBITDA grew 42% YoY to INR7.5b (25% beat) as margins expanded to 64% (vs. 58.8% in 2QFY25), driven by film revenue.

* However, since film-related costs are booked as amortization, EBIT provides a more appropriate basis for comparison.

* Depreciation and amortization doubled YoY to INR4b, led by the amortization of movie production costs.

* As a result, EBIT grew by a modest ~4% YoY to INR3.5b (28% miss on our estimates), as the core business’s performance remained weak.

* Adjusted net profit declined 10% YoY to INR3.6b (28% miss) due to weaker EBIT, lower other income, and a higher tax rate.

* SUNTV declared an interim dividend of INR3.75/share. (1H dividend at INR8.75/share vs. INR10/share YoY).

* For 1HFY26, SUNTV’s revenue grew 11% YoY, driven by Coolie, while EBIT/PAT declined 6%/7%% YoY due to weaker ad revenue and operating deleverage.

* 1HFY26’s OCF grew 3.5% YoY to INR9.5b as ~11% growth in reported EBITDA was offset by the buildup of working capital. Capex increased sharply to INR5.5b (vs. INR1.7b YoY), which led to an FCF generation of INR4b (-46% YoY). SUNTV paid a dividend of ~INR2b and invested ~INR11.9b to purchase the franchise rights for Northern Superchargers, a Leeds (UK)-based cricket team in The Hundred.

* SUNTV’s net cash moderated to INR58b (from INR61b at end-Mar’25).

Valuation and view

* The shift in FMCG ad spends toward digital continues to pose a structural headwind for linear TV broadcasters, such as SUNTV, over the medium term. A sustained recovery in ad revenue remains crucial for a potential re-rating.

* Further, we continue to believe that the Star-Viacom merger is a double whammy for SUNTV due to: 1) heightened competition for ad revenue from deep-pocketed players in the core business amid a structural shift from linear to digital, and 2) a potential downward revision in IPL media rights in the next renewal cycle (from FY29), which would significantly impact the valuation for SUNTV’s IPL franchise (SRH).

* A potential transaction at a premium for Royal Challengers Bangalore (RCB) could be a sentimental positive in the near-to-medium term. However, we believe IPL teams’ valuations are due for a correction (vs. our ascribed 10x EV/sales), given reduced competition for media rights renewal.

* We increase SUNTV’s FY26-27E EBITDA by ~3%, as higher film revenue offsets our ~7-8% cut in advertising revenue. However, we cut our FY26E/27E PAT by 9%/3% due to higher amortization of film-related costs and operating deleverage.

* We expect SUNTV’s revenue/EBITDA/PAT to increase by a modest 5%/3%/2% over FY25-28, as weaker ad revenue continues to weigh on core business margins.

* At ~13.2x one-year forward P/E, valuations remain ~16% below historical averages. However, an improvement in the core business’s ad revenue remains key for re-rating.

* We value SUNTV on an SoTP basis: 10x Dec’27 EV/sales for SRH, ~5x EV/EBITDA for the core TV business, 0.5x investments for Northern Superchargers, and 1x for cash/dividends (~INR 78b), for our revised TP of INR630 (implies ~14x Dec’27E P/E). We reiterate our Neutral rating.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412