Buy Inox Wind Limited For Target Rs. 193 by Religare Broking Ltd

Best-ever Q2 performance backed by strong execution and margin stability: Inox Wind delivered its strongest-ever Q2, marking a clear structural improvement in performance despite monsoonrelated challenges. Revenue rose 53% YoY to Rs. 1,119 crore, while EBITDA grew 37% to Rs. 227 crore, with the company reaffirming its 18-19% margin guidance. Execution stood at 202 MW in Q2 and 350 MW in H1, keeping IWL on track to achieve its 1.2 GW FY26 target, especially as 70% of execution typically occurs in H2. Strong execution discipline, manufacturing readiness, and the maturing 3.3 MW platform highlight a sustainable improvement in scale, efficiency, and financial strength.

Robust and diversified order book ensures multi-year growth visibility: Inox Wind’s 3.2 GW order book provides 18-24 months of execution visibility, ensuring strong cash flow stability. The order mix is well diversified across IPPs, C&I players, and third-party developers, reducing concentration risk. A strategic shift toward long-term framework agreements is set to secure over 1 GW of recurring annual orders, while the group’s IPP arm will add 500-700 MW each year. This diversified and recurring order pipeline enhances manufacturing utilization, reduces volatility, and strengthens longterm growth visibility.

Manufacturing expansion and platform upgrades to drive higher MW sales: Inox Wind is expanding manufacturing capacity in South India to access high-wind states like Tamil Nadu, Karnataka, and Andhra Pradesh, which are key for upcoming hybrid and RTC projects. Its 3.3 MW turbines are gaining traction, while preparation for 4.X MW platforms will further boost realizations and margins. With turnkey realizations of Rs. 8 crore/MW, this capacity expansion and shift to higher-MW turbines strengthen IWL’s competitiveness in both scale and profitability.Strengthened balance sheet outlook with tighter working capital discipline: IWL continues to reinforce its financial position with disciplined working capital management. Management has reiterated its goal of achieving a 120-day net working capital cycle within FY26, supported by rising execution volumes and improved collection mechanisms, especially under framework agreements. The company’s capex requirement remains modest at ~Rs. 200 crore, primarily directed toward manufacturing expansion. This limited capex ensures that growth does not create balance sheet stress. With higher execution expected in H2 and stronger cash conversion, the company is positioned to exit FY26 with improved liquidity, reduced leverage pressure, and better overall financial resilience.

Integrated group strategy enhancing cost competitiveness and order flow: Inox Wind benefits from the Inox GFL Group’s fully integrated renewable ecosystem covering manufacturing, EPC, project development, power generation, and O&M through IGESL. This reduces costs, enhances execution speed, and boosts repeat business. The group’s IPP arm provides a steady order flow, improving capacity visibility. The substation business demerger into Inox Renewable Solutions will streamline EPC operations, strengthen capital efficiency, and enhance ROCE, positioning IWL strongly for growing hybrid and RTC demand

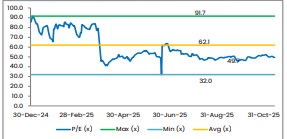

Outlook and Valuation: Policy support, including a GST reduction to 5%, boosts wind project viability and demand. The growing preference for hybrid, RTC, and firm renewable tenders strengthens wind’s appeal. IWL has no exposure to at-risk PPAs, reflecting prudent management. With improving grid access and rising RTC demand, the sector outlook remains strong, benefiting IWL. On the financial front, we have estimated its Revenue/EBITDA/PAT to grow at 57.5%/53.1%/62.5 CAGR over FY25-27E and maintain a Buy rating with a target price of Rs. 193

Please refer disclaimer at https://www.religareonline.com/disclaimer

SEBI Registration number is INZ000174330