Add Tata Consumer Products Ltd For Target Rs. 1,265 By JM Financial Services

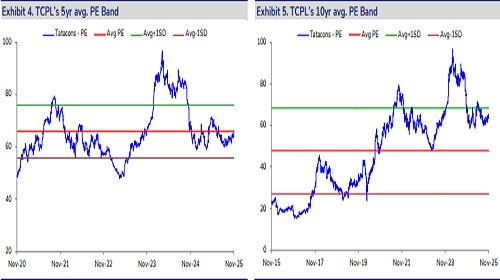

TCPL’s 2QFY26 earnings print was ahead of estimate. Revenue beat was driven by better-thanexpected performance in India Foods (led by Salt while domestic tea business sales performance was inline), growth business (led by Nourischo, Organic India, Sampann) and higher growth in Non-branded business. This along with higher gross margins resulted in overall earnings beat for the quarter. Going ahead, revenue performance is likely to remain healthy – with mid to highsingle-digit growth in domestic Tea, continued strength in salt business and sustaining momentum in growth businesses. On profitability front, management expects margins to improve QoQ (moderation in tea prices & uptick in international/non-branded business) and should achieve c.15% consol. EBITDA margins by 4QFY26E (slower vs. earlier guidance of achieving c.15-16% by Q3FY26E, owing to volatility in coffee prices). We are building in healthy sales growth (11% sales CAGR) & margin expansion (c.120bps) resulting in earnings CAGR of 21% over FY26-28E. With recent run-up (c.12% in last 3 months) and valuations at 60x FY27E, upsides are limited. We roll forward to Dec’27E EPS; maintain ADD rating with revised TP of INR 1,265. Movement in input costs (especially coffee) will be key monitorable.

* Better-than-envisaged growth across segments drove revenue beat; Salt and Growth businesses surprise positively:

Consol. sales grew 17.8% YoY to INR 49.7bn, c.5% above our expectations. EBITDA grew 7.3% YoY to INR 6.7bn (c.7% above est.) and adjusted PAT grew 11.0% YoY to INR 4.1bn. Segmentally: 1) India beverages delivered broad-based growth of 15.8% YoY – India Tea business grew 12% YoY with 5% volume growth, while coffee continued its strong momentum and grew 56% YoY. RTD’s (NourishCo) business saw strong recovery and delivered revenue growth of 25% YoY (1st time since acquisition) with volume growth of 31% YoY, despite unseasonal rains and competitive headwinds. 2) India Foods grew 19.3% YoY – led by continued momentum in Salt (+16% with volume growth of 9%) and Tata Sampann (+40%). Capital Foods (+8.3%) and Organic India (+30.4%) together grew 16% YoY, impacted by GST transition across MT(destocking) and GT (extra GST passed on as discount on old MRP packs) trade channels. 3) International business continued its trajectory and grew 15% YoY (9% CC) – as softness in UK (down 5% on high base) was more than offset by strong performance in US coffee (+21% YoY) and Canada business (+7% YoY led by speciality tea). 4) Non-branded sales grew 28% while EBIT declined 28%, impacted by coffee price corrections. On QoQ basis EBIT margins improved with uptick in coffee prices (led by US tariff hike on Brazil). 5) Starbucks’ revenue grew 8% YoY, similar to growth in store-count (+8% YoY to 492 stores).

* Margin expansion in India business offset by weakness in International and non-branded business:

Consol. gross margins compressed 152bps YoY to 42.1% (78bps below est.), as uptick in standalone margins (due to moderation in tea prices) was more than offset by weakness in International (lower gross margins YoY due to high coffee prices and lack of commensurate price hikes) and non-branded business. Staff cost/other expenses grew c.12%/19% YoY respectively. Resultant consolidated EBITDA grew by 7.3% with a margin compression of 133bps YoY to 13.5% (tad above our est. of 13.2%). PAT (bei) grew by 5% YoY to INR 4.1bn due to lower other income. Going ahead management expects EBITDA margins to improve QoQ; guided for c.15% consol. EBITDA margins by 4Q led by moderation in tea prices, likely uptick in International (benefit of price hikes) and non-branded business. Impact of US tariff hikes on international coffee prices will be key monitorable.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361