Accumulate Relaxo Footwears Ltd For Target Rs. 489 By Elara Capital

Volume showing signs of strain

Relaxo Footwears’ (RLXF IN) Q4 performance was a miss on revenue, EBITDA and PAT by 13.9%, 13.4% and 14.1%, respectively (versus our estimates). This underperformance was led by a 10.0% YoY drop in volume against our estimate of 1.3% YoY de-growth. The performance was hit by lower volume, led by subdued demand in the mid-range footwear segment and restructuring of the distribution model. RLXF is calibrating a strategy to expand its consumer reach via its “Relaxo Parivaar” app, improving its online presence while following “Brand as a Seller” model on e-commerce channels and launching exclusive products to support growth.

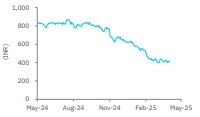

We believe the revamp in strategy will take a few quarters to yield results amid muted demand and increased competitive intensity. So, we pare down our earnings estimates by 10.5% for FY26E and by 10.9% for FY27E and introduce FY28E estimates. On revised earnings, we arrive at a lower TP of INR 489 (INR 549 earlier), based on 50x FY27E P/E (unchanged). We believe there is limited downside risk to profitability and return ratios, given RLXF’s efforts to drive secondary sales. So, we upgrade RLXF to Accumulate from Reduce

Volume continues to dip; ASP up: Q4 revenue fell 7.0% YoY to INR 6,952 mn, led by a 10.0% YoY dip in volume, partly offset by improved average selling price (ASP) by 3.4% YoY. In FY25, brand-wise revenue contribution was as follows – Hawai at 40%, Flite at 37% and Sparx at 23%. In terms of volume mix, Hawai accounted for 45%, Flite 39%, and Sparx 16%. To drive growth, RLXF is streamlining its distributor network through distribution management system (DMS) and retailer network via “Relaxo Parivaar” app (reach across network; impact to be visible in the near term). At present RLXF is facing some resistance as regards the app from distributors. RLXF opened eight EBOs in Q4 to 418. Expect a revenue CAGR of 11.2%, led by volume CAGR of 8.0% and price CAGR of 3% in FY25-28E.

Expect EBITDA CAGR of 17.0% in FY25-28E: EBITDA was INR 1,121mn, down 6.9% YoY. EBITDAM was flat on the back of lower other expenses (down 21.4% YoY) and employee cost (down by 11.1% YoY). RLXF reduced its expenses while being hit by a 535bps YoY drop in gross margin. We expect margin to reach 14.5% in FY26E, 15.2% in FY27E and 16.0% in FY28E, led by improvement in demand in the long term, operating leverage from average realization and efforts to drive secondary sales.

Upgrade to Accumulate with a lower TP of INR 489: Expect a revenue CAGR of 11.2%, an EBITDA CAGR of 17.0% and an earnings CAGR of 20.8% in FY25-28E. RLXF continues to sustain a robust balance sheet. ROCE is likely to improve to 14.1% by FY28E, led by margin improvement. We believe there is limited downside risk to profitability and return ratios, given RLXF’s efforts to drive secondary sales. So, we upgrade RLXF to Accumulate from Reduce. But we lower our TP to INR 489 from INR 549, on 50x (unchanged) FY27E P/E. as we pare down our earnings estimates (given that revival some quarters away). Key trigger for the stock is a revival in demand.

Please refer disclaimer at Report

SEBI Registration number is INH000000933