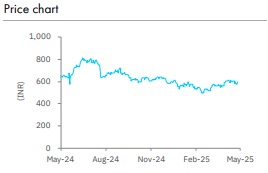

Buy LIC Housing Finance Ltd for Target Rs. 773 by Elara Capitals

Tight balancing act

Albeit in-line, LIC Housing Finance’s (LICHF IN) Q4 earnings were a drag, with continued pressure on core led by somber growth and tepid margin. LICHF may have to continue with its tight balancing act as regards growth versus margin improvement. This trend is largely led by heightened competition in home loans and project finance, coupled with quarterly lags in lending rate resets that help maintain margins. Moreover, portfolio diversification takes a backseat amid intense rate competition in project loans and the nascent stage of affordable housing finance business. Valuation multiple has seen a mild uptick from 0.8x to 0.9x in the past three months. In light of the difficult trade-off (thus, impacting profitability), we pare our target multiple but maintain BUY as current multiple is at the lower end of the PBV band.

Growth versus margin conundrum stays: PAT was INR 13.7bn, down 4.5% QoQ but up 25.4% YoY, as gains from NPA recoveries and write-backs were offset by higher business-led operational expenses. NII came in at INR 21.2bn, up 8.3% QoQ but down 3.2% YoY, with FY25 NIMs declining to 2.73% from 3.08% in FY24. To support margins, LICHF is shifting focus to higher-yield segments of LAP, LRD, Project Finance, and Affordable Housing. While easing funding costs from maturing high-cost liabilities may help, limited PLR transmission could restrict margin improvement. FY26 NIM guidance is 2.6-2.8%.

Limited levers to growth: LICHF’s AUM rose to INR 3.08tn in Q4FY25, up 2.9% QoQ/7.3% YoY, led by IHL (97% of the book), up 2.8% QoQ/7.1% YoY. Retail home loans and LAP grew steadily, while corporate loans, though small, posted the fastest rise at 6.4% QoQ / 14.9% YoY. Disbursements were strong at INR 191.6bn (+24% QoQ/+5% YoY), driven by a 26.1% QoQ/9.3% YoY jump in IHL disbursements. Growth is expected to continue, backed by market recovery, better momentum in May, selective pricing, and expansion in project and affordable housing, with 10-12% disbursement and double-digit AUM growth guidance for FY26.

Asset quality improvement – Good visibility: Asset quality improved strongly, with GNPA dropping to 2.47% in FY25 from 3.31% in FY24, backed by recoveries, restructuring, and prudent underwriting. The aim is to bring GNPA below 2.2% in FY26. Stage 3 PCR stood at 51%, with provisions at INR 48.99bn. In FY25, net recoveries were INR 18bn and technical write-offs INR 17.1bn, with credit cost well-contained at 9bps. With FY26 recovery targets of INR 15bn+ expected to boost P&L, LICHF is on track for further de-risking and asset quality gains (FY26 credit cost guidance of 9-15 bps).

Retain BUY with reduced TP of INR 773: We tweak our EPS estimates only marginally for FY26-27, modelling in the rate transmission scenario. Considering sustaining growth versus margin conundrum (thus, impairing profitability metrics), we expect RoEs at 15-16% and RoAs at 1.5-1.6% in FY26E-28E. Even as beaten down valuation provides comfort as regards risk-reward, and the underlying sectoral trends are upbeat, we retain Buy but with a downward bias. Modelling in slowing growth trends, we value LICHF at 1.1x P/ABV (earlier 1.2x P/ABV) to arrive at a pared TP of INR 773 (from INR 821). Improvement in growth should drive a re-rating.

Please refer disclaimer at Report

SEBI Registration number is INH000000933