Buy HDFC Life Insurance Ltd For Target Rs. 850 By Emkay Global Financial Services Ltd

Growth guidance retained; GST ITC loss impact manageable

HDFC Life’s H1FY26 performance was on expected lines, with largely in-line APE at Rs74.1bn (+10.2% YoY), while VNB margin at 24.5% was in line with consensus’ and our estimates. During H1, VNB margin was impacted by 1) increased contribution of ULIPs partially offset by increased share of the Protection business; 2) enhanced margin profile across products led by longer tenure and higher sum assured; and 3) discipline in the pricing of Non-Par products. The management remains optimistic about the growth recovery in H2, led by demand recovery owing to the GST rate cut; it retained its FY26 guidance of APE growth to the early teens. While the management expects ~3% gross impact on VNB margins owing to GST ITC losses, it plans to mitigate the impact by adjusting commissions and driving operating efficiencies. To bake in the Q2 developments, we marginally cut our APE estimates while we lower VNB margin projections by ~20-50bps over FY26-28E. We retain BUY on HDFCLIFE with an unchanged Sep-26E TP of Rs850, implying FY27E P/EV of 2.5x.

In-line APE and VNB margin lead to VNB coming on expected lines

For H1FY26, APE at Rs74.1 grew 10.2% YoY and was largely in line with our estimate of Rs74.3bn. VNB margin at 24.5% (-10bps YoY) was in line with consensus/our estimates of 24.5%/24.4%, respectively. VNB margin was impacted by increased share of ULIPs partially offset by higher share of Protection products. Resultantly, VNB at Rs18.2bn (+9.8% YoY) was largely in line with our estimate of Rs18.1bn. Embedded Value at Rs595.4bn increased 14.2% YoY vs our estimate of Rs594.2bn. Solvency ratio in H1 declined drastically to 175%, largely owing to dividend payout, repayment of subordinated debt, higher share of Protection business, and GST ITC loss-related impact.

The management is confident of nullifying GST ITC loss impact on VNB margin in 2-3 quarters

The mgmt said that gross impact of the GST ITC losses on VNB margin would be ~300bps on annualized basis. However, impact of GST ITC losses would be mitigated by renegotiating the commissions and via operational adjustments led by increased cost efficiencies. Further, while engaging with distributors, the mgmt plans to jointly focus on finalizing a suitable product mix toward uplifting the margin profile. Additionally, growth is expected to pick up in Non-Par products, given the movement in interest rates. However, the mgmt will remain watchful of the pricing environment. With the GST rate cut, protection is expected to witness healthy growth which will also support overall VNB margin. Further, product-level margins are expected to enhance, with focus on longerterm and higher sum-assured products. Overall, the mgmt expects VNB margin to normalize by start-FY27. APE growth is expected to pick up in H2, on demand recovery.

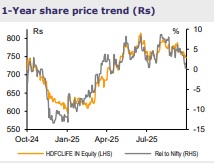

We retain BUY with unchanged TP of Rs850

Following the developments in Q2FY26, we tweak our estimates which results in ~1% cut in APE estimates, while we lower VNB margin by ~20-50bps over FY26-28E which leads to a ~1-3% cut in VNB. We retain BUY on the stock with unchanged Sep-26E TP of Rs850, implying FY27E P/EV of 2.5x as we recognize the franchise strength, and the management’s established track record to navigate through external challenges.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354