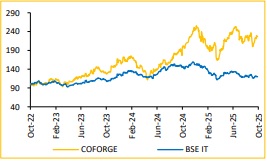

Daily Morning Briefing : Buy Coforge Ltd for the Target Rs. 2,015 by Choice Institutional Equities

To Sustain Robust Growth By Leveraging AI & IP

We believe, COFORGE to stay ahead of the curve in delivering services by embedding AI early across its offerings. It will also leverage its proprietary IP and platforms like, Code Insight AI, BlueSwan and Forgex to infuse GenAI and intelligent automation led delivery. The company continues to build on its large-deal momentum, signing 5 large deals during the quarter, with size of deals showing a steady rise. These underpins management’s confidence in sustaining robust growth over the coming years, supported by both organic and inorganic initiatives. Accordingly, we revise our estimates upward and now expect Revenue/EBIT/PAT to grow at a CAGR of 21.7%/26.4%/38.6% over FY25–FY28E. Taking the average of FY27E and FY28E EPS at INR 57.6 and maintaining a P/E multiple of 35x, we arrive at a revised target price of INR 2,015 (earlier INR 1,930), reaffirming our BUY rating.

Revenue slightly below Estimates; Strong Improvement in EBIT and PAT

* Reported Revenue for Q2FY26 stood at USD 462.1Mn up 4.5% QoQ (vs CIE est. at USD 467.0Mn) and 5.9% in CC terms. In INR terms, revenue stood at INR 39.9Bn, up 8.1% QoQ.

* EBIT for Q2FY26 came at INR 5.6Bn, up 31.8% QoQ. EBIT margin was up 251bps QoQ to 14.0% (vs CIE est. at 13.5%).

* PAT stood at INR 3.8Bn in Q2FY26, up 52.0% QoQ, driven by the absence of exceptional item seen in the previous quarter (vs CIE est. INR 3.5Bn).

Large Deal Momentum Continues; Strategic Focus on Scaling Verticals

COFORGE continues to build on its large-deal momentum, reinforcing it as a key growth engine. The company secured 5 large deals during the quarter across North America and Asia Pacific, driving a strong order intake of USD 514Mn and an executable order book of USD 1.63Bn, up 26.7% YoY. Notably, COFORGE closed 10 large deals in H1FY26, compared to 14 deals in FY25, underscoring its improving win rate and deal pipeline. Management highlighted growing traction in AI-led modernization deals, especially in North America and reiterated its focus on robust organic growth complemented by selective acquisitions over the next 2–3 years, despite prevailing macro uncertainties. Vertical-wise, Banking & Financial Services (BFS) grew 4.0% QoQ, while Travel, Transportation & Hospitality (TTH) posted a strong 6.4% QoQ rise, maintaining its leadership momentum. The company aims to scale its Healthcare and Public Sector verticals, targeting an order book run-rate of USD 100Mn and USD 200Mn, respectively, in the near term.

EBITM To Be Maintained In Narrow Band

COFORGE reported margin resilience in Q2FY26, with EBITM rising 251 bps QoQ to 14.0% due to lower SG&A costs. The company aims to maintain EBITM at around 14% going ahead aided by large-deal ramp-ups. Management intends to invest back any excess to 14% of EBITM, for prioritizing growth over margins. Accordingly, we expect EBIT margins to remain range-bound through FY27E–FY28E. The company targets FCF/PAT conversion at 70%-80% going forward. Employee headcount stood at 34,896 as of Q2FY26, while attrition rate remained stable at 11.4%.

Management Call - Highlights

* Employee headcount stood at 34,896 as of Q2FY26. Attrition rate rose marginally to 11.4% compared to 11.3% in Q1FY26.

* Three of the five large deals were from North America — two in the Insurance vertical and one in Travel. Notably, two of these North American deals were with new clients.

* Growth was led by the Travel vertical, which grew 6.4% sequentially. The 'Others' vertical (including healthcare, retail, high tech, and manufacturing) grew 5.9%. BFS grew 4%, Insurance grew 1.8%, and Government outside India grew 0.4%.

* Top five clients grew 6.2% QoQ and contributed 21% to Q2 revenue. Top 10 clients grew 9.8% QoQ and contributed 31% to total revenue.

* Management remains strongly committed to turning in the ninth consecutive year of robust growth and expects FY26 to be an exceptional fiscal year.

* Management emphasized that they are fundamentally changing service delivery by embedding AI early using proprietary IP and platforms. It utilizes Code Insight AI (for enhanced software reverse engineering), BlueSwan (for integrated automation and orchestration), and Forge-X (for rapid transformation).

* Revenue per Employee (RPE): RPE for the tech services business is nudging USD 70,000 per employee, a metric called out to illustrate the impact of AI-led platforms and high-quality growth. Management believes RPE should continue trending upwards due to the success of platforms like Code Insight, Evolve OPS, and BlueSwan QE AI.

* A wage hike was announced effective October 1st. Historically, this causes a drop of 100-250 bps in the subsequent quarter (Q3), which the management intends to partially offset using other levers to hit the 14% EBIT target for the full fiscal year.

* The company has received NCLT approval for the merger with Cigniti which is expected to be completed by Jan’26. The merger will be effective from 1st April’25.

* The Board has recommended an interim dividend of INR 4 per share.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131