Buy Ceat Ltd For Target Rs. 4,200 By JM Financial Services

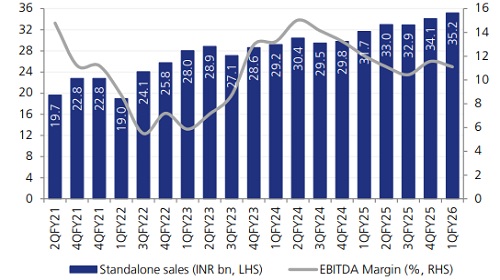

CEAT’s 1QFY26 EBITDA margin came in at 11.0%, 40bps below JMFe. 40bps QoQ contraction in EBITDA margin was on account of lower realisations and higher marketing spends (seasonal IPL related). Strong momentum in OEM and RE segments, along with steady market share gains, continues to support volume growth. Management remains optimistic on the demand outlook and maintains its double-digit growth expectation for FY26. With respect to the international business, geopolitical and tariff-related headwinds continue to persist. However, seasonal demand in EU and partial completion of channel destocking are expected to drive demand going forward. CEAT plans to hold prices in the near-term. Margins are expected to be supported by softer RM (1-2% benefit from 2Q onwards), volume growth in the international market, and astute cost controls. We expect revenue/EPS CAGR of 10%/25% over FY25-FY28E. Maintain BUY with Mar’27 TP of INR 4,200 (18x PE).

* 1QFY26 – Margin slightly below JMFe: In 1QFY26, CEAT reported consolidated net sales of INR 35.3bn (+11% YoY, +3% QoQ), c.1% above JMFe. Overall volumes grew by 9% YoY led by healthy growth in OEM and replacement segment. Consol. EBITDA stood at INR 3.9bn (+1% YoY, flat QoQ), c.2% below JMFe. Consol. EBITDA Margin stood at 11.0% (-100bps YoY, -40bps QoQ), 40bps below JMFe. Adj. PAT came-in at INR 1.2bn (- 21% YoY; -15% QoQ), after adjusting for VRS expense of INR 33mn.

* Demand environment: Domestic demand remained healthy, with early-twenties YoY growth in the OEM segment and strong single-digit growth in the replacement segment. In the OEM segment, the company witnessed robust growth in share of business, led by product approvals in higher rim sizes. In the replacement segment, PC demand remained soft impacted by weak growth in the urban market, and the management expects this trend to persist in the near-term. On the other hand, 2W segment continued to perform well, driven by strong rural and scooter demand. TBR also saw steady mid-single-digit growth. The management highlighted that market share gains in both 2W and PC segments. Overall, the company has maintained its double-digit growth outlook in FY26 on a standalone basis, supported by sustained momentum in the OEM and RE segments. International business remained flat YoY owing to geopolitical and tariff-related headwinds. LATAM and MEA continue to face challenges. CEAT has a limited direct exposure in the US market and hence, the minimal impact of tariff. Going ahead, the company expects international business to improve in 2QFY26, led by seasonal demand of PC tyres in EU and channel destocking getting partially over. However, visibility for 2HFY26 in EU remains limited.

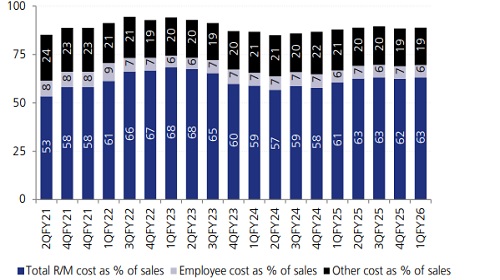

* Margin outlook: Gross margin contracted by c.70 bps QoQ in 1QFY26. This was primarily driven by lower realisation due to 1) partial absorption of tariff, 2) one-time execution of a large private label order, and 3) lower EU sales. RM basket remained flattish QoQ. While international NR (60% of CEAT’s requirement) prices declined during 1Q (from USD 1,900 to USD 1,700 per metric ton), domestic rubber prices remained elevated. CEAT plans to hold prices, and expects margin improvement from 2Q onwards, led by 1-2% benefit from a softer RM basket, volume growth in intl. market and normalisation of marketing spends.

* Other highlights, capex and debt: 1) Overall capacity utilization stands at 80%+. Capex in 1QFY26 stood at INR 2.31bn. Capex guidance for FY26 stands at INR 10bn (including maintenance capex and INR 4.5bn for Chennai plant to be spent over the next 18-24 months. 2) Debt reduced by INR c.1.15bn during 1Q. Debt/EBITDA ratio improved from 1.29x to 1.21x. 3) CAMSO’s consolidation is expected from 1st September (Annual revenue rate: USD 150mn with mid-teens margin). The prevailing tariff rate for SL stands at 30% (vs. 44% previously) and the company remains hopeful for further reductions.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361