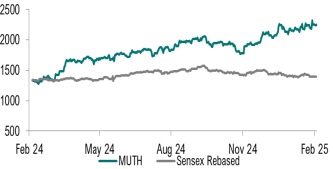

Accumulate Muthoot Finance Ltd For Target Rs. 2,512 By Geojit Financial Services Ltd

Gold Loans Thrive as Unsecured Lending Slows

Muthoot Finance, India’s largest NBFC in gold loans by loan portfolio, operates over 6,759 branches nationwide. Besides gold loans, it offers various loans, insurance, money transfer services, and gold coin sales through its subsidiaries.

* The consolidated loan AUM, grew by 34%YoY to Rs. 1,11,308 cr in Q2FY25, primarily driven by the growth in standalone gold business.

* The gold loan portfolio increased to Rs. 92,964 cr, registering a 34% YoY growth. This was supported by accelerated demand for gold loans, especially during the festive season, and a slowdown in unsecured lending.

* The expansion of branch network and the increasing adoption of our digital platform further strengthened customer engagement.

* Asset quality in the gold book improved marginally, with the Gross loan asset stage 3 ratio standing at 4.2% in Q3FY25, down from 4.3% in Q2FY25. Auctions during the quarter were Rs. 600mn vs Rs. 2500mn Q2FY25.

* The gold loan business reported a current yield of 18.62%, earning Rs. 4,369 cr as interest income. Net Interest Income (NII) stood at Rs. 2,721 cr, showing a 43% YoY growth in Q3FY25.

Outlook & Valuation

We anticipate continued outperformance in the gold loan segment in the near term. The expansion of gold loans through the subsidiary, Muthoot Money, combined with elevated gold prices and a slowdown in unsecured lending options, is expected to support growth. Credit costs have increased by 23 bps YoY, primarily due to substantial provisions resulting from a less aggressive auction policy. With rising gold prices, asset quality risks remain limited. Considering the favourable outlook for gold, we value the consolidated entity at 2.4 times FY26E BVPS. We maintain our "Accumulate" rating with a rolledforward target price of Rs. 2,512 based on the SOTP valuation method.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345

.jpg)