Buy Ujjivan Small Finance Bank Ltd For Target Rs. 57 - Centrum Broking Ltd

Ujjivan SFB (Ujjivan) has delivered better-than-expected numbers for Q4FY25. NII came in at Rs8.6bn (down 7% YoY/down 3% QoQ), which was below our estimate of Rs8.2bn. Cost/assets continued its upward trajectory to 6.7% vs. 6.5% in Q4FY24. Slippages stood flat at 4.7% vs. 4.7% in Q3FY25, with 87% coming from MFI. The trend in MFI slippages going ahead should get under control as PAR trend across buckets improve. Credit cost spiked to 3.38% vs. 2.93% in Q3FY25 and 4.3% for FY25. RoA and RoE were subdued at 0.7% and 5.5%, respectively. However, there were several encouraging developments such as an improvement in Bucket X CE for both Group and IL books, reaching 99.5% as of March 2025. Further, in the month of April, 2025 the bank has reversed the yield cuts (115bps on the JLG book and 75bps on the IL book) taken on its MFI portfolio in January 2025, as bank if confident of growth revival in the sector. We have factored in marginally NIMs compression given change in Advances mix in favour of secured from 43% in FY25 to 50% in FY27. Given this backdrop and undemanding valuation (1.1x FY27ABV coupled with expected RoE improvement to ~17% from 12% in FY25), we maintain BUY on Ujjivan with a revised Target Price of Rs57 (earlier target: Rs59) at a recommended P/BV multiple of 1.5x FY27E. Maintain Ujjivan as one of our Top Pick in SFB space.

Operating performance under pressure on expected lines

NIM (calc) came in at 8.6%, down 52bps, due to higher slippages and change in loan mix. Further, CTI was sequentially higher at 68.3% vs. 66.1% in Q3FY25. Provision surged to Rs2.65bn (+235% YoY/+19% QoQ). PCR was down marginally QoQ to 78% from 80%. PAT came in at Rs834mn, down 74.7%/23.2% YoY/QoQ. Annualized gross slippages were 4.7% of AUM (flat QoQ) and the bank did a write-off/ARC sale of Rs4.2bn during the quarter.

Sequentially secured book increases to 43% up ~300bps

Gross loan book at Rs321bn was up 8%/5% YoY/QoQ with Non-MFI (secured) book forming 43% of the book vs. ~41% in Q3FY25. Disbursements stood at Rs74.4bn, up ~39% QoQ. Total deposits stood at Rs376bn, up by 20% YoY and 9% QoQ. CASA print was marginally higher at 25.5% vs. 25.1% in Q3FY25. Management has been pivoting towards secured book with robust performance in HL (up 14% QoQ)/MSME (up 21% QoQ)/ FIG segments (up 23% QoQ).

MFI portfolio stress has likely peaked; FY26 expected to be better

The management has refrained from giving guidance on the JLG book due to uncertainties in the macro environment. However, they provided some colour on their expectations about the loan book: strong disbursements (including MFI) growth is anticipated in the coming quarters. As per the management, after nearly nine months of muted disbursements across industry, demand is showing signs of recovery coupled with improvement in X-Bucket CE. Further, the company expects a pick-up in new customer acquisition in FY26, which had slowed due to a cautious approach and focus on repeat customers. Additionally, improved collection efficiency is allowing branches to shift focus back to sourcing new customers, supporting a revival in disbursement activity. This improving trend has already begun and is expected to sustain in the coming quarters. On liability front, Deposit growth is expected to align with loan book growth.

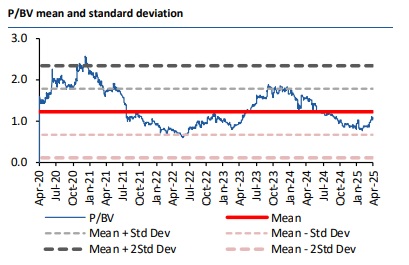

Valuation

We maintain BUY on Ujjivan with a revised target price of Rs57 (earlier target: Rs59) at a recommended P/BV multiple of 1.5x FY27E. We have baked in MFI cycle improvement in FY26 and the bank is well-positioned to deliver ~14% RoE by FY26.

For More Centrum Broking Disclaimer https://www.centrumbroking.com/disclaimer/

SEBI Registration No.:- INZ000205331