Neutral LIC Housing Finance Ltd for the Target Rs. 630 by Motilal Oswal Financial Services Ltd

Profitability taking precedence over loan growth

Disbursement weak and BT-OUT elevated; Asset quality continues to improve

* LIC Housing Finance’s (LICHF) 2QFY26 PAT grew ~2% YoY to ~INR13.5b (in line). NII in 2QFY26 rose ~3% YoY to ~INR20.4b (in line). Fee and other income grew 74% YoY to INR1.4b.

* Opex declined ~3% YoY to INR3b (~12% lower than est.) and the costincome ratio declined ~120bp YoY to ~13.9% (PY: ~15.1% and PQ: ~13.4%). PPoP grew ~8% YoY to ~INR18.7b (in line).

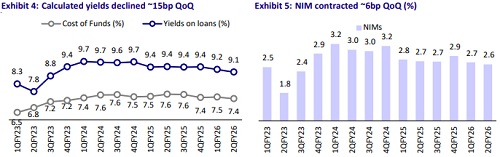

* Reported yields declined ~20bp QoQ to 9.4%, while CoB declined ~8bp QoQ to ~7.4%. This resulted in spreads declining ~12bp QoQ to ~1.98%. NIM in 2QFY26 declined ~6bp QoQ to ~2.62%.

* The muted loan growth was driven by both a weakness in disbursements as well as higher repayments (from elevated BT-OUTs). Banks (particularly PSU banks) continue to remain aggressive in both the IHL (individual home loans) and non-IHL segments. Management shared that it will prioritize NIM (and profitability) over aggressive loan growth. The company continued to guide for NIM of ~2.6-2.8% in FY26, and we estimate NIM of 2.6%/2.7% in FY26/FY27.

* LICHF plans to review its organizational structure and distribution channels to improve loan growth. It plans to expand its direct sourcing through lead generation and improve the share of its subsidiary-sourced business. We model loan growth/disbursements CAGR of 7%/ 8% for FY25-FY28.

* The company reported a minor improvement in asset quality, which is expected to improve further, with 2-3 large accounts (ticket size > INR2b) in their final stages of resolution and expected to be resolved in 2HFY26. The increase in Stage 3 PCR during the quarter was attributed to the creation of management overlays on a few long outstanding stressed assets.

* We estimate a CAGR of ~7%/4% in advances/PAT over FY25-28 and RoA/RoE of 1.7%/13% by FY28. LICHF is planning to engage with a consultant to evaluate areas for process improvement and reorganization. However, these changes are often long-drawn with no real certainty of a turnaround. Meanwhile, as shared by the company, it will continue to prioritize NIM (and profitability), which will keep the loan growth in mid-tohigh single digits over the medium term. With no near-term catalyst, we reiterate our Neutral rating on the stock with a TP of INR630 (based on 0.7x Sep’27E P/BV).

Weak disbursements and higher repayments lead to subdued growth

* Loan disbursements in IHL grew ~3% YoY, while non-IHL disbursements rose 23% YoY. Non-housing commercial disbursements declined ~19% YoY. Builder/project loan disbursements declined ~73% YoY.

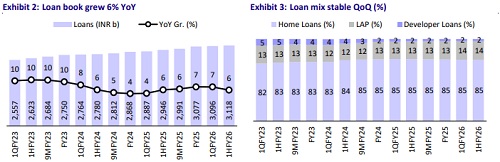

* Loan growth was sluggish, driven by both weak disbursements and higher repayments. Total disbursements declined ~1% YoY to ~INR163b. Overall loan book grew ~6% YoY and ~1% QoQ to INR3.12t. Home loans grew ~7% YoY, while the developer loan book grew ~17% YoY. Repayments stood at 18.2% (PQ and PY both at 14.6%).

* Management expects a better disbursement momentum in 3Q and 4QFY26, especially with a strong pipeline in the construction finance segment.

Marginal improvement in asset quality

* GS3/NS3 declined ~10bp each QoQ to ~2.5%/1.2%, respectively. Stage 3 PCR improved ~230bp QoQ to ~53% (PQ: ~51%). Stage 1 PCR declined to ~17bp (PQ: ~18bp), and Stage 2 PCR rose ~15bp QoQ to ~3.9% (PQ: 3.7%).

* Stage 2 + 3 assets (30+ dpd) declined ~30bp QoQ to 5.9% (vs. ~6.2% in Jun’25). ECL/EAD remained stable QoQ at ~1.63%. Management shared that most of the Stage 3 loans are legacy stressed accounts. About 2-3 large corporate loans (Ticket size >INR2b) are expected to be resolved in 2HFY26, which will further improve the asset quality.

* Credit costs stood at ~INR1.7b (~25% higher than MOFSLe) and translated into annualized credit costs of 22bp (PY: ~11bp and PQ: 25bp). Despite credit costs of 22-25bp in 1HFY26, the management expects FY26 credit costs to be contained between 15bp and 20bp. We model credit costs of ~18bp/25bp in FY26/FY27.

Highlights from the management commentary

* The company’s ~43% of borrowings are repo-linked and benefit directly from lower market rates, while ~53% are fixed-rate NCDs that will reprice gradually.

* The construction finance segment witnessed a slowdown due to home loan-like interest rates offered by banks. However, the company has a strong pipeline in this segment, which is expected to support overall disbursements in 2H.

Valuation and view

* LICHF reported a tepid quarter, marked by muted loan growth and weak disbursements. NIM continued to remain under pressure due to the realization of the full impact of the ~25bp PLR cut taken in Apr’25. Management indicated that NIMs have bottomed out and are now expected to see improvement in subsequent quarters.

* We believe that the declining interest rate environment, coupled with aggression from banks (in the home loan as well as construction finance segments), will weigh on LICHF’s loan growth and its consequent trade-off with margins.

* LICHF’s valuation of ~0.7x FY27E P/BV reflects the inability of the franchise to deliver stronger loan growth. We estimate a CAGR of ~7%/4% in advances/PAT over FY25-28E and RoA/RoE of 1.7%/13% by FY28. We reiterate our Neutral rating on the stock with a TP of INR630 (based on 0.7x Sep’27E BV).

* Key risks: a) an elongated period of weak loan growth due to high competitive intensity and b) volatility in the NIM profile.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412