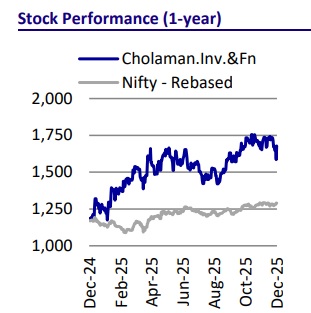

Buy Cholamandalam Investment and Finance Company Ltd for the Target Rs. 2,000 by Motilal Oswal Financial Services Ltd

Refutes allegations; franchise fundamentals intact

Robust near-term outlook on the back of improving business momentum

* On 22nd Dec’25, an agency named Cobrapost released an investigative report alleging large-scale related-party transactions, cash handling irregularities, governance lapses, and regulatory non-compliance at CIFC. CIFC’s management responded promptly, categorically refuting the claims and stating that the allegations are malicious, distorted, and motivated, and lack any factual or regulatory basis.

* CIFC’s management convened an investor call to address investor queries and the allegations raised, reiterating that the claims are baseless, selective, and stem from misinterpretation of disclosures and the applicable regulatory framework. The company further stated that there is no change in business strategy, operating performance, or guidance, and reiterated confidence in delivering on its stated growth, profitability, and asset quality objectives.

* CIFC stated that its capital position and balance sheet remain strong, with net worth expected to increase by around INR25b from FY25 levels. This is supported by INR3b already infused through CCD conversion and a further INR17b of CCD conversions expected over the next three quarters, which will further strengthen capital adequacy.

* While the call was convened to address queries related to the allegations, management also highlighted that the current quarter has been strong in terms of disbursements across both vehicle finance and home loans. The company expects 3QFY26 to mark a turnaround, with 2HFY26 likely to be seasonally strong.

* Moreover, CIFC stated that it will engage with regulators to assess whether there is any financial or market-manipulation motive and will consult legal advisors to evaluate appropriate action against Cobrapost and related reporting, while expressing confidence that regulatory scrutiny will validate its position. ? CIFC remains a robust franchise, with an expected CAGR of ~20% in AUM and ~25% in PAT over FY25-28, alongside projected RoA/RoE of 2.7%/20% in FY28. Reiterate our BUY rating with a TP of INR2,000 (4x Dec’27E BVPS).

Summary of key allegations and management’s clarification

* Cobrapost’s key allegations include aggregation of transactions over multiple years and claims of fund diversion through group entities such as Murugappa Management Services (MMS), Chola Business Services Ltd. (CBSL), and Chola MS General Insurance (CMGICL). The report alleges transactions exceeding INR100b involving CIFC, group entities, family members, and senior management that were inadequately disclosed as related party transactions (RPTs).

The key allegation and management response are as follows:

* Allegation 1: The report highlights cash deposits of ~INR250b made by CIFC across 14 banks over the past six years, raising questions around cash handling practices for a large NBFC.

* Management response 1: CIFC shared that given the cash-based nature of borrower incomes, EMIs are often collected in cash and subsequently deposited into banks. These cash collections are governed by robust internal controls and are subject to both internal and statutory audits. Management further shared that cash collections have come down to 15% from 50% historically.

* Allegation 2: CIFCL is alleged to have earned very high insurance commission income, including about INR9.4b in FY25, raising questions on whether insurance was bundled with vehicle and home loans, which is not allowed by regulators.

* Management response 2: CIFC offers accident and hospitalization insurance to its borrowers, with premiums remitted to Chola MS General Insurance based on competitive pricing and coverage, while also partnering with multiple thirdparty life and health insurers, underscoring the absence of exclusivity or coercion.

* Allegation 3: The report also raised concerns in relation to payments made to rating agencies over the years.

* Management response 3: Management stated that fees paid to credit rating agencies are market-linked and lower than peers, with payments of ~INR 380m to ICRA and ~INR 170m made to CRISIL over the past eight years. The company shared that it paid annual CRA fees of ~INR200m in FY25, which are below industry averages for CIFC’s balance sheet size, and emphasized that there is no preferential treatment or influence involved.

* Allegation 4: CIFCL allegedly paid more than INR200m to non-profit organizations, religious bodies, and trade associations, including Isha Foundation, but recorded these as work-contract expenses rather than donations.

* Management response 4: Management clarified that all CSR spending is fully disclosed in the annual reports and is structured as work contracts rather than donations to ensure proper monitoring, measurable outcomes, and regulatory compliance, describing this approach as a governance-led choice rather than an exception.

* Allegation 5: RPT and disclosure allegations

* Management response 5: Management strongly refuted allegations of undisclosed or improperly classified RPTs. It clarified that all RPTs have been disclosed in accordance with applicable accounting standards, and all payments have been made in full compliance with legal requirements. Management pointed out that Cobrapost’s analysis aggregates transactions across extended periods and applies retrospective related party definitions that were not applicable in earlier years, leading to inflated and misleading aggregates.

Valuation and view

* CIFC is gradually evolving into a more robust and resilient NBFC—one that is less cyclical, more diversified, and increasingly anchored in stable, secured retail and SME income streams. The company’s measured approach of curbing exposure to riskier product lines, while simultaneously expanding newer businesses, such as CD and gold loans, underscores its commitment to preserving earnings quality and maintaining balance sheet strength.

* The company is navigating a complex operating environment by reinforcing its core businesses while taking corrective measures in an underperforming segment like CSEL. A key management priority is improving operational efficiency, with efforts directed toward enhancing productivity and optimizing costs, particularly in its vehicle, home loans, and LAP businesses.

* CIFC trades at 3.9x FY27E P/BV, a premium that we believe is well-deserved and likely to sustain. This reflects the company’s consistent focus on navigating vehicle demand cyclicality while sustaining healthy AUM growth and stable asset quality through a well-diversified product mix. We expect CIFC to deliver a PAT CAGR of ~25% over FY25-28, with RoA/RoE of 2.7%/20% by FY28. We reiterate BUY with a TP of INR 2,000 (based on 4x Dec’27E BVPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412