Buy Star Health Ltd for the Target Rs. 460 by Motilal Oswal Financial Services Ltd

Weak underwriting profitability due to elevated claims

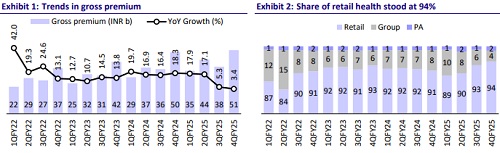

* Star Health (STARHEAL)’s net earned premium rose 12% YoY to INR38b (inline) in 4Q. For FY25, the net earned premium grew 15% YoY to INR148b.

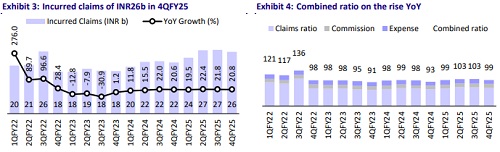

* The claims ratio at 69.2% (vs. our est. of 68.1%) grew 510bp YoY in 4QFY25, with a 21% YoY increase in net claims incurred to INR26.3b (in-line). The rise was due to a higher claim frequency and severity. Operating expenses were in line, with the expense ratio (incl. commission ratio) at 29.9% (vs. our est. of 29.2%).

* The elevated claim ratio led to a 640bp YoY surge in the combined ratio to 99.2% (vs. our est. of 97.3%) in 4QFY25.

* A flat YoY performance with respect to investment income along with elevated claims resulted in a PAT of INR5.2m in 4QFY25. For FY25, PAT declined 24% YoY to INR6.5b.

* STARHEAL expects fresh business growth momentum, price correction across the product portfolio (20-40% hike in 60% of the products), and prudent selection in the micro-segment to fuel growth and improve loss ratios.

* Considering the performance in 4QFY25, we cut our FY25/FY26 PAT estimates by 13%/2%, factoring in an elevated claims ratio and reduction of our investment income estimates. We reiterate our BUY rating with a TP of INR460 (based on 25x FY27E EPS).

Combination of elevated claims and lower investment yield hurts PAT

* Gross written premium at INR51.4b grew 35% YoY (in line), driven by 37% YoY growth in retail health premium and 6% YoY de-growth in group health premium. The decline in the group health segment is the result of a recalibrated strategy towards reducing group health contribution.

* The underwriting loss for 4QFY25 came in at INR2.8b vs. the underwriting loss of INR0.9b in 4QFY24 (our est. of INR2.1b).

* Total investment income was INR2.9b (24% below est.), flat YoY, due to lesser profit booking in equity investments vs. previous quarters.

* The renewal premium ratio was at 97% for FY25 (vs. 98.4% in FY24). In FY25, fresh business contributed 23% to the mix (22% in FY24).

* The commission ratio at 15.8% (vs. our est. of 14.0%) grew 150bp YoY, while net commission grew 17% YoY to INR7.6b (11% above). This was due to a higher share of new business in the mix.

* The expense ratio at 14.2% (vs. our est. of 15.2%) declined by 20bp YoY on account of a 3% YoY decline in employee expenses while other expenses grew 22% YoY.

* For FY25, without considering the impact of the 1/n framework, the combined ratio grew 350bp YoY to 100.2% (101.1% considering the 1/n impact). The impact of 1/n was 90bp on the expense ratio.

* Investment assets stood at INR17.9t by the end of 4QFY25, reflecting an investment leverage of 2.5x. Investment yield for FY25 was 7.8% (vs. 7.7% in FY24).

* IFRS PAT was INR7.9b in FY25 compared to INR11b in FY24. Management has set a target to triple the FY24 IFRS PAT by FY28.

Key takeaways from the management commentary

* The company expects product-level loss ratios to decline 2-3%, driven by price correction of the respective products.

* The company witnessed 25% YoY growth in fresh retail GWP driven by renewed agent productivity, sharpened campaigns, and acceleration of digital channels.

* The claim frequency increased by over 7%, driven by movement from secondary to tertiary care hospitals, preference towards hospitalization, higher accessibility for hospitals, and a rise in preventive screening. Earlier, the claim frequency increase used to be 3-4%.

Valuation and view

* STARHEAL is witnessing the impact of: i) the 1/n accounting framework and ii) a significant rise in claim frequency and severity on the profitability of the company. Recent pricing actions may provide some relief from rising medical inflation and hospitalization trends and likely bring the claims ratio down gradually over the next few quarters. Scale benefits will help reduce the expense ratio, while the commission ratio is expected to remain in the current range.

* Considering the performance in 4QFY25, we cut our FY25/FY26 PAT estimates by 13%/2%, factoring in an elevated claims ratio and reduction of our investment income estimates. We reiterate our BUY rating with a TP of INR460 (based on 25x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)