Neutral Asian Paints Ltd for the Target Rs.2,500 by Motilal Oswal Financial Services Ltd

Challenges persist, exciting days still far away

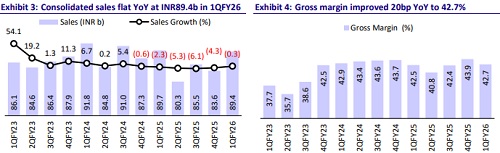

* Asian Paints (APNT)’s consolidated revenue growth was flat in 1QFY26, with standalone revenue declining 1% YoY (in line). Domestic volume grew 4% YoY. Demand was subdued, as it was partially hit by the early monsoon, while product mix was unfavorable. APNT is witnessing early green shoots of demand recovery in urban areas, while rural areas remain steady. Demand in Jun and Jul’25 was muted, but management is hopeful for a recovery in Sep’25. International business revenue grew 8.4% (+17.5% in CC terms).

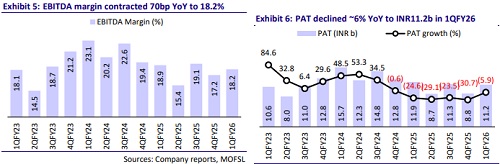

* Consolidated GM improved 20bp YoY due to softening RM prices, while it contracted 130bp QoQ to 42.7%. EBITDA margin contracted 70bp YoY to 18.2%. APNT’s EBITDA declined 4% YoY (est. -1%) to INR16.2b.

* Management expects a gradual demand recovery ahead; it alluded to the fact that competitive intensity remains elevated in the space. The company is targeting single-digit growth in both value and volume terms in the near term and maintains its EBITDA margin guidance of 18-20%, supported by formulation and sourcing efficiencies.

* Given the uncertainty in demand and intense competition, the softening of RM prices is not rendering the required confidence in desired earnings. Against this backdrop, we reiterate our Neutral rating with a TP of INR2,500 (based on 45x Jun’27E EPS).

In-line performance; domestic volume up 4% YoY

* Flat performance: Consol. net sales remained flat YoY at INR89.4b (est. INR90.6b), given the muted demand environment. Decorative business (India) clocked a volume growth of 3.9% (est. 7%, 1.8% in 4QFY25), while revenue dipped 1% YoY. Downtrading was observed in the luxury segment, while both the economy and premium segments displayed healthy growth.

* Contraction in operating margin: Gross margin inched up 20bp YoY to 42.7% (est. 43.8%). GP was flat YoY at INR38.2b. Employee expenses rose 4% YoY, and other expenses were up 3% YoY. EBITDA margin contracted 70bp YoY to 18.2% (est. 18.5%).

* Better industrial performance: The Industrial Coatings segment posted an 8.8% YoY revenue growth, led by strong performance in Auto and Protective Coatings. The bath business revenue declined 5% YoY, while that of the kitchen business dipped 2.3%. Teak and Weather Seal revenue declined 32% YoY.

* Healthy international growth: International business registered a value growth of 8.4% (17.5% growth in CC terms) backed by growth in Asian markets, the UAE, and Egypt.

* Continued dip in profitability: EBITDA declined 4% YoY to INR16.2b (est. INR16.8b). PBT dipped 6% YoY to INR14.7b (est. INR14.8b. Adj. PAT declined 6% YoY to INR11.2b (est. INR11.3b) for the quarter.

Key highlights from the management commentary

* The key retailing season is likely to shift to Sep’25, supported by the early festive season and the hope that monsoons will not affect demand.

* Competition remains intense, and the company is focusing on innovation, brand saliency, regionalization, and other strategic levers to navigate nearterm uncertainties.

* The company is targeting single-digit growth in both value and volume terms.

* Raw material prices have softened, especially crude derivatives, but the company is monitoring potential cost increases due to anti-dumping duties on TiO? from China—while the impact was not felt in Q1 due to sufficient inventory, a 1.5–2.5% cost increase is expected from Q2 onwards, though the company aims to maintain its EBITDA margin guidance of 18–20% supported by formulation and sourcing efficiencies.

* Management has planned INR7b in capex for FY26, of which INR1b has already been spent in 1Q.

Valuation and view

* We largely maintain our estimates for FY26 and FY27.

* APNT remains focused on innovation, brand saliency, regionalization, and other strategic levers such as new launches across price segments and packaging revamps to stay competitive against both organized and unorganized players. The entry of deep-pocketed new players with notable investment commitments could drive shifts in market share and cost structures across the industry.

* We remain cautious about both value growth and margin for FY26. The stock has not performed well on a YTD basis (up by a mere 4%) as demand and competitive pressure still hover around earnings. We reiterate our Neutral rating with a TP of INR2,500 (based on 45x Jun’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412