Neutral Asian Paints Ltd for the Target Rs. 3,000 by Motilal Oswal Financial Services Ltd

Turning the corner; improving growth commentary

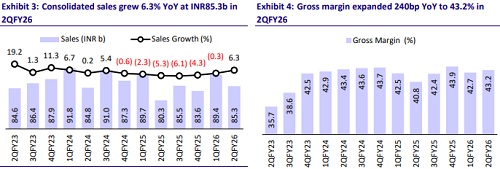

* Asian Paints (APNT) reported a 6% YoY growth in consolidated revenue (base -5%), with standalone sales up 6% YoY, marking growth after six consecutive quarters of decline. Two-year revenue CAGR was flat in 2Q, in line with its listed peers. Domestic decorative volumes grew 11% YoY. Extended monsoon impacted early-quarter demand, but a visible recovery was seen in September and October, supported by festive demand and improved consumer sentiment. The international business grew 9.9% YoY (+10.6% in constant currency terms).

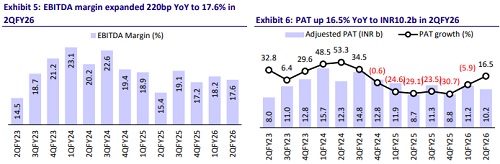

* Gross margin expanded 240bp YoY to 43.2% (est. 42.5%), driven by lower raw material costs. EBITDA margin expanded 220bp YoY to 17.6%, resulting in a 21% YoY growth in EBITDA to INR15.0b (vs. est. +9%).

* Management expects mid-single-digit value growth and high-single-digit volume growth for FY26. Additionally, it maintains its EBITDA margin guidance of 18-20%, supported by formulation and sourcing efficiencies. We model +8% revenue growth in 2HFY26, factoring in a favorable base, improving demand scenario, and the company’s own initiatives to regain growth.

* APNT is focused on innovation, brand salience, regionalization, and execution excellence to drive consistent growth. While competitive intensity remains elevated, the demand environment is stabilizing, and with the peak of disruption behind, APNT appears well-positioned to sustain steady growth and defend its market leadership.

* Given that the worst of demand pressure is behind, coupled with stability in competitive pressure and benign RM, we increase EPS by 4-6%. With expectations of better earnings, we raise our target valuation multiple to 50x (10-year average P/E) on Sep’27E EPS to derive a TP of INR3,000. We reiterate our Neutral rating.

Beat after multiple quarters of miss; domestic volume up 11%

* Sales up 6% after six quarters of contraction: Consolidated net sales grew 6% YoY to INR85.3b (est. INR81.1b). Decorative business (India) clocked volume growth of 10.9% (est. 5%, 3.9% in 1QFY26), while revenue grew 6% YoY on a favorable base (-5%). Growth was further aided by improved consumer sentiment, supportive government policies, and an early festive season, despite the impact of an extended monsoon in September. Twoyear CAGR was flat for APNT in 2Q. Berger and Indigo reported 1% and 5% CAGR.

* Beat in margins: Gross margin expanded 240bp YoY to 43.2% (est. 42.5%). GP grew 13% YoY at INR36.8b. Employee expenses rose 1% YoY, and other expenses rose 10% YoY. EBITDA margin expanded 220bp YoY to 17.6% (est. 16.7%).

* Industrial performed better: The industrial coatings segment posted a 12% YoY revenue growth, led by strong performance in auto and protective coatings. The bath business declined 5%, while the kitchen business’s revenue declined 7%. The white teak business’s revenue declined 15%, while Weather Seal’s revenue increased 57%.

* International saw healthy growth: International business registered a value growth of 9.9% (10.6% growth in CC terms), backed by growth in Nepal, Sri Lanka, and Egypt.

* Double-digit growth in profitability: EBITDA grew 21% YoY to INR15b (est. INR13.5b). PBT grew 22% YoY to INR13.5b (est. INR11.8b). Adj. PAT grew 16.5% YoY to INR10.2b (est. INR9.1b).

* In 1HFY26, net sales, EBITDA, and APAT grew 3%, 7%, and 4%.

Key highlights from the management commentary

* The overall paint industry grew by about 3–3.5% in 1HFY26, with a visible recovery during September and October, supported by the festive demand.

* The focus remains on strengthening brand equity through continued investments in regional and national media to enhance awareness and influence customer decisions.

* Over the past 6-9 months, the company has strengthened relationships with dealers and distributors, focusing on improving its return on investment and driving higher retail-level business.

* New product development (NPD) contributed over 15% of total revenue, underscoring the company’s strong innovation pipeline.

* For FY26, the company expects mid-single-digit value growth and high-singledigit volume growth, with the 4–5% gap between value and volume likely to persist.

Valuation and view

* We increased our EPS estimates by 5% for FY26 and FY27, given the improving demand in 2QFY26 and expanding margins.

* APNT remains focused on innovation, brand salience, regionalization, and execution excellence to drive consistent growth. While competitive intensity remains elevated, the demand environment is stabilizing, and with the peak of disruption behind, APNT appears well-positioned to sustain steady growth and defend its market leadership.

* With expectations of better earnings, we raise our target valuation multiple to 50x (10-year average P/E) on Sep’27E EPS to derive TP of INR3,000. We reiterate our Neutral rating.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412