Buy EPL Ltd for the Target Rs. 260 by Motilal Oswal Financial Services Ltd

Business growth driven by strong performance in the Americas Operating performance misses estimates

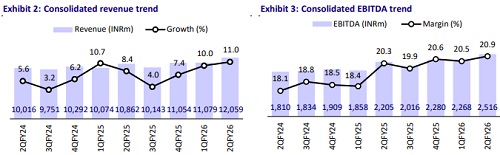

* EPL reported a revenue of INR12b (+11% YoY) in 2QFY26, in line with estimates. This was driven by revenue growth across the Americas/EAP (up 27%/11%), while AMESA declined 1% to INR3.9b during the quarter. Further, Europe recorded only 2.8% growth, impacted by temporary softness from a few large customers

* EPL continued its trajectory of margin expansion (up 60bp YoY), supported by AMESA/EAP/Americas (up 110bp/70bp/210bp). Europe recorded a margin contraction of 310bp; however, it is expected to recover in the coming quarters, supported by its strong order pipeline. Further, EPL remains optimistic about its growth trajectory, led by healthy demand in the Americas and EAP.

* We maintain our estimates for FY26/FY27/28 and value the stock at 15x Sep’27E EPS to arrive at our TP of INR260. Reiterate BUY.

Steady quarter with broad-based margin expansion

* EPL’s consolidated revenue grew 11% YoY to INR12b (est. in line). Gross margin stood at 59.6% (up 160bp YoY). EBITDA margin expanded ~60bp YoY to 20.9% (est. 21.9%), led by improving margins in AMESA/EAP/Americas.

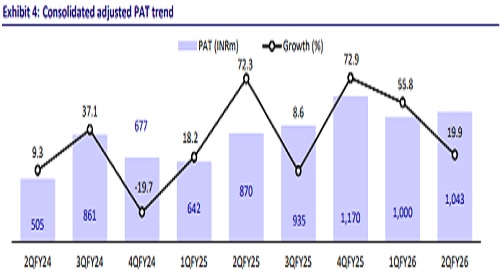

* EBITDA stood at INR2.5b (est. INR2.7b), up 14% YoY. Adj. PAT grew 20% YoY to INR1b (est. INR1.3b).

* Revenue from the Americas/Europe/EAP grew 27%/3%/11% YoY to INR2.9b/2.7b/2.9b, while revenue from AMESA declined 1% YoY to INR3.9b.

* EBITDA margins for AMESA/EAP/Americas expanded 110bp/70bp/210bp to 19.3%/22.4%/20.9%, while EBITDA margin for Europe contracted 310bp to 13.9%

* EBITDA for AMESA/EAP/Americas grew 6%/14%/48% YoY to INR753m/INR662m/INR733m, while EBITDA for Europe declined 16% to INR158m during the quarter.

* For 1HFY26, revenue/EBITDA/adj PAT grew 11%/18%/35% YoY to INR23b/INR4.8b/INR2b.

* Gross debt stood at INR6.8b as of Sept’25 vs INR6.7b as of Mar’25. CFO stood at INR2.9b as of Sept’25 vs INR3.2b as of Sept’24.

Highlights from the management commentary

* Guidance: EPL expects to maintain double-digit revenue growth, with EBITDA growth expected to outpace revenue, driven by strong traction in the Beauty and Cosmetics (BNC) segment and the anticipated recovery in the oral care segment. The company has also guided for an ROCE of over 25% by FY29E.

* EAP: The company commercialized its greenfield plant in Thailand in October, just nine months after the announcement. It plans to start supplying to its customers from 3Q. Going ahead, the company remains confident of sustaining double-digit growth in EAP, driven by strong momentum in the BNC segment.

* Europe: Europe recorded only 2.8% growth, impacted by temporary softness from a few large customers. However, moving forward, Europe remains well-positioned with a strong order pipeline and is expected to rebound in the coming quarters.

Valuation and view

* EPL continues to deliver a healthy operating performance across geographies (except Europe), supported by a healthy demand, product innovations, an improving sustainable mix (38% of total volume), and continued capacity expansion. We expect this positive trend to continue.

* With a focus on improving market share across geographies in the BNC segment and an expected recovery in Europe, we expect a CAGR of 10%/12%/19% in revenue/EBITDA/adjusted PAT over FY25-28. We value the stock at 15x Sept’27E EPS to arrive at our TP of INR260. Reiterate BUY

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412