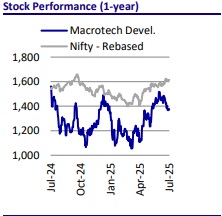

Buy Lodha Developers Ltd for the Target Rs.1,870 by Motilal Oswal Financial Services Ltd

MMR leader growing in Pune, Bangalore, and new businesses

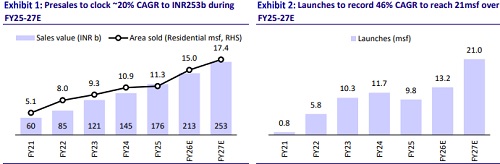

LODHA’s presales are expected to clock a 20% CAGR, led by healthy collections and a comfortable debt level of 0.2x as of 4QFY25 end. The company entered Pune and is scaling up at a healthy pace. Additionally, it has completed its pilot phase in Bengaluru and started scaling up with the acquisition of a 5.6msf project with a GDV of INR66b in FY25. Further, LODHA is expanding its commercial and industrial portfolios to garner strong rentals. We believe the company’s ability to acquire projects at a constant pace is commendable and provides strong growth visibility, along with timely execution. We reiterate our BUY rating with a revised TP of INR1,870, which implies a 36% potential upside.

Well positioned to achieve 20% presales CAGR

* Since its listing in FY21, LODHA has been religiously focusing on identifying new markets and geographies to scale up its residential business. In FY25, presales grew 21% YoY to INR176.3b, surpassing the guidance.

* In 1QFY26, even after the geopolitical tensions, Lodha has reported INR44.5b in pre-sales, up 10% YoY. Adhering to its strong presence in MMR, Pune, and now Bangalore, LODHA is set to clock a 20% presales CAGR over FY25-27E to reach INR253b, backed by a strong launch pipeline and healthy execution capabilities.

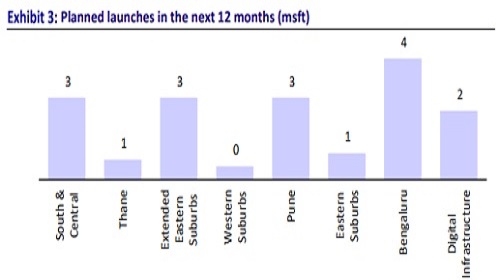

* Unlike other peers, LODHA, though not dependent on launches, has not yet laid back on introducing new projects/phases or even entering new markets. In 4QFY25, LODHA announced a land acquisition in NCR and Chennai for its commercial projects to be launched in FY26. For FY26, the company has guided for presales of INR210b and volumes of 11msf.

* LODHA is all set to now enter the growth phase in Bangalore, in line with its laid-down strategy. Currently, sales in Bangalore account for ~4% of total sales, which management plans to raise to 15% within a decade.

* Overall, launches in FY25 have been from diversified areas of MMR, Bengaluru and Pune. At Palava, LODHA launched its premium housing projects – ‘Lodha Hanging Garden’ and ‘Lodha Golf View’.

* LODHA plans to launch its upcoming projects with a GDV of INR188b in FY26. It currently has an unsold inventory of 7.5msf of completed projects and 16.8msf of ongoing ones. Further, it has a planned inventory of ~85msf that will help it progress toward the targeted FY31 presales guidance of INR500b.

* The company also has a large land parcel at Palava Township (~600msf), which is expected to result in new projects in the residential, commercial, and industrial segments. LODHA also plans to execute at least one land sale deal each year at Palava, which will contribute to sales.

* It added 10 new projects in FY25 for business development – two in MMR Western Subs (1.3msf with a GDV of INR93b), five in Pune (7.9msf with GDV of INR78b) and three in Bangalore (5.6msf with GDV of INR66b). In 1QFY26, the company added 5 new projects in MMR, Pune and Bengaluru with total GDV of INR227b. This marked a strong 91% of FY26 business development guidance already met in the first quarter of FY26 itself. The company’s strong project acquisition in Bangalore in FY25 continued in FY26 shows the beginning of the growth phase of LODHA in that market.

Valuation and view: On track for steady growth; reiterate BUY

* LODHA has delivered steady performance across key parameters, and as it prepares to capitalize on strong growth and consolidation opportunities, we expect this consistency in operational performance to continue.

* At Palava, the company has a development potential of 600msf. However, we assume a portion of this potential to be monetized through industrial land sales. We value 250msf of residential land to be monetized at INR637b over the next three decades.

* We reiterate BUY with a revised TP of INR1,870/share (earlier INR1,625/share).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)