Neutral L&T Technology Ltd for the Target Rs. 4,400 by Motilal Oswal Financial Services Ltd

A steady quarter

Guidance demands tight delivery

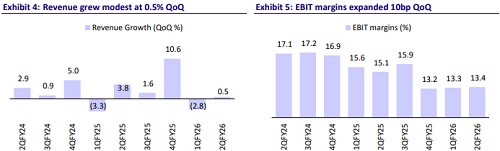

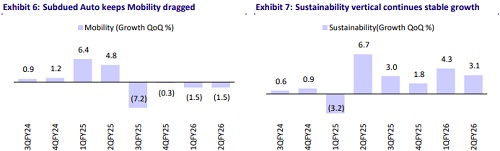

* L&T Technology’s (LTTS) 2QFY26 revenue grew 1.3% QoQ in CC terms vs. our estimate of 1.0% QoQ growth. Sustainability grew 3.0% QoQ, while Mobility declined 1.4% QoQ.

* EBIT margin stood at 13.4%, rising 10bp QoQ, in-line with our estimate of 13.4%. PAT rose 4.1% QoQ to INR3.2b, in line with our estimate of INR3.2b.

* For 1HFY26, revenue/EBIT/PAT grew 16.1%/1.1%/1.8% YoY. We expect revenue/EBIT/PAT to grow 10.9%/8.1%/14.4% YoY in 2HFY26. We reiterate our Neutral rating on the stock with a revised TP of INR4,400 (based on Jun’ 27E EPS).

Our view: Furloughs to impact 3Q growth

* Mobility to stabilize in 4Q; sustainability segment leads growth: LTTS reported a stable 2QFY26, largely driven by growth in the sustainability segment (up 3.1% QoQ). Mobility still remains weak, dragged by subdued auto demand. Trucks and off-highway sub-segments provided some relief. Management expects Auto to witness an improvement from 4Q onwards. Hi-tech remains a mixed bag. While the Intelliswift integration is supporting growth, ramp-ups in med-tech in the US have experienced some deferrals.

* LTTS reported a record-high TCV of USD300m, driven by multiple deal wins, including a USD100m large deal in the sustainability segment. The company reiterated its double-digit growth guidance for FY26 and expects both the revenue and margin momentum to improve in 2H over 1H. We believe furloughs in 3Q may partially temper growth expectations. That said, sustainability is likely to anchor performance, provided Mobility stabilizes in 4Q. We estimate 8.9% YoY CC growth for FY26.

* Margin holds up; positive outlook despite a likely wage hike impact: Margins were stable sequentially at 13.4% (up 10bp QoQ), as currency gains were offset by softness in the auto segment. Management expects margins to expand going forward, aided by a favorable segment mix, growth leverage, and SG&A optimization. With client-support investments now concluded, margin recovery should begin from 3Q. Wage hikes are expected either in 3Q or 4Q. We build a gradual improvement in margins and expect a 30bp QoQ increase to 13.7% in 3QFY26.

Valuation and revisions to our estimates

* We expect USD revenue CAGR of 10% over FY25-28E, with an EBIT margin improving to 15.5% by FY28E. LTTS remains a diversified ER&D play, further strengthened by Intelliswift’s platform engineering capabilities. Its strong performance in the sustainability vertical continues to be hindered by subdued mobility performance. Our estimates remain unchanged. We reiterate our Neutral rating on the stock with a revised TP of INR4,400 (based on 27x Jun’27E EPS).

Beat on revenue, margins in-line; maintains double-digit growth guidance for FY26

* USD revenue grew 1.3% QoQ CC above our estimate of 1% QoQ CC growth. Revenue stood at USD337m.

* LTTS reaffirmed its guidance for double-digit growth in FY26.

* Sustainability grew 3.0% QoQ, while mobility declined 1.4% QoQ.

* EBIT margin stood at 13.4%, up 10bp QoQ vs. our estimate of 13.4%.

* PAT was up 4.1% QoQ to INR3.2b, in line with our estimate of INR3.2b.

* The employee count addition remained flat QoQ at 23,678; attrition was flat QoQ at 14.8%.

* Deal signings: Large deal TCV reached a record high of USD300m for the first time.

Key highlights from the management commentary

* The macro environment remained similar to 1QFY26, though deal conversations have increased across all segments except for auto. FY26 is expected to remain a tight year.

* Customers are gradually adapting to the ‘new normal’, with decision-making showing early signs of improvement in recent months.

* The adoption of AI in manufacturing continues to pick up steadily.

* Multiple consolidation deals are underway, especially among Western and Eastern European firms, with more expected in the coming quarters.

* Management noted potential signs of a demand revival from February 2026 onwards.

* The ‘Go deeper to scale’ and multi-segment strategy is driving deeper client engagements.

* LTTS reaffirmed its double-digit revenue growth guidance for FY26 and remains confident of achieving its medium-term USD2b target.

* Growth continues across the US and Europe, with a broad-based recovery expected across all verticals from 4QFY26 onwards.

* The auto vertical continues to face headwinds as clients reassess spending priorities. However, local manufacturing programs remain resilient.

* The trucks and off-highway segments performed well; aerospace and railways remained resilient.

* LTTS signed a USD100m+ multi-year deal in the sustainability vertical with a USbased industrial equipment manufacturer in the semiconductor value chain. The deal spans over five years, is largely offshore, and aligns with segment margins.

Valuation and view

* LTTS’s strength lies in its engineering heritage from its parent company, as well as a well-diversified portfolio. The addition of Intelliswift enhances its capabilities in platform engineering, further strengthening its positioning in the ER&D space. That said, near-term growth visibility remains modest and margin expansion, while directionally intact, appears back-ended and executiondependent.

* We expect a USD revenue CAGR of 10% over FY25-28E, with EBIT margin expanding to 15.5% by FY28E. We reiterate our Neutral rating on the stock with a revised TP of INR4,400 (based on 27x Jun’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412