Buy Biocon Ltd for the Target Rs. 480 by Motilal Oswal Financial Services Ltd

Operationally in-line 2Q; healthy growth in core business

Scaling biosimilar franchise and reducing debt to support stronger profitability ahead

* Biocon (BIOS) delivered in-line revenue/EBITDA for 2QFY26. PAT for the quarter was better than expected, driven by lower minority interest for the quarter.

* BIOS has maintained a positive YoY revenue growth trend over the past five quarters, driven by the biologics and generics segment. The Syngene business was impacted by the higher base of last year.

* For biosimilars, BIOS witnessed robust momentum across key markets of North America (NA) and Europe, as well as emerging markets, led by market share gains and product launches.

* New launches have also boosted growth for the company’s generics business in the US/EU markets. Notably, improved sales led to better operating leverage, given that three new facilities were capitalized in FY25.

* We have trimmed our earnings estimate for FY26/FY27/FY28 by 2%/4%/3%, factoring in: a) procedural time required to add Insulin Aspart biosimilar in the formulary list, b) gradual reduction in interest costs, and c) R&D spending to boost product pipeline across the biosimilar/generics segments.

* We value BIOS on an SOTP basis (22x 12M forward EV/EBITDA for 73% stake in Biocon Biologics, 53% stake in Syngene, and 10x EV/EBITDA for the Generics business) to arrive at a TP of INR480.

* Following an earnings revival in FY25, BIOS is entering a scale-up phase, poised for strong earnings growth driven by robust traction across segments and improved profitability. Ongoing financial deleverage is expected to further enhance earnings prospects. Revenue/EBITDA are expected to record a CAGR of 16% over FY25-28, while earnings are expected to compound at a significantly higher rate of 77%, supported by financial deleveraging benefits. Reiterate BUY.

Product mix benefit outweighed by better operating leverage

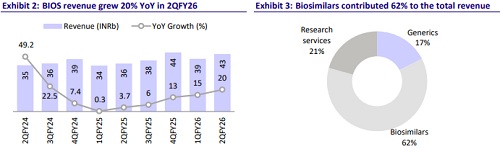

* BIOS’s 2QFY26 revenue grew 20% YoY to INR43.0b (est. INR41.4b).

* Revenue growth was led by Biosimilars (62% of sales), up 25% YoY to INR27.2b. Research services (21% of sales) rose 2% YoY to INR9.1b. Generics (17% of sales) sales rose 24% YoY to INR7.7b.

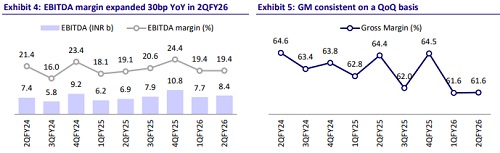

* Gross margin contracted 280bp YoY to 61.6%.

* EBITDA margin expanded 30bp YoY to 19.4% (est: 20.2%), led by better operating leverage (employee expense/other expense down 130bp/210bp YoY as % of sales). R&D cost inched up (30bp YoY as % of sales) for the quarter. EBITDA grew 21.6% YoY to INR8.4b (est: INR8.4b).

* PBT came in below estimates, driven by higher-than-expected finance costs and depreciation during the quarter.

* BIOS had incurred an exceptional expense of INR291m related to the settlement of litigation. Following the settlement, the amount disclosed under ‘other expense’ in 1QFY26 has been re-classified as an exceptional item.

* Adj. for the same, PAT at INR910m (est. INR700m) was higher than expected, mainly due to substantially lower minority interest of INR480m (est. INR1,135m) for the quarter.

* In 1HFY26, Revenue/EBITDA grew 17%/22% YoY, while PAT came in at INR1.2b vs a loss of INR1.2b in 1HFY25.

Highlights from the management commentary

* With the approval/launch of Insulin Aspart in place, BIOS is working on formulary-related procedures and expects meaningful traction from the product beginning CY26 onwards.

* The only outstanding debt is with Edelweiss, which is scheduled to be fully repaid on or before 31st Jan’26.

* Gross margin in the generics business stood at ~45%. With product launches including Liraglutide/Dasatinib, the profitability of the generics business is expected to experience an improving trend.

* R&D spend is expected at 7-9%/8-10% for biosimilars/generics, respectively, as a % of sales.

* The reduction in interest costs will start to reflect from 2HFY26 onwards, with about INR3b reduction projected to be reflected in FY27.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412