Buy Sapphire Foods Ltd for the Target Rs. 350 by Motilal Oswal Financial Services Ltd

Early festive season adds pressure

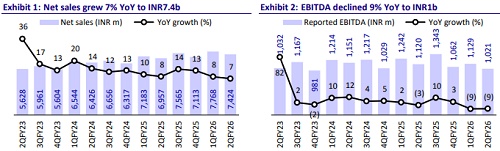

* Sapphire Foods India (SAPPHIRE) reported revenue growth of 7% YoY (in line) in 2QFY26, backed by a 10% YoY increase in store count. KFC sales grew 7% YoY and same-store sales declined 3% (in line). Excluding Navratri, sales grew 10% YoY with flat SSSG. Pizza Hut (PH) revenue declined 6% YoY as same-store sales declined 8% (est. -7%). PH in Tamil Nadu grew in double digits, backed by mass media advertising. PH saw 5% store additions. Sri Lanka posted healthy revenue growth of 23% YoY (+18% in LKR), driven by 14% LKR SSSG and 7% store growth.

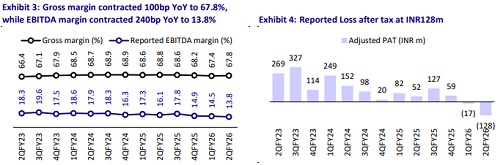

* Gross margin contracted 100bp YoY (up 40bp QoQ) to 67.8% (in line). KFC ROM was down 270bp YoY at 13.8% (est. 13%), impacted by lower ADS (down 7% YoY to INR103k), operating deleverage, lower gross margin and higher delivery mix. PH ROM contracted 590bp YoY to -1.8%. However, excluding additional marketing investments, PH ROM was at a breakeven level. Sri Lanka ROM declined 10bp YoY to 15.4%. Consolidated restaurant EBITDA pre-Ind-AS fell 13% YoY to INR841m (beat) and margins declined 250bp YoY to 11.3% (12.1% in 1QFY26). PreInd-AS EBITDA fell 7% YoY to INR548m and margins contracted 110bp to 7.4% (7.1% in 1QFY26).

* The recent GST reduction on input prices resulted in a marginal benefit of around 50bp. However, the company has not realized the benefit yet, as most of its inventory was procured at pre-revised rates. From 22nd Sep, the company passed on the benefit to consumers, adopting a selective approach by offering price reductions on 7-10 high-selling products across KFC and PH.

* The growth weakness with continuous contraction in store profitability is a big concern for QSR players. KFC ADS has dipped ~30% over the last three years and ROM contracted by ~700bp. SAPPHIRE is taking various steps to drive order growth. We model marginal growth in ADS for FY27, with improved store profitability. Although management commentary for recovery was muted, we will track if overall consumption drivers help in recovering dine-in demand. We reiterate our BUY rating on the stock with a TP of INR350 (30x Sep’27E pre-IND-AS EV/EBITDA).

In-line performance; early Navratri weighs on KFC

* In-line revenue growth: Consolidated sales grew 7% YoY to INR7.4b (est: INR7.6b). KFC revenue grew 7% YoY to INR4.9b and same-store sales declined 3%. Excluding Navratri, sales grew 10% YoY with flat SSSG. Sales declined by 6% YoY to INR1.3b, with same-store sales down 8%. KFC ADS fell 7% YoY to INR103k, while PH ADS decreased 11% YoY to INR42k. PH Tamil Nadu, Sapphire’s exclusive territory, saw double-digit revenue growth. Sri Lanka sales grew 23% YoY (+18% in LKR term) to INR1.3b and SSSG was 14%. ADS grew 17% YoY to INR109k.

* Store additions on expected lines: Store growth was 10% YoY in 2Q to 997 stores. It added net 23 stores during the quarter (19 KFC, 2 PH and 2 in Sri Lanka).

* Weak operating margin: Consolidated gross profit grew 5% YoY to INR5b (est. INR5.1b). GM contracted 100bp YoY to 67.8%. Reported EBITDA declined 9% YoY to INR1b (est. INR1b), while margins contracted 240bp YoY and 80bp QoQ to 13.8% (est. 13.2%). Consolidated ROM (pre Ind-AS) decreased 250bp YoY and 80bp QoQ to 11.3%. EBITDA pre-Ind AS contracted 110bp YoY but increased 30bp QoQ to 7.4%. SAPPHIRE reported a loss before tax amounting to INR166m.

Highlights from the management commentary

* The recent GST reduction on input prices resulted in a marginal benefit of around 50bp. However, the company has not realized the benefit yet, as most of the inventory was procured at pre-revised rates. From 22nd Sep, the company passed on the benefit to consumers, adopting a selective approach by offering price reductions on 7-10 high-selling products across KFC and PH instead of across the entire portfolio.

* KFC’s dine-in revenue share declined due to multiple factors: (1) the company’s extended delivery operations between 11 p.m. and 2 a.m., with around 10-15% of stores remaining open till 5 a.m.; (2) a higher concentration of high-street stores, which witness stronger delivery footfalls; and (3) structurally lower mall dine-in footfalls after Covid.

* Dine-in mix improved to 50% in 2QFY26 vs. 48% in 2QFY25, supported by strong regional initiatives and improved customer engagement.

* In Sri Lanka, the company effectively managed the minimum wage increase implemented in 1QFY26 and maintained EBITDA margins above 15% in 2Q. The company said that it will sustain margins at the current level in India as well.

Valuation and view

* We cut our EBITDA estimates by ~5% for FY27.

* KFC’s store addition is expected to continue in FY26, while PH’s store addition will be muted as management focuses on addressing ADS and profitability challenges within the current network.

* The company continues to face challenges in unit economics, with dine-in seeing more pressure than delivery. To drive recovery, SAPPHIRE focuses on driving product innovation, enhancing customer engagement, and strengthening valueled offerings. However, improvement in ADS and SSSG will be key monitorables, as they are essential for restoring unit-level profitability. The stock trades at 42x and 28x pre-Ind-AS EV/EBITDA on FY26E and FY27E, respectively. We reiterate our BUY rating on the stock with a TP of INR350 (30x Sep’27E pre-IND-AS EV/EBITDA).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412