Buy Shriram Finance Ltd for the Target Rs. 1,100 by Motilal Oswal Financial Services Ltd

Execution strength + strategic partner: Resilient -> remarkable

Margin tailwinds, asset quality stability, and potential catalysts ahead

* The Board of Shriram Finance (SHFL) has approved a preferential equity issuance of INR396.2b to MUFG Bank Ltd., a leading Japan-based financial institution, at an issue price of INR840.93 per share. Upon completion, MUFG will hold ~20% stake in the company on a fully diluted basis and will be classified as a public shareholder.

* We view this transaction as a strategically significant and value-accretive development for SHFL. MUFG’s investment is expected to support the company’s next phase of growth by providing long-term capital to accelerate expansion across core segments, including CV and MSME lending, while strengthening balance sheet resilience through enhanced creditworthiness and funding capacity. Over time, this could culminate in a potential credit rating upgrade to AAA for SHFL.

* SHFL continues to deliver sector-leading performance, driven by broadbased loan growth, a diversified product mix, and disciplined risk management. Over the past 6-9 months, the franchise has outperformed peers, supported by sustained demand in the used-vehicle segment and resilience across its core customer base.

* Asset quality remained largely stable, despite seasonal softness in 1Q and weather-related disruptions in 2Q caused by heavy rainfall and flooding. These were short-lived, typically lasting 10-15 days, and were followed by a recovery. Importantly, SHFL’s 30+ dpd held steady over the last two quarters, in contrast to peers, which experienced a 60-110bp rise over the same period.

* The operating environment is turning more supportive. A well-distributed monsoon, expectations of a healthy kharif harvest, and a pickup in rural income sentiment are already visible in enquiry and disbursement trends across the PV, 2W, and SCV/LCV segments. Further, recent GST reductions on select vehicle categories are clearly stimulating retail demand, with visible traction from late Sep’25 sustaining into Oct-Nov‘25 and likely to extend through the remainder of 2HFY26.

* NIMs, which were under pressure over the past few quarters, are now showing signs of improvement as excess liquidity has largely tapered off. We expect NIMs to expand in 2HFY26 on liquidity normalization, with a further uplift in FY27 driven by a decline in leverage post equity infusion.

* We have assumed the capital from the preferential issue to be infused in FY27, post receipt of all requisite approvals, and have accordingly revised our earnings estimates. We increase our FY26/FY27 EPS estimates by ~10%/17%, driven primarily by lower leverage and further supported by a modest uplift from improved AUM growth prospects.

* We expect SHFL to deliver a PAT CAGR of ~25% over FY25-28E and an RoA/RoE of 3.8%/13.2% by FY27. Reiterate our BUY rating on the stock with a TP of INR1,100 based on 2x Mar’28E P/BV.

MUFG’s entry marks a key strategic inflection point

* We believe MUFG’s entry represents a meaningful strategic upgrade for SHFL, with positive implications for both market positioning and long-term profitability. The identity and balance sheet strength of a global strategic partner can play a decisive role in shaping a lender’s competitive advantage, particularly in a tightening regulatory and funding environment.

* In our view, MUFG’s entry will create multiple structural advantages for SHFL: a) Strengthen the company’s credit profile and materially improve the likelihood of a credit rating upgrade to AAA; b) Enable a structural reduction in cost of funds (CoF) through enhanced balance sheet credibility; c) Expand SHFL’s ability to competitively serve a wider customer base, including lower-yield new CV financing; d) Reinforce long-term franchise strength, market positioning, and competitive advantage, and e) unlock synergies in technology, innovation, and customer engagement, driving sustainable growth.

* With MUFG’s equity capital infusion, we have modestly increased our AUM growth assumptions, as the presence of a strong strategic partner is expected to enhance the company’s ability to address a broader customer spectrum and scale more competitively across segments. We model an AUM CAGR of ~18% over FY25-FY28 (compared to a 16.5% AUM CAGR previously).

Rural demand momentum and GST tailwinds to drive stronger growth

* Rural conditions remain supportive, aided by a well-distributed monsoon and expected improvement in kharif output, which should strengthen rural incomes and spending. Recent GST rate cuts have also triggered a clear pickup in demand since late Sep’25, with momentum maintained through Oct and likely to continue into Nov-Dec’25.

* SHFL has seen a meaningful improvement in enquiries and disbursements across PVs, 2Ws, and SCV/LCVs since late Sep’25, with momentum sustained through Oct and likely to continue into Nov-Dec’25. These trends position the company for stronger, broad-based loan growth in 2HFY26.

* SHFL is sharpening its focus on gold loans by appointing a senior leader to drive the segment and expanding its standalone gold loan branch network to enhance reach and accelerate growth.

* These factors should drive strong disbursement and AUM growth in 2HFY26. Management expects 17–18% AUM growth in the second half, supported by improving rural sentiment, GST-led affordability, and sustained traction across key product segments. We model an AUM growth CAGR of ~18% over FY25- FY28E.

NIMs: Liquidity normalization and decline in leverage to support expansion in FY27

* After several quarters of NIM pressure, driven by elevated liquidity buffers, SHFL is now entering a phase of margin recovery. Liquidity has been reduced from the equivalent of six months of liability repayments to roughly three months, a normalization that occurred only in late September, implying that the margin benefit is yet to be fully reflected in reported numbers. We expect a more visible NIM uplift in 2HFY26, with momentum extending into FY27.

* Transmission from recent repo rate cuts remains limited for now, as ~87% of borrowings are fixed rate. However, as these liabilities mature over the next 12- 18 months and are refinanced at lower rates, the benefit should gradually accrue. Additionally, repricing of MCLR-linked floating-rate loans and a rising contribution from high-yielding products (PL, gold loans, MSME finance) will support blended yield improvement.

* Further, the equity capital infusion is expected to materially reduce leverage, supporting margin expansion over FY27-FY28. We estimate leverage to decline from 5x in FY26E to 3.6x by FY28E.

* We expect a ~60bp NIM expansion over the next two years, driven by the normalization of surplus liquidity, a favorable product mix, expansion in spreads following the repo rate cut, and a reduction in leverage. We estimate an NIM (as % of total assets) of 8.2%/8.8% in FY26/FY27 (vs. 8.2% in FY25).

Asset quality resilient amid sector volatility

* SHFL delivered stable asset quality in 1HFY26, supported by robust on-ground collections and healthy vehicle utilization across its core customer base. While some regions faced 10-15 days of disruption due to heavy rainfall, the impact was limited and recovery was swift.

* The GST rate cut initially raised concerns about potential declines in used vehicle prices, which could have pressured collateral values and recoveries. However, OEMs reduced discounts on new CVs, preventing a sharp correction in used CV prices. The impact on PV pricing has been modest and manageable for the company.

* Given its strong collections infrastructure, familiarity-driven borrower engagement model, and a supportive operating environment, we expect SHFL to maintain stable asset quality. Additionally, a favorable monsoon, easing inflation, and improving freight and utilization levels should further support portfolio performance.

Valuation and view

* The entry of MUFG as a strategic partner represents a transformative milestone for SHFL, materially strengthening its capital base and enhancing its credit credibility. This strategic partnership not only de-risks the company’s growth trajectory but also expands its ability to serve a broader customer base across the CV, MSME, and retail segments, while reinforcing long-term franchise positioning.

* SHFL has navigated recent asset-quality pressures better than most vehicle financiers, delivering stronger performance than peers. NIMs are expanding as excess liquidity normalizes, and growth is set to accelerate, supported by GST rate cuts, a favorable monsoon, and easing inflation.

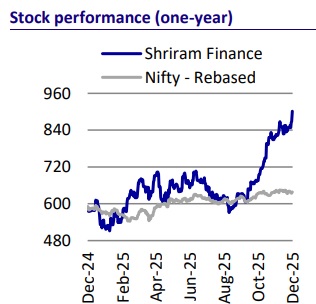

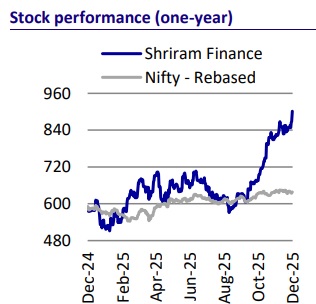

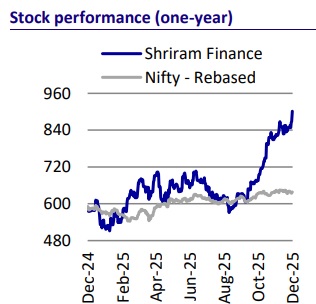

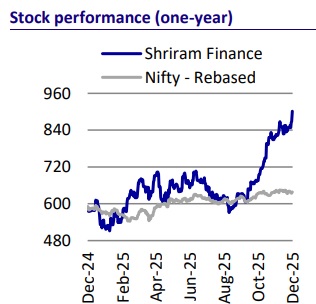

* Despite strong stock performance (~35% in the past two months and ~70% since Jan’25, when we identified SHFL as a top CY25 idea), we see a further upside as the company enters a phase of stronger execution and profitability. Valuations have re-rated from ~1.5x to ~2.6x FY26E P/BV, with room for additional expansion if growth and asset quality trends hold. At ~1.9x FY27E P/BV (post money), valuations remain attractive for ~25% PAT CAGR and RoA/RoE of ~3.8%/13.2% by FY28E. We reiterate BUY with a TP of INR 1,100 (2x Mar’28E BVPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412