Buy RBL Bank Ltd For Target Rs. 220 by Motilal Oswal Financial Services Ltd

Earnings to recover gradually; slippages decline QoQ

NIMs remain broadly stable

RBL Bank (RBK) reported 4QFY25 PAT of INR687m (81% YoY decline).

* NII declined 2.3% YoY to INR15.6b (in line) due to lower disbursals in the JLG business. NIMs remained broadly stable at 4.89% during the quarter.

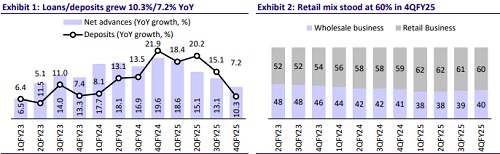

* Advances grew 10.3% YoY/2.4% QoQ, while deposits grew 7.2% YoY/3.9% QoQ. The CASA mix increased 130bp to 34.1%. The C/D ratio stood at 83.5%.

* Fresh slippages stood at INR10.6b vs INR13.1b in 3QFY25 and INR10.3b in 2QFY25. GNPA moderated 32bp QoQ to 2.6%, while NNPA improved 24bp QoQ to 0.29%. PCR increased to 89%.

* We increase our EPS estimates by 12% each for FY26/FY27, as business growth is gaining traction and slippages are expected to normalize by 2QFY26. We also estimate the C/I ratio to improve to 61% by FY27. we estimate FY26E RoA/RoE at 1.2%/12.8%. We upgrade RBK from Neutral to Buy with a TP of INR220 (premised on 0.8x FY27E ABV).

Guides 16-17% loan growth for FY27E; NNPA moderates to 0.29%

* RBK reported PAT of INR687m for 4QFY25, representing an 81% YoY decline. In FY25, earnings declined 40% YoY to INR6.9b.

* NII declined 2.3% YoY (down 1.4% QoQ) to INR15.6b (in line), as NIMs remained broadly stable at 4.89% during the quarter.

* Other income grew 14% YoY/declined 7% QoQ to INR10b (broadly in line). Treasury gains stood at INR300m vs. INR2b in 3QFY25. Opex grew 7.2% YoY to INR17b (in line). Thus, the C/I ratio increased 390bp QoQ to 66.4%.

* PPoP declined 14% YoY/2.9% QoQ to INR8.61b (in line). Provisions stood at INR7.8b (up 90% YoY, down 34% QoQ, in line). In 4QFY25, the bank made additional provisioning of INR2.48b to fully provide on GNPAs. In addition, the bank has taken 75% provision of the total SMA position of INR3.78b, amounting to INR2.83b. This includes the utilization of 1% contingent provisions that were previously created by the bank for its unsecured segments.

* Advances grew 10% YoY (up 2.4% QoQ) to INR926b. Retail books grew 13% YoY (1% QoQ), while wholesale grew 6% YoY (4.8% QoQ). Housing loans rose 3.7% QoQ and business loans were up 13.2% QoQ. Personal loans declined 12.8% QoQ, while credit cards dipped 1% QoQ, with the mix of cards accounting for 18.5% of loans. The JLG mix is expected to remain ~6- 7% of total advances.

* Deposits grew 7.2% YoY (up 3.9% QoQ). The CASA ratio increased to 34.1%. The CD ratio moderated to 83.5% vs 84.7% in 3QFY25.

* Fresh slippages stood at INR10.6b vs INR13.1b in 3QFY25 and INR10.3b in 2QFY25. GNPA moderated 32bp QoQ to 2.6%, while NNPA improved 24bp QoQ to 0.29%. PCR increased to 89%. Restructured book declined to 0.29% (from 0.32% in 3QFY25).

* Credit costs, including the additional provision for 4QFY25, stood at 93bp (annualized 3.7%).

Highlights from the management commentary

* Blended loan growth is expected to be ~16-17% going forward, and the bank aims to maintain CET-1 above 13%.

* Margins will be flattish to lower before it will claw back up . The trajectory is expected to improve starting FY26.

* In credit cards, net slippages stood at INR4.44b, while JLG slippages were at INR4.39b.

* The cards business is expected to grow in the mid-single digit. The JLG business is expected to remain ~6-7% of total advances.

Valuation and view

RBK reported beat in earnings, with margins remaining broadly stable. Asset quality ratios improved during the quarter, with NNPA on the JLG business being nil, following a 100% provision on this business. Deposits grew 4% QoQ with the CASA ratio showing some improvement to 34%. Advances grew 2.4% QoQ and the bank expects growth of ~16-17%, with wholesale advances projected to grow 10-12%. Additionally, the comfortable CD ratio will further support credit growth. Credit cost was ~93bp during the quarter due to the JLG book. The bank expects ~10% opex growth, driven by operating efficiencies, with margins expected to remain flattish in 1H before improving thereafter. We increase our EPS estimates by 12% each for FY26/FY27, as business growth is gaining traction and slippages are expected to normalize by 2QFY26. We project the C/I ratio to improve to 61% by FY27, with FY26 RoA/RoE estimated at 1.2%/12.8%. We upgrade RBK from Neutral to Buy with a TP of INR220 (premised on 0.8x FY27E ABV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412