Neutral Axis Bank Ltd for the Target Rs.1,300 by Motilal Oswal Financial Services Ltd

Navigating through challenges

Weak near-term earnings; estimate gradual recovery from 2HFY26

* Axis Bank’s (AXSB) stock has significantly underperformed key private peers, led by concerns on muted growth, elevated credit cost, and a decline in RoE. The bank is strategically shifting toward secured, better yielding segments amid a cautious stance on unsecured retail and aims to outpace system growth by ~3% CAGR over the coming years.

* AXSB continues to focus on strengthening its liability franchise and is witnessing strong traction in the NTB (new to bank) segment. With digital initiatives, branch expansion, and a supportive LCR framework, we estimate deposits to post a 13% CAGR over FY25-27.

* Margins are likely to remain under pressure in the near term, driven by the transmission of repo rate cuts and slower unsecured loan growth. However, a wellmatched ALM duration will help make the impact more manageable. The bank continues to guide for through-cycle NIMs of 3.8%.

* Cost ratios remain higher compared to peers. While AXSB remains focused on building a stronger and more sustainable franchise—and will continue making necessary business investments—we expect positive operating jaws to emerge from FY27.

* The bank aims to further tighten its provisioning and asset quality classification norms, and has guided for elevated credit costs in 1HFY26. While the credit card portfolio has seen stabilization, the bank remains watchful of trends in the PL business.

* While the stock trades at reasonable valuations and the risk-reward appears favorable, clarity on the trajectory of credit costs, margins, and growth remains key for a sustained performance. We estimate AXSB to deliver FY27 RoA/RoE of 1.74%/15.3%. Reiterate Neutral with a TP of INR1,300 (1.6x FY27E ABV + INR127 for subs).

Modest near-term growth; focus on granular, high-yield lending

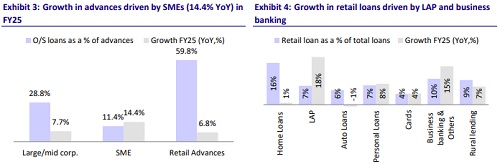

AXSB reported a modest 8% YoY loan growth in FY25, affected by a modest 7.7% YoY growth in corporate lending, a 6.8% YoY growth in retail advances, and a cautious stance on unsecured retail. Both personal loans and card segments witnessed a sharp deceleration in loan growth to 8% YoY and 4.3% YoY, respectively, in 4QFY25 vs ~30% YoY in 4QFY24. The bank is strategically pivoting toward higher RAROC segments, with relatively stronger growth in SME, midcorporate, and small business loans (collectively growing at 14% YoY). Together, these segments now form 23% of the loan book, marking an increase of ~740bp over the past four years. While near-term loan growth is expected to remain modest, the bank aims to outperform the system by ~300bp CAGR over the medium term (3-4 years).

Healthy traction in NTB; focus on building a granular liability franchise

AXSB’s deposits grew 10% YoY in FY25, slightly ahead of loan growth, leading to a slight improvement in CD ratio at 88.7%. The bank has witnessed healthy traction in the NTB segment, with savings account acquisitions growing 19% YoY. Average balances per account also grew by 17%, reflecting a steady CASA mix at 41%. Salary deposits and premium segments remain strong, with NTB salary uploads rising 18% YoY and Burgundy AUMs growing 10% YoY. The new LCR framework is expected to enhance the bank’s funding and liquidity operations, supporting future growth, especially with its current LCR at 118%. With initiatives like Project Triumph (an internal initiative focused on deepening customer relationships and driving consistent growth), digital partnerships, and NTB growth initiatives, the bank is wellpositioned to sustain healthy traction in deposit growth. We estimate deposits to post ~13% CAGR over FY25-27.

Maintains through-cycle NIM guidance of 3.8%

The bank is likely to face near-term margin pressure due to repo rate cuts (with 57% of its book linked to repo), an elevated CD ratio, and a moderation in the mix of high-yield unsecured credit. However, its tightly matched asset-liability duration will make the impact of rate transmission more manageable. Recent deposit rate cuts across retail and non-retail term deposits, along with a reduction in the SA rate (50bp cut, implemented in two tranches of 25bp each in Apr’25 and Jun’25), will help limit margin impact. While NIMs stood at 3.97% in 4QFY25, the bank has reiterated its guidance to maintain through-cycle margins at 3.8%. The bank is addressing margin challenges through liability repricing, maintaining a favorable deposit mix, and optimizing its loan portfolio toward better-yielding segments, while adopting a cautious stance on unsecured retail disbursals.

Operating efficiency remains key lever; C/I ratio estimated at 46% by FY27

AXSB has strategically invested in technology and business expansion, shifting toward a more retail-focused portfolio that now accounts for ~60% of advances. This transition has supported a robust fee-to-asset ratio of 1.6%. In FY25, operating expenses grew at a modest 6% YoY vs 30% in FY24, driven by productivity gains and controlled overheads, with tech expenses making up ~10.1% of total opex.

* Fee income grew 12% YoY, backed by granular fees, which account for 94% of total fees. Strong growth in bancassurance fees reflects the bank’s deepening presence in cross-selling and a more integrated customer offering.

* The bank has expanded its footprint with 500 new branches, while also reducing PSLC-related costs. Backed by its Bharat Bank strategy, AXSB leverages a mix of organic PSL growth and PSLCs to meet regulatory targets. In 4QFY25, the bank incurred INR5.9b in PSLC purchases for SMF and NCF shortfalls, while earning INR1.7b from PSLC sales in other PSL categories.

* With disciplined cost control and strong tech capabilities, the bank aims to sustain positive operating jaws. We believe opex remains a key earnings lever, with AXSB trailing significantly vs larger peers on this front. We estimate C/I ratio to improve to 46% by FY27.

Prudential tightening to keep near-term credit costs elevated

AXSB continues to maintain resilient asset quality, with a strong net NPA ratio of 0.3% and a PCR of 75%. Stability in the card business, controlled exposure to riskier segments like MFI (~2.1% of retail loans), and tightened underwriting practices are expected to keep slippages under control over the medium term, although the bank remains watchful of trends in the PL segment in the near term. The bank has proactively tightened credit filters, strengthened portfolio monitoring, implemented early warning systems, and adopted risk-based pricing to manage stress. Enhanced tech-enabled collections have supported recoveries, helping contain the slippage ratio at 1.9% in FY25. However, near-term credit costs and slippages are likely to remain elevated, driven by stricter provisioning norms (100% provisioning on unsecured loans) and tightened classification criteria. We estimate GNPA/Net NPA ratio at 1.35%/0.33% with a credit cost of 70bp by FY27

Valuation and view

AXSB remains focused on building a stronger, more consistent, and sustainable franchise. The bank witnessed modest advance growth in FY25 due to a previously high CD ratio, which has now eased to 88.7% vs 92.6% in 3QFY25.

* Given the sharp reduction in repo rates, margins are expected to remain under pressure in the near term. However, the SA and TD rate cuts will help limit the overall impact and support recovery from 2H onwards. While the bank will continue to invest in business growth and technology, it aims to sustain positive operating jaws as productivity gains begin to materialize.

* AXSB aims to deliver 3% higher growth than the industry on a CAGR basis over the next three years, while targeting through-cycle margins of 3.8%. Over the past couple of years, the bank has significantly tightened its provisioning policy and asset quality classification criteria. However, management indicated that the ongoing provisioning represents the final phase of voluntary tightening and is not expected to have a material impact on the bank’s economic performance over the medium term.

* While the stock trades at reasonable valuations and the risk-reward appears favorable, clarity on the trajectory of credit costs, margins, and growth remains key for sustained performance. We estimate AXSB to deliver FY27 RoA/RoE of 1.74%/15.3%. Reiterate Neutral with a TP of INR1,300 (1.6x FY27E ABV + INR127 for subs).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412