Neutral Axis Bank Ltd for the Target Rs.1,250 by Motilal Oswal Financial Services Ltd

Weak quarter; slippages surge on technical impact

Controlled opex and treasury gains offset higher provisions

* Axis Bank (AXSB) reported 1QFY26 net profit of INR58.1b (down 4% YoY, in line) as lower opex and higher other income offset higher provisions.

* NII was flat YoY at INR135.6b (down 2% QoQ, in line). NIMs declined by 17bp QoQ to 3.80% (in line).

* Provisioning expenses spiked 190% QoQ to INR39.5b (49% higher than est.). Other income grew by 25.5% YoY/7.1% QoQ to INR72.6b (9% beat).

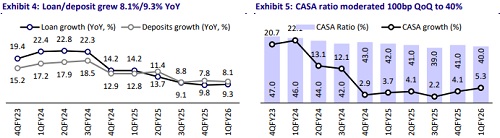

* Loan book grew 8.1% YoY (up 1.8% QoQ). Deposits grew 9.3% YoY (down 1% QoQ), thus CD ratio increased to 91.2% (vs. 88.7% in 4QFY25). CASA mix moderated 100bp QoQ to 40%.

* Fresh slippages increased sharply by 71% QoQ to INR82b due to a technical impact (INR48.1b in 4QFY25 and INR54.3b in 3QFY25). Adjusted for the technical impact, gross slippages stood at INR54.9b. GNPA/NNPA ratios increased by 29bp/12bp QoQ to 1.57%/0.45%. PCR moderated 300bp QoQ.

* We reduce our earnings estimates for FY26/27 by 8.6%/5.7%, factoring in higher credit costs and margin pressure. We estimate FY27E RoA/RoE at 1.6%/14.6%. Retain Neutral with a TP of INR1,250 (1.6x FY27E ABV).

Business growth muted; NIM contracts sharply by 17bp QoQ

* 1QFY26 net profit stood at INR58.1b (down 4% YoY/18% QoQ, in line).

* NII was broadly flat YoY at INR135.6b (down 2% QoQ, in line). NIMs declined by 17bp QoQ to 3.80%. Other income grew 25.5% YoY to INR72.6b (9% beat) as treasury gains were healthy at INR14.2b (vs. INR1.7b in 4QFY25). Total revenue thus grew 8% YoY to INR208.2b (in line).

* Opex declined by 5.4% QoQ to INR93b (4% lower than est.). PPoP grew 14% YoY to INR115b (8% beat).

* Loan book grew 8.1% YoY/1.8% QoQ, with retail loans flat QoQ, corporate growing 5.5% QoQ and SME loans up 16% YoY/2% QoQ. Deposits grew 9.3% YoY (down 1% QoQ), resulting in an increase in C/D ratio to 91.2%. CASA mix moderated 100bp QoQ to 40%.

* Fresh slippages increased sharply to INR82b due to a technical impact. Adjusted for the technical impact, gross slippages stood at INR54.9b. GNPA / NNPA ratios increased by 29bp/12bp QoQ to 1.57%/0.45%. PCR moderated 300bp QoQ to 71.5%. Restructured loans stood at 0.11%.

* CAR/CET-1 stood at 16.85%/14.68%. Average LCR improved 108bp QoQ to 119%.

Highlights from the management commentary

* AXSB has reviewed classification on various types of loans. The technical Impact is largely restricted to cash credit and overdraft products and one-time settled accounts.

* The technical impact due to changes in recognition criteria has affected PAT by INR6140m, RoA by 15bp and RoE by 1.4%.

* Advances are likely to grow 300bp above the industry rate.

Valuation and view

AXSB reported broadly in-line earnings in 1QFY26 as lower opex and higher other income offset higher provisions. However, margins contracted sharply by 17bp QoQ due to repo rate cuts. Asset quality deteriorated as slippages came in higher due to stringent classification of loans (technical impact), with GNPA/NNPA ratios also increasing. Advances growth was modest, while deposits declined 1% QoQ, leading to an increase in C/D ratio to 91.2%. The bank has tweaked its classification of loan norms, which affected the slippages and credit cost. AXSB intends to complete this exercise by 2Q, which will keep near-term slippages and credit cost elevated. The residual loan re-pricing will also continue to put pressure on margins, though the bank has maintained its through-cycle margin guidance of ~3.8%. We cut our earnings estimates for FY26/27 by 8.6%/5.7%, factoring in higher credit cost and margin pressure. We estimate FY27E RoA/RoE of 1.6%/14.6%. Retain Neutral with a TP of INR1,250 (1.6x FY27E ABV + INR137 for subs).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412