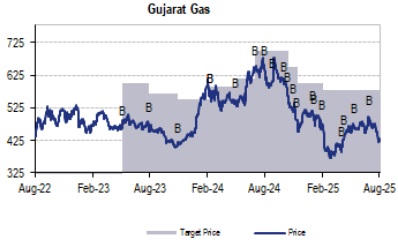

Buy Gujarat Gas Ltd For Target Rs. 550 By JM Financial Services

Gujarat Gas’ (GGas) 1QFY26 standalone EBITDA, at INR 5.2bn, was higher than JMFe/consensus of INR 4.5bn/INR 4.6bn led by lower gas cost but partly offset by lower overall volume (2% below JMFe). Gross margin was higher at INR 10.8/scm in 1QFY26 vs. JMFe at INR 9.7/scm led by lower gas cost; hence, EBITDA margin was also higher at INR 6.4/scm vs. JMFe of INR 5.5/scm. However, overall volume was 2% below JMFe at 8.9mmscmd due to lower industrial and domestic PNG volume though partly offset by slightly better CNG volume. Further, the management shared that Morbi volume will decline further QoQ in 2QFY26 on account of festival-related shutdown of customer facilities, and also as gas continues to be uncompetitive vs. propane due to high spot LNG price. We maintain BUY (revised TP of INR 550) as we expect industrial segment volume growth to be robust in the medium to long term driven by likely strengthening of competitiveness of gas vs. propane on account of moderation in spot LNG prices in the medium to long term.

* Overall volume was 2% below JMFe at 8.9mmscmd due to lower industrial volume though partly offset by slightly better CNG volume; management guides for weak industrial volume in 2QFY26:

Overall volume was 2% below JMFe at 8.9mmscmd in 1QFY26 (down 4.6% QoQ and down 19.2% YoY). Industrial volume was 4.4% lower than JMFe at 4.7mmscmd (down 6.4% QoQ and down 35.0% YoY) – the management said that Morbi volume declined to 2.51mmscmd (vs. 2.87mmscmd in 4QFY25) due to relatively high spot LNG prices while non-Morbi volume continued to grow to 2.2mmsmcd in 1QFY26 (vs. 2.16mmcmd in 4QFY25). Further, it guided for a further decline in Morbi volume in 2QFY26 on account of festival-related shutdown of customer facilities, and also as gas continues to be uncompetitive vs. propane due to high spot LNG price (current propane price is INR 40/scm vs. gas price of INR 44/scm after the recent reduction in gas price by INR 3.25-3.5/scm. Separately, domestic PNG volume was also lower at 63mmscm (down 21.6% QoQ but up 11.3% YoY) while commercial segment volume was largely in line at 13mmscm (down 11.5% QoQ but up 7.7% YoY). However, CNG volume was 1.5% higher than JMFe at 3.3mmscmd (up 3.4% QoQ and up 11.7% YoY; the management guides for CNG volume growth to be strong at ~12% in FY26 driven by Thane/Amritsar/ Dadra & Nagar Haveli.

* Gross margin higher at INR 10.8/scm in 1QFY26 vs. JMFe at INR 9.7/scm led by lower gas cost; hence, EBITDA margin was also higher at INR 6.4/scm vs. JMFe of INR 5.5/scm:

Average realisation was slightly higher at INR 48/scm vs. JMFe of INR 47.7/scm (vs. INR 49.0/scm in 4QFY25); further, average cost of gas was also lower at INR 37.2/scm or USD 12.1/mmbtu vs. JMFe of INR 38/scm (and vs. INR 38.9/scm or USD 12.5/mmbtu in 4QFY25). Hence, gross margin was higher at INR 10.8/scm in 1QFY26 vs. JMFe at INR 9.7/scm (vs. INR 10.1/scm in 4QFY25). However, opex normalised at INR 4.3/scm in 1QFY26 (after having jumped to INR 4.8/scm in 4QFY25). Hence, EBITDA margin was also higher at INR 6.4/scm in 1QFY26 vs. JMFe of INR 5.5/scm (and vs. INR 5.4/scm in 4QFY25). But the management reiterated its medium-term EBITDA margin guidance of INR 4.5-5.5/scm due to seasonal decline in 2QFY26 volume and risk of jump in spot LNG price during winter, apart from APM allocation cuts

* Management targeting 25% market share in propane distribution business, banking on GSPC’s LNG sourcing strength:

On its recent board-approved initiative to undertake sourcing and sale of propane / LPG to Industrial customers, the management shared that company aims to get 25% market share in the propane segment in Morbi; it also clarified that this business won't be just limited to Morbi. Given GSPC’s strength in LNG sourcing, GGas will directly import propane on DES basis and on spot basis and expressed its confidence that existing customers will take propane from GGas as it can provide working capital support to customers. Further, it said that there will be minimal capex requirement given its trading business, except for the need to book some terminal capacity; however, it hasn’t commented on margin profile as of now. GGas has got credit rating from the agency, which is required for regulatory approvals.

* Maintain BUY as we expect GGas’ competitiveness to improve due to likely moderation in spot LNG price over medium to long term on significant jump in global LNG supply:

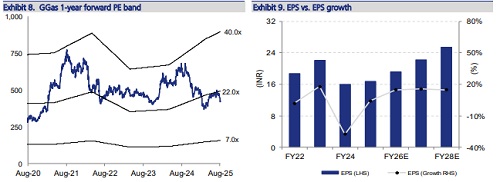

We have cut our FY26-FY28 PAT estimates by 6-10%, building in lower industrial volume and slightly lower average gas cost based on 1QFY26 actuals and management’s weak 2QFY26 guidance on industrial volume in Morbi. Hence, our TP is cut to INR 550 (from INR 580). However, we maintain BUY as we expect volume growth momentum to sustain in the medium to long term led by: a) rise in gas use in the industrial segment driven by likely improvement in competitiveness of gas vs. propane (on account of moderation in spot LNG price supply over the medium to long term due to significant jump in global LNG from 2026-27 onwards), and also due to regulatory push; and b) expansion of CNG in new GAs and limited threat from electric vehicles. At CMP, GGas is trading at 19.4x FY27 P/E and 2.9 x FY27 P/B. Key risks: a) sustained high spot LNG prices and fall in propane price could pose a competitive threat from propane; b) further sharp APM gas allocation cuts could pose a risk to margin/volume in the CNG business.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361