Buy Gujarat Gas Ltd for the Target Rs. 500 by Motilal Oswal Financial Services Ltd

Morbi’s volume pickup crucial

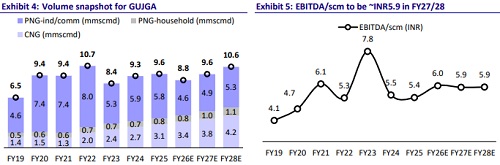

* Gujrat Gas’ (GUJGA) volumes came in line with our estimate at 8.7mmscmd in 2QFY26, as both CNG/I&C-PNG volumes were in line with our estimate. Morbi volumes declined ~0.4mmscmd QoQ to ~2.1mmscmd, primarily due to customers shifting toward cheaper alternate fuels. EBITDA/scm margin contracted ~INR0.8 QoQ to INR5.6 (in line with estimates), largely due to a decrease in realization.

* Industrial volumes are expected to remain under pressure in the near term as propane prices soften and spot LNG prices remain high. Even after an INR3.25/scm I&C-PNG price cut taken by GUJGA in Aug’25, propane continues to remain INR4- 6/scm cheaper vs piped natural gas in Morbi. As the current volume run rate in Morbi is even lower at ~1.7-1.8mmscmd (2.1mmscmd in 2Q), we cut our I&C-PNG volume assumption for FY26/27/28 by 0.3/0.5/0.5mmscmd to 4.6/4.9/5.3mmscmd. This results in a 4%/3% cut on our FY27/28 EBITDA estimates. While we have not factored in any earnings contribution from the recently announced initiative to sell propane in Morbi and other industrial areas, this remains a key upside risk to our current volume estimates.

* CNG and D-PNG volumes contributed to ~48% of GUJGA’s total volumes in 2Q and have consistently grown by 10-12% YoY over the past six quarters. We build in CNG and D-PNG volumes to contribute 48-50% of GUJGA’s volumes over FY26-28, with CNG/D-PNG volumes expected to clock 11%/13.5% CAGR over FY25-28. Overall, we estimate total volumes for GUJGA to clock 9% CAGR over FY26-28, reaching 10.6mmscmd in FY28.

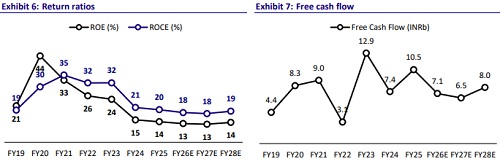

* GUJGA is currently trading at 22.9x 1-year forward P/E, below its long-term average of 25.4x. While near-term performance may remain subdued given the uncertain volume growth outlook, the merger of GUJGA, GUJS, and GSPC remains a key near-term catalyst for the stock. Shareholder approval has been obtained, and filings have been submitted to the MCA. Final approval is expected by endDec’25.

* We maintain our EBITDA/scm assumption of INR5.9 over 1HFY26-FY28. However, we revise our P/E multiple downward to 24x (from 26x earlier) to reflect the softer volume growth prospects and now value the stock on Dec’27E EPS of INR20.6 (vs. FY27E EPS earlier), arriving at a TP of INR500 per share.

Other key takeaways from the conference call

* CNG volumes grew 11%/26% YoY in Gujarat/other areas.

* APM allocation was 36%/100% for CNG/D-PNG (49% in total for the priority segment sale).

* INR2.8b capex was incurred in 1HFY26. FY26 capex is expected to be INR8b. FY27 capex is expected to be INR8-10b.

* Shareholder approval has been received for the merger scheme. Filings have been made with MCA post-approval. Approval is expected by end-Dec’25. No objection has been received from NSE, BSE, and PNGRB.

EBITDA in line; other income drives beat on PAT

* Total volumes came in line with our estimate at 8.7mmscmd (down 12% YoY).

* CNG/I&C-PNG volumes were in line with our estimate, whereas D-PNG volumes came in 15% above estimates.

* EBITDA/scm came in line with our est. at INR5.6.

* Realization decreased ~INR0.6/scm QoQ, while gas cost/opex increased INR0.2/INR0.1 per scm QoQ, leading to ~INR0.8/scm QoQ decrease in EBITDA/scm margin.

* Resultant EBITDA stood in line with our estimate at INR4.5b (down 13% YoY).

* However, PAT came in 15% above our est. at INR2.8b (down 8% YoY), driven by higher-than-estimated other income.

* Press release KTAs:

* GUJGA continues to expand its CNG network, adding four new stations in 2QFY26; CNG volumes rose 13% YoY, supported by 834 operational stations.

* The company is undertaking an aggressive rollout of the FDODO model, having signed 74 agreements so far. The first FDODO station has become operational in Jamnagar, and several more are expected to commence in the near term.

* Shareholders have approved the Composite Scheme of Amalgamation and Arrangement with an overwhelming majority on 17 Oct’25. Filings have been submitted to MCA.

* The company has added over 42,400 new domestic customers during the quarter, taking total connections to over 2.3m households.

* The pipeline network has expanded to 43,900 inch-km cumulatively.

Valuation and view

* The company’s long-term volume growth prospects remain robust, with the addition of new industrial units and the expansion of existing units. It is aggressively investing in infrastructure to push industrial gas adoption in Thane rural, Ahmedabad rural, and newly acquired areas in Rajasthan.

* The stock is trading at a P/E of 22.2x FY27E and EV/EBITDA of 13x for FY27E. We reiterate our BUY rating on the stock with a TP of INR500, valuing it at 24x Dec’27E EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412