Buy Amber Enterprises Ltd for the Target Rs. 7,600 by Motilal Oswal Financial Services Ltd

Strong quarter for RAC and Electronics

Amber Enterprises posted better-than-expected revenue and EBITDA in 4QFY25, while the PAT miss was led by higher losses from JV and a higher-than-expected tax rate. Revenue outperformance was driven by strong growth in consumer durables, particularly RAC and electronics divisions. However, the railways segment’s performance was impacted by delays in offtake. Despite near-term weakness in RAC demand, Amber remains optimistic about long-term growth for RAC segment, led by its market-leading position as well as increased wallet share from clients. With increased capex and diversification across new segments in electronics, we expect strong growth in electronics segment to continue, which will be further boosted after the company’s capacity in JV with Korea Circuit is commissioned. We expect the railway segment’s performance to remain subdued in the near term. We cut our estimates by 8% each for FY26/27 to factor in higher losses from JV and a higher tax rate. Retain BUY with a revised TP of INR7,600 (INR7,800 earlier)

Outperformance in revenue and EBITDA; miss on PAT

Consolidated revenue grew 34% YoY to INR37.5b, beating our estimate by 22%, mainly aided by increased demand in the consumer durables and electronics segments. Absolute EBITDA grew 33% YoY to INR1.58b, beating our estimate by 18%. Margins were flat YoY at 7.9% vs. our estimate of 8.1%. The company’s PAT at INR1.16b (+23% YoY) missed our estimate by 10% due to a higher-thanexpected tax rate of 34.9% vs. our estimate of 27.0%. PAT margins contracted 30bp YoY to 3.1% vs. our estimate of 4.2%. For FY25, revenue/EBITDA/PAT stood at INR99.7b/INR7.6b/INR2.4b, up 48%/55%/83% YoY.

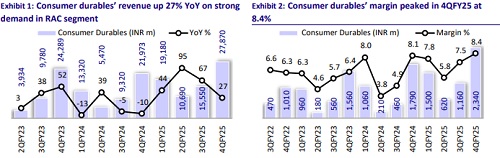

Consumer durables segment’s growth driven by strong demand in RAC

Consumer durables segment revenue increased 27% YoY to INR27.9b in 4QFY25 as it benefited from strong AC demand during the quarter, improved wallet share with existing clients, as well as new client additions. With increased share of component business in RAC, the company was able to improve consumer durable segment margins too by 30bp YoY to 8.4% in 4QFY25. The RAC business alone grew 49% YoY, while non-RAC components saw a 31% YoY increase, driven by robust demand, conversion of customers to ODM, and the continued expansion of component manufacturing. During the year, Amber supplied around 28,000 units of washing machines, but at a loss. Management stressed that they are working on this and that the segment should break-even during FY26. Supported by a strong market share of 26-27% in RAC manufacturing, the company’s continuous efforts in expanding its component portfolio across segments, and an anticipated increase in washing machine sales (reaching breakeven), we expect the company’s consumer durables segment to clock a CAGR of 14% over FY25-27 with margins of around 8% in FY27

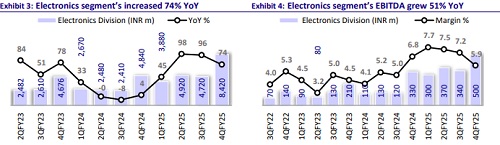

Electronics segment to benefit from the recently announced schemes

Electronics segment revenue increased 74% YoY in 4QFY25 to INR8.4b (up 77% YoY in FY25 vs. guidance of 55%), as it benefited from new segment additions as well as new orders from defense and renewable energy for PCBA. The company benefitted from the imposition of anti-dumping duty on PCBs (up to six layers), enabling inroads into customers of consumer electronics, IT, auto - EV, aerospace and defense. Amber plans to file an application under the Electronic Component Manufacturing Scheme (ECMS). It has targeted a capex of INR30b over the next five years; however, the net capex will be significantly lower (only 35%) due to combined central and state government incentives through ECSM, which would cover up to 65% of total capex. These investments will be directed toward expanding its existing Ascent Circuits operation, which is in multi-layer and double-layer PCB categories, for its new JV with Korea Circuits for the high-density interface and substrates category. ECMS is expected to not only enhance Amber’s technological capabilities and vertical integration but also help it deliver RoCE of 25-30% on net investments, creating a strong foundation for long-term, capital-efficient growth in the electronics division. With the already existing growth opportunities and the newly announced supporting schemes by the government, we expect the electronic segment’s revenue/EBITDA to report a CAGR of 35%/59% over FY25-27 with margins of 8.8%/9.5% for FY26/27E.

Railways segment’s revival hinges on additional offtake

Railways segment revenue was largely flat during the quarter at INR1.25b due to delays in offtake for metro and Vande Bharat projects. Margin, however, improved to 24.0% (+610bp YoY) during the quarter. The company is in the process of adding pantry doors and gangways, couplers, brakes, and gears to its portfolio through its planned greenfield facility for Sidwal, increasing its share to ~INR150m per coach. Hence, Amber’s total TAM in these projects has now expanded by fivefold over the years. This facility is, however, expected to commence operations by 3QFY26 and start revenue contribution beyond FY27-28. We expect the underperformance of the railways segment to persist for the next two years and we estimate a CAGR of 28%/28% in revenue/EBITDA over FY25-27 with margins of 18.5% by FY27

Financial outlook

We cut our estimates by 8% each for FY26/27 to factor in losses from JV and a higher tax rate. We thus expect a CAGR of 20%/27%/49% in revenue/EBITDA/PAT over FY25-27 for Amber.

Valuation and view

The stock currently trades at 59.9x/39.0x P/E on FY26/27E earnings. We downgrade our estimates and reiterate our BUY rating on the stock with a DCF-based TP of INR7,600, implying 47x P/E on a two-year forward EPS (Mar’27E).

Key risk and concerns

Key risks and concerns include lower-than-expected demand growth in the RAC industry; change in BEE norms making products costlier; change in announced capex policy; and increased competition across the RAC, mobility, and electronics segments

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)