Buy Cummins India Ltd for the Target Rs. 4,060 by Motilal Oswal Financial Services Ltd

Strong margins offset weak revenue performance

Cummins India (KKC)’s 4QFY25 results reflected weakness in revenue, while EBITDA margin and PAT outperformed our estimates. The company reported 6% YoY revenue growth, while EBITDA/PAT declined by 5%/7% YoY, mainly due to a high base of last year. For FY25, industrial, distribution and export segments’ growth was broadly in line with our estimates, while powergen was slightly lower than our expectations. Export markets have been consistently improving QoQ for the last four quarters. We remain positive on KKC as we believe that the company will benefit from 1) better volumes for CPCB 4+ products in FY26 as powergen demand recovers further; 2) improved growth in railways, construction in industrial and increased penetration of distribution-led products; and 3) improving growth outlook in export markets. We marginally trim our estimates by 1% each for FY26/27 to bake in FY25 performance. We reiterate BUY on the stock with a TP of INR4,060 based on 41x Mar’27E earnings.

In-line PAT

Revenue increased 6% YoY to INR24.6b, lower than our estimate due to weak domestic revenue. Domestic revenue at INR19.4b grew 1% YoY, while exports at INR4.8b grew strongly by 39% YoY. Exports have been continuously growing since 4QFY24. Gross margin at 37.2% saw a 120bp YoY/240bp QoQ expansion, while EBITDA margin for 4QFY25 stood at 21.2%, which was much better than our expectation of 19.1%. This was fueled by a better-than-expected gross margin. Absolute EBITDA dipped 5% YoY to INR5.2b, a 5% miss on our estimate. PAT declined 7% YoY to INR5.2b, though it was broadly in line with our estimate of INR5b due to higher-than-expected other income and a lowerthan-expected tax rate. For FY25, the company’s revenue/EBITDA/PAT grew 15%/17%/15% YoY to INR103.4b/INR20.7b/INR19.1b, while margin expanded 30bp YoY to 20%. The company’s OCF/FCF increased 32%/46% YoY to INR16.9b/INR14.6b due to lower net working capital. As of 31st Mar’25, the company was debt-free.

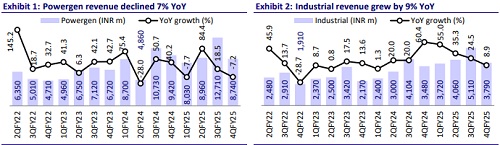

Powergen segment growth lower than our estimates

Powergen segment revenue declined by 7% YoY in 4QFY25, affected by a high base of last year. 4QFY25 volumes were around 80-85% of 4QFY24 level. For FY25, powergen revenue grew by 14% YoY, implying that some part of volume decline during the year due to CPCB 4+ transition was offset by an average pricing improvement of 25-30%. With competitive intensity stabilizing now and demand also recovering from key areas like residential, commercial, and infrastructure, we expect volume growth to start recovering in FY26. Beyond CPCB 4+ portfolio, KKC continues to see strong demand from data centers, and HHP portfolio continues to benefit from the same. We marginally revise our estimates and expect a CAGR of 16.5% in powergen revenue over FY25-27.

Industrial segment growth remains strong during the year

Industrial segment delivered a healthy performance in 4QFY25, posting INR3.8b in revenue (+9% YoY), and INR17b in FY25 (+28% YoY), reflecting broad-based demand across key verticals. The construction and rail segments remained stable. Railways saw demand from diesel-electric tower cars and power cars, and momentum is also building around specialized applications such as hotel load converters and accident relief trains. The compressor business remained steady and the mining segment saw a temporary lull due to delayed Coal India tenders. With its product offerings, we believe KKC is well-positioned to capture growth across its industrial portfolio in the coming quarters. We, thus, estimate a 19% CAGR for this segment over FY25-27.

Distribution growth driven by improved offerings

KKC’s distribution segment revenue grew by 5%/14% YoY in 4QFY25/FY25. Key growth drivers included increasing adoption of KKC’s extended warranties, expansion of rebuild engine offerings, and rising penetration in the powergen and industrial sectors. The segment benefited from long-term contracts, value-added services, and aftermarket support, which strengthened customer relationships and service revenue streams. We bake in a CAGR of 25% in distribution segment revenue over FY25-27.

Exports continuously improving sequentially

Export revenue surged 39% YoY in 4QFY25, led by strong performance in both HHP and LLP products. Latin America and Europe continued to perform exceptionally well, while other geographies are yet to show meaningful improvement. Management is cautiously optimistic about exports for FY26 in light of the current tariffs and global trade policies. However, we believe that KKC’s strategic focus on deepening its market presence by tailoring products to local needs and maintaining supply of non-emission compliant gensets will position the company to capture export growth as conditions stabilize. We expect export revenue to clock a CAGR of 10% over FY25-27.

Financial outlook

We marginally trim our estimates by 1% each for FY26/27 to bake in FY25 performance. We expect revenue/EBITDA/PAT CAGR of 18%/17%/18% over FY25-27 and build in EBITDA margin of 19.7% each for FY26/27. Our estimates factor in gross margin of 35% in FY26/27 vs. 36% in FY25 as we expect some gross margin contraction after price levels for CPCB 4+ normalize.

Valuation and view

The stock is currently trading at 37.5x/32.0x on FY26/27E EPS. We reiterate BUY on the stock with a revised TP of INR4,060 based on 41x Mar’27E earnings.

Key risks and concerns

Key risks to our recommendation would come from lower-than-expected demand for key segments, higher commodity prices, increased competitive intensity, and lower-than-expected recovery in exports.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412