Buy Cholamandalam Inv. & Finance Ltd for the Target Rs.1,650 by Motilal Oswal Financial Services Ltd

Asset quality weakness across segments; recovery expected in 2H

Earnings in line; elevated credit costs offset by higher other income

* Cholamandalam Inv. & Finance (CIFC)’s 1QFY26 PAT grew ~21% YoY to INR11.4b (in line). Its 1Q NII grew ~24% YoY to ~INR31.8b (in line). Other income increased ~48% YoY to ~INR6.8b (~16% above est.), primarily driven by upfront assignment income of ~INR1.5b (PQ: INR940m).

* Opex rose ~23% YoY to ~INR14.5b (in line), and the cost-income ratio declined ~40pp QoQ to ~37.6% (PQ: 38% and PY: ~39%). PPoP grew ~30% YoY to INR24.1b. Management guided for an opex-to-assets ratio of ~2.9- 3.0% over the next few quarters.

* Yields (calc.) declined ~10bp QoQ to ~14.4%, and CoF (calc.) dipped ~10bp QoQ to ~7.8%. NIM contracted ~5bp QoQ to ~6.75%.

* Management attributed the weakness in asset quality within the vehicle finance (VF) segment to subdued capacity utilization caused by the early onset of monsoons and a weak macroeconomic environment. However, the company expects a recovery in collections by the end of 2QFY26, with a visible improvement in asset quality anticipated from 2HFY26 onwards.

* The company guided for a ~12-15bp expansion in NIM in FY26, driven by a drop in CoF in a declining interest rate environment. We expect its NIM to expand ~15bp/10bp to ~7.0%/7.1% in FY26/FY27 (vs. ~6.9% in FY25). We estimate a CAGR of 12%/20%/26% in disbursement/AUM/PAT over FY25-27.

* We cut out FY26/FY27 EPS estimates by ~3%/4% to factor in lower loan growth and higher credit costs. CIFC will have to utilize its levers on NIM (and fee income) to offset the impact of moderation in AUM growth and elevated credit costs. We estimate RoA/RoE of ~2.6%/20% in FY27. Reiterate BUY with a TP of INR1,650 (premised on 3.8x Mar’27E BVPS).

*Key risks: 1) weak macros translating into weaker vehicle demand and sustained lower capacity utilization; and 2) deterioration in asset quality, particularly in the new businesses (including unsecured business loans and micro-LAP), which could keep the credit costs high for longer than estimated

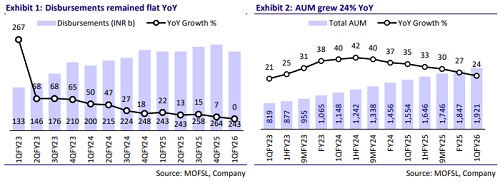

AUM rises ~24% YoY; disbursements remain flat YoY

* Business AUM grew 24% YoY/4% QoQ to INR1.92t, with newer businesses now forming ~13% of the AUM mix.

* Total disbursements in 1QFY26 were flat YoY at ~INR243b. New lines of businesses contributed ~17% to the disbursement mix (PQ: ~17% and PY: ~24%), and VF disbursements in 1QFY26 grew ~7% YoY. Disbursements in CSEL further dipped, as the company is exiting the Partnership CSEL business completely. Additionally, CIFC has slowed down certain low RoTA products like supply chain financing and loans against shares in the SME segment.

* Management noted that CIFC has performed better than the industry within vehicle finance and has either maintained or gained some market share across auto sub-segments. The company guided for ~10-12% growth in vehicle finance disbursements and a ~15-17% growth in vehicle AUM, and it is confident of achieving an overall AUM growth of 20% in FY26. We model AUM CAGR of ~20% over FY25-27E.

Asset quality deteriorates further in new businesses; GS3 rises ~35bp QoQ

* GS3/NS3 deteriorated ~35bp/25bp QoQ to 3.15%/1.8% while PCR on S3 declined ~155bp QoQ to ~43.7%. ECL/EAD rose to 1.97% (PQ: ~1.84%). GS3 in newer businesses rose ~40bp QoQ to ~2.6% (PQ: 2.2% and PY: 1.3%).

* Stage 2 + Stage 3 (30+ dpd) rose ~85bp QoQ to ~6.2%.

* CIFC’s 1Q credit costs stood at ~INR8.8b (~8% higher than MOFSLe). This translated into annualized credit costs of ~1.8% (PY: ~1.5% and PQ: ~1.6%). In 1QFY26, write-offs stood at ~INR5.1b, translating into ~1.3% of TTM AUM (PY: ~1.1% and PQ: 1.35%). CRAR stood at ~20% (Tier 1: ~14.3%) as of Jun'25.

* Management guided for credit costs of ~1.5% in FY26 (vs. ~1.4% in FY25). We estimate credit costs (as % of avg. assets) of ~1.5%/1.4% in FY26/FY27.

Key highlights from the management commentary

* CIFC indicated that FY26 will be focused on collections rather than disbursements. Management acknowledged asset quality weakness (from multiple customer loans) in the unsecured MSME segment but emphasized that the company's MSME portfolio primarily comprises mortgage-backed loans. In the secured MSME segment, CIFC remains confident, expecting resolutions through SARFAESI or arbitration processes.

* CIFC shared that it has reduced quarterly disbursements by ~INR15b from the discontinuation of partnership-sourced CSEL and ~INR5b from the Supply Chain Finance segment. Going forward, the company intends to focus on expanding Consumer Durables (CD) and strengthening in-house digital originations.

Valuation and View

*CIFC reported a subdued quarter, with muted disbursements primarily because of the discontinuation of Partnership CSEL and supply chain finance. Notwithstanding the seasonality, asset quality weakness was pronounced across all segments, which resulted in significantly high credit costs. Further, reported NIM dipped, primarily due to a drop in yields and interest income reversals.

* The stock trades at 3.3x FY27E P/BV. In order to sustain this premium valuation multiple, CIFC will have to give higher confidence in its ability to deliver on its AUM growth and credit costs guidance in FY26. Further, it might have to navigate any further weakness in vehicle demand to deliver healthy AUM growth and asset quality by leveraging its diversified product mix. We estimate a CAGR of ~20%/26% in AUM/PAT over FY25-27 for an RoA/RoE of 2.6%/20% in FY27E. Reiterate BUY with a TP of INR1,650 (premised on 3.8x Mar’27E BVPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412