Buy ACC Ltd For Target Rs.2,400 by Motilal Oswal Financial Services Ltd

Adjusted earnings disappoint as margins shrink

Demand to post 4-5% YoY growth for FY25

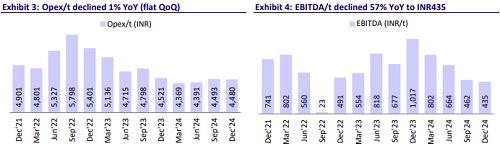

* ACC’s 3QFY25 EBITDA (adj. for the refund of INR6.4b in excise duty pertaining to previous years) declined 22% YoY to INR4.7b (20% miss). EBITDA/t declined 57% YoY to INR435 (est. INR600). OPM contracted 9.4pp YoY to ~9% (est. ~12%). PAT (adjusted for the reversal of certain tax liabilities) declined 57% YoY to INR2.3b (est. INR3.1b).

* Management highlighted that two of its plants (Wadi and Kymore) were shut down for upgrades and maintenance work, leading to inventory drawdown and higher costs, which impacted profitability. The company is investing in WHRS and other RE projects to reduce power costs. Additionally, it is optimizing logistics costs by reducing lead distances and improving the rail road mix. The company anticipates higher cost benefits in FY26.

* We cut our EBITDA estimates by 18%/13%/11% for FY25/FY26/FY27 due to continued weak profitability. ACC trades at 10x/7x FY25E/FY26E EV/EBITDA and USD82/USD77 EV/t. We value the stock at 10x Dec’26E EV/EBITDA to arrive at our revised TP of INR2,400 (earlier INR2,680).

Sales volume above estimates; EBITDA/t at INR435 (down 57% YoY)

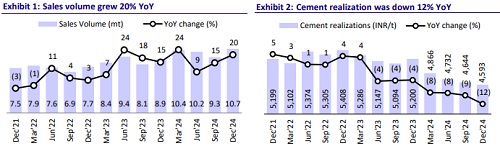

* Adjusted for one-offs, revenue/EBITDA/PAT stood at INR52.6b/INR4.7b/ INR2.3b (up 7%/down 48%/down 57% YoY; up 6%/ down 20%/ down 28% vs. our estimate) in 3QFY25. Sales volumes were up 20% YoY at 10.7mt (up 9% vs. our estimate). Realization was down 11% YoY/ 1% QoQ at INR4,915/t (2% below our estimate).

* Variable cost/t increased 5% YoY (flat QoQ; +2% vs. our est.) and employee cost grew 9% YoY/QoQ (each). Meanwhile, freight cost/other expenses per ton declined ~5%/16% YoY. Overall opex/t declined 1% YoY (+1% vs. estimate). OPM contracted 9.4pp YoY at ~9% and EBITDA/t declined 57% YoY to INR435.

* In 9MFY25, revenue/EBITDA/Adj. PAT stood at INR150.2b/INR15.8b/ INR8.3b (up 3%/down 29%/down 40% YoY). Sales volume was up 14% YoY, while realization declined 10% YoY. EBITDA/t was down 38% YoY at INR523. We estimate revenue/EBITDA/PAT at INR54.8/INR6.0/INR5.0 (+1%/-28%/- 2% YoY) in 4QFY25. Additionally, we estimate OPM at 11% vs. 16%/9% in 4QFY24/3QFY25.

Highlights from the management commentary

* Fuel consumption cost stood at INR1.65/kcal vs. INR1.86/INR1.68 in 3QFY24/2QFY25. Kiln fuel consumption declined to 732kcal vs 739kcal in 3QFY24. Green power share increased 6pp YoY to ~19% (at ~16% in 9MFY25). AFR consumption in kiln increased 40bp YoY to 9.6% (at ~10% in 9MFY25). .

* The company is increasing its grinding capacity at Sindri, Jharkhand, by 1.6mtpa, which is expected to be commissioned in 4QFY25. Additionally, it is setting up a greenfield GU at Salai Banwa, Uttar Pradesh, with a capacity of 2.4mtpa, expected to be commissioned in 1QFY26.

* The company’s cash balance stood at INR25.3b as of Dec’24 vs. INR29.2b as of Sep’24 and INR46.7b as of Mar’24.

Valuation and view

* ACC reported lower-than-estimated operating performance (adjusted for oneoffs). While the company continued to post higher volume growth (up 20% YoY in 3Q), driven by higher MSA volumes, lower realization weighed on margins. We expect margin recovery to be gradual due to weak pricing in a few of its core markets (South and East) and slower-than-expected realization in cost savings through group synergy.

* We cut our EBITDA estimates by 18%/13%/11% for FY25/FY26/FY27. We estimate a CAGR of 34%/41% for EBITDA/PAT over FY25-27, albeit on a low base. We estimate a volume CAGR of ~9% over FY25-27. Additionally, EBITDA/t is estimated to improve to INR690/INR800 in FY26/FY27 vs INR530 in FY25. ACC trades inexpensively at 10x/7x FY26E/FY27E EV/EBITDA. We value the stock at 10x Dec’26E EV/EBITDA to arrive at our revised TP of INR2,400 (earlier INR2,680).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)