Neutral Shoppers Stop Ltd for the Target Rs. 500 by Motilal Oswal Financial Services Ltd

Growth remains tepid; INTUNE store additions guidance cut

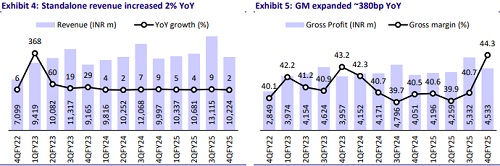

* Shoppers Stop (SHOP) reported in-line results, with muted 2% YoY revenue growth (vs. +8% YoY in 3Q) on a 3% LFL growth (4% YoY in 3Q).

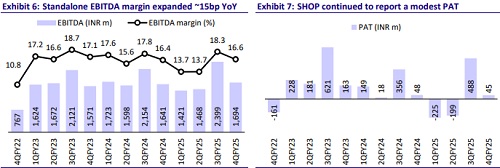

* EBITDA rose 3% YoY, as ~380bp gross margin expansion was largely offset by higher costs and operating deleverage (other opex up 21% YoY).

* The company added a net of 15 stores during 4QFY25 across its formats, with INTUNE's presence rising to 71 stores in 30 cities.

* However, management has trimmed the guidance on INTUNE store additions for FY26 to 40-60 stores (vs. 90-100 store openings earlier). We believe the profitable scale-up of INTUNE remains the key trigger for SHOP.

* We cut our FY26-27 EBITDA estimates by 2-7% due to a slower ramp-up in INTUNE. We build in an FY25-27 revenue/EBITDA CAGR of 8%/10%.

* We value SHOP at 10.5x Mar’27E EV/EBITDA (implies ~30x FY27E pre-INDAS 116 EBITDA) to arrive at our TP of INR500 (vs. INR600). Reiterate Neutral.

Muted growth; GM expansion offset by higher other expenses

* SHOP’s standalone revenue inched up 2% YoY to INR10.2b (in line, 8% YoY in 3Q), driven by 3% LFL growth and 15 net store additions.

* SHOP added five departmental stores (closed two), one Beauty store (closed one), and 15 INTUNE stores (closed three). The respective store count stood at 112, 85, and 71 stores, taking the total to 299 (net addition of 15 stores QoQ).

* Gross profit was up 12% YoY at INR4.5b (6% beat) as gross margins expanded sharply by ~380bp YoY to 44.3% (350bp ahead), likely due to higher intake margins in private brands and optimized markdowns.

* Employee cost increased 12% QoQ/21% YoY, while other expenses jumped ~21% YoY (18% higher).

* As a result, EBITDA inched up 3% YoY to INR1.7b (in line), as the margin expanded ~15bp YoY to 16.6%. GM expansion was largely offset by higher costs and operating deleverage.

* Pre-Ind-AS EBITDA for the quarter stood at a modest INR110m (vs. INR70m YoY), with a pre-Ind-AS margin of 1.1%.

* Depreciation and interest costs were up 11% QoQ/22% YoY.

* Reported PAT came in at INR25m (vs. an estimated loss of INR86m), driven primarily by higher other income (29% ahead of est.).

* For FY25, revenue grew 5% YoY, while reported EBITDA dipped ~2% YoY.

* FY25 average selling price (ASP) grew ~4% YoY to INR1,743, while average transaction value (ATV) improved ~8% YoY to INR4,942.

* CFO (interest + leases) declined to INR247m (vs. INR1.1b in FY24), impacted by higher WC requirements and an increase in lease payments. FY25 capex stood at INR1.7b, resulting in an FCF outflow of INR1.4b (vs. INR0.6b outflow YoY).

INTUNE ramp-up delayed; ex-INTUNE, growth remains muted

* Revenue from INTUNE stood at INR540m (vs. INR630m QoQ), with presence expanding to 71 stores (vs. 59 QoQ) in 30 cities.

* The company opened 49 INTUNE stores in FY25 (vs. a plan of ~75+ stores earlier) and now plans to open 12 stores in 1QFY26 and ~40-60 stores in FY26, which is significantly lower than earlier guidance of 90-100 stores.

* Revenue growth ex-INTUNE was muted at ~1% YoY (vs. ~3% YoY in 3Q).

* Private Brands revenue was flat at INR1.5b (vs. -2% YoY in 3Q).

* Beauty segment revenue stood at INR2.1b (down 6% YoY excluding distribution, but up 3% YoY including distribution).

Highlights from the management commentary

* Demand trends: SHOP witnessed a modest demand recovery during Q4 FY25 despite ongoing macroeconomic challenges. Departmental stores delivered ~3.5% LTL growth, the second quarter of a mid-single-digit LTL growth. Urban markets, particularly in southern India, continued to lag. Overall sentiment improved as the quarter progressed, and management expects the gradual recovery to continue into FY26.

* INTUNE: Management indicated that INTUNE witnessed a challenging quarter, marred by weak demand and higher discounting. SHOP has trimmed guidance on INTUNE store additions to 40-60 for FY26 (from 90-100 earlier). The slightly mature stores continue to deliver INR10k+ annual SPSF, while three store closures in INTUNE were driven by weak organic footfalls in the store locations.

* Capital allocation: SHOP invested heavily in working capital in FY25 (up INR1.4b), primarily for scaling up INTUNE and onboarding new brands. Management aims to reduce working capital by ~INR1b in FY26.

* Store openings: In addition to INTUNE, management has also lowered its FY26 guidance for departmental store additions to 6-7 stores (vs. 10-12 net additions earlier). However, management is looking to fund the growth through internal accruals while focusing on reducing leverage and inventory.

Valuation and view

* SHOP’s medium-term focus has been to: 1) open smaller stores (30k sq ft vs. the existing average of 50k sq ft) to improve store efficiency; 2) rationalize unprofitable stores; 3) revive private label brands; 4) focus on the high-growth and margin-accretive Beauty segment; and 5) ramp up INTUNE.

* We believe improved profitability in the departmental stores and profitable scale-up of INTUNE remain the key to the re-rating of the stock.

* We cut our FY26-27 EBITDA estimates by 2-7% due to a slower ramp-up in INTUNE. We build in an FY25-27 revenue/EBITDA CAGR of 8%/10%.

* We value SHOP at 10.5x Mar’27E EV/EBITDA (implies ~30x FY27E pre-INDAS 116 EBITDA) to arrive at our TP of INR500 (earlier INR600). Reiterate Neutral.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412