Buy ABB India Ltd For Target Rs. 6,700 by Motilal Oswal Financial Services Ltd

Remains focused on new areas

ABB, in its annual report, highlighted its focus on high-growth segments and deeper penetration into Tier 2 cities, along with new product development. During the year, the company continued to benefit from demand for premium products and increased penetration into Tier 2 and Tier 3 cities. ABB continues to see strong potential in segments such as chemicals, pharmaceuticals, automotive, power distribution, water, electronics, and data centers, all of which are expected to attract significant investments, while also considering the global geopolitical situation. It remains focused on new areas of investment, such as green hydrogen, battery storage, and data centers. The company has grown its revenue at a 20% CAGR over the last five years and has doubled its profits over the past four years. Ordering in CY24 was lower than our expectations and we may see a near-term impact on overall ordering due to a slowdown in capex activity. However, with the company’s continued focus on high-growth segments, we expect inflows and execution to ramp up after a few quarters. The stock has corrected in the recent past to take into account this weakness and is currently trading at 48.2x/43.4x P/E on CY26/27 estimates. We reiterate BUY with a TP of INR6,700.

Focus remains on high-growth segments

While the company has shared an optimistic outlook across high-growth segments, especially electronics, semiconductors, data centers, and power distribution, it has remained cautious about global market demand due to continued geopolitical uncertainty, as well as the growth outlook of base industries—such as metals, mining, and oil & gas—on the domestic front. ABB’s order inflow reported a growth of 6.2% in CY24, which was impacted by transient weakness from government and private capex. During CY24, ABB’s EBITDA margin expanded 460bp YoY to 18.9%. Cash flow from operations was broadly flat YoY as NWC increased due to a conscious build-up in inventory to support the order book. FCF remained strong at INR11.2b. Cash balance stood at INR9.4b by the end of CY24.

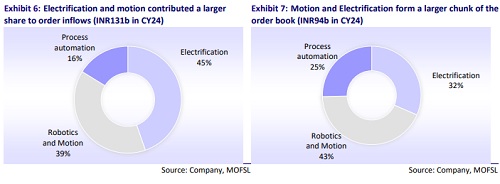

Segmental performance to be driven by electrification and motion segment

Electrification and motion continue to remain the key segments for ABB. The Annual Report for 2024 highlighted the following:

* In CY24, the electrification segment’s growth was led by sectors such as buildings, chemicals, oil & gas, and metals, along with emerging segments such as data centers, renewables, railways, other transportation sectors, and exports. Margins in this segment were supported by product mix and localization initiatives. Growth in the electrification segment is expected to be driven by solutions for low and medium-voltage systems, such as Electric Vehicle (EV) infrastructure, modular substations, distribution automation, power protection, switchgear, etc. Key sectors such as renewables, data centers, automation, power protection, switchgear, etc. Key sectors such as renewables, data centers, buildings, rail, textiles, and food & beverages will continue to drive growth in the segment.

* During CY24, for the motion segment, F&B, data center, rubber, tyre, cement, and oil & gas performed well. Meanwhile, sugar, textiles, metals, and mining remained weak. The motion segment’s growth is likely to be driven by diverse automation needs across sectors, which the company is well-positioned to serve through its portfolio of drives, NEMA motors, IEC LV motors, large motors & generators, and traction motors. The company introduced two advanced motor solutions during the year—IE4 Super Premium Efficiency Motors (Small Frame, Cast Iron) and IE3 Aluminium Motors—designed for lightweight and corrosion-resistant applications. In 2025, the business anticipates initial challenges in discrete industries but remains optimistic about a recovery, supported by improving pricing and growing demand from cement, renewables, water, rail, and green hydrogen.

* During CY24, for the process automation segment, the cyclical industry remained subdued for almost two quarters, though there is a strong buildup of pipeline in the infrastructure space. The process automation segment will continue to focus on sectors such as energy and water supply, goods production, and transportation.

* For the robotics and discrete automation segment, the automotive industry accounted for a major share of the business. Improved traction was also observed in electronics, food and beverages, and service industries, which will continue to remain demand drivers in CY25 as well.

Deeper penetration into Tier II and III cities

ABB is continuously enhancing its outreach to partners and customers, with a focused effort to penetrate deeper into Tier II and Tier III cities. Last year, the company saw a significant rise in orders from Tier III and below cities, led by the Electrification and Motion segment. Tier III and below cities were also a growth hub for the Robotics and Discrete Automation segment, while the Process Automation segment expanded its scope in Tier I and II cities.

Margin performance remains strong; some moderation expected going forward

Over CY20-24, ABB’s gross margin expanded 830bp, driven by the benefits of localization, favorable product mix, and improved pricing. With a CAGR of 2.7% in the number of employees, the company’s employee costs increased at a 10% CAGR during the same period. Other expenses as a % of sales came down 280bp over CY20-24, despite payouts to the parent remaining high at around 8.1% of sales, indicating operating leverage benefits. The company’s purchases from related parties have come down as a % of sales. With some demand moderation observed and the benefit of low-cost RM inventory fading, we expect margins to come down from the current level of 18.9% in CY24. We bake in an EBITDA margin of 18.3%/17.7%/17.1% for CY25/26/27E. ABB expects PAT margin to be broadly around 12-15% going forward.

Sustainability initiatives in focus

In CY24, the company achieved ~86% reduction in Scope 1 and 2 GHG emissions compared to the CY19 baseline. Moreover, 50% of its manufacturing facilities are now water-positive and generate zero waste to landfill. Improvement of water recyclability in CY24 stood at ~47%. Additionally, supplier participation in the company’s ESG program increased to 40.5%, marking a 33% rise from CY23, as the company actively partnered with suppliers in their sustainability journey. The company’s near-term target is to achieve 80% reduction of scope 1 and 2 GHG emissions and 25% reduction of scope 3 GHG emissions by 2030. Its longterm target is to achieve a 100% reduction of scope 1 and 2 GHG emissions and 90% reduction of scope 3 GHG emissions by 2050.

Capex incurred during the year

ABB incurred a capex of INR2.1b during the year, which was directed towards the upgrade and expansion of the motors factory and office in Faridabad, renovation of the administration building in Nelamangala, upgrade and expansion of Gas Insulated Switchgear shop floors, factory acceptance test and production offices in Nashik, modernization of office space and warehousing and storage for the large motor division in Vadodara, and the establishment of a new sales and marketing office in Mumbai. We have built in a capex of INR2.5b/3.6b/4.1b over CY25/26/27.

We expect margin to moderate from highs of CY24

With some demand moderation observed and the benefit of low-cost RM inventory fading, we expect margins to come down from the current level of 18.9% in CY24. We bake in EBITDA margin of 18.3%/17.7%/17.1% for CY25/26/27E. ABB expects the PAT margin to be broadly around 12-15% going forward.

Valuation and recommendation

We expect ABB to be relatively better placed than peers, as 1) the company has more than 50% exposure to high and moderate growth segments, 2) it has better control over margins through cost efficiencies, even if gross margins come off from current levels in future, and 3) it has the ability to gain more from exports, as it is increasingly preferred by group companies for exports. We incorporate AR2024 details and expect revenue to grow 13%/16%/16% in CY25/26/27E. We bake in margins of 18.3%/17.7%/17.1% for the same period, translating into PAT growth of 10%/12%/11% for CY25/26/27E. We reiterate our BUY rating with a DCF-based TP of INR6,700, implying a multiple of 60x P/E on Mar’27E EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412