Neutral Phoenix Mills Ltd For Target Rs.1,810by Motilal Oswal Financial Services Ltd

Non-core business drags financials; core portfolio going strong

LFL consumption growth 7% up in 9M

* Phoenix Mills (PHNX) reported revenue of INR9.8b, -1%/6% YoY/QoQ (6% below estimate) and EBITDA came in at INR5.5b, flat/7% YoY/QoQ (10% below estimate). Margins were at 56.7%, up 73bp/30bp YoY/QoQ (246bp below estimate).

* Adj. PAT stood was -5%/21% YoY/QoQ at INR2.6b (6% below estimate). Margins were at 27.2%, -117bp/339bp YoY/QoQ. (17bp above estimate).

* In 9MFY25, revenue was up 5% at INR28b. EBITDA was up 3% at INR16b. Margin was down 76bp YoY at 57.3%. Adjusted PAT stood at INR7b, down 7% YoY. PAT margin was at 25.6%, down 332bp YoY.

* In 3QFY25, Phoenix Logistics and Industrial Parks Private Limited (PLlPPL), the subsidiary of PHNX, divested its entire shareholding in Janus Logistics and Industrial Parks Private Limited (100% subsidiary) for a consideration of INR0.5b. PAT of INR0.2b recognized by PLIPPL in this transaction is treated as an exceptional item for PHNX.

* For 9MFY25, PHNX generated net cash flow from operations (post interest) of INR12.2b and incurred INR17.6b on capex, up INR3.8b from 1HFY25 (land acquisition and construction cost). It also received INR2.7b from JV partners, but the consolidated net debt was lower at INR23.2b, (v/s INR24.1b in 2QFY25).

Upcoming malls in Thane and Coimbatore; expansion of Palladium, Mumbai

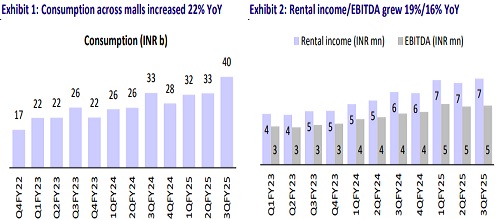

* Total consumption stood at ~INR40b, up 21% YoY, driven by a healthy ramp-up in Palladium, Millennium, and Mall of Asia at Ahmedabad, Pune, and Bengaluru, respectively. Among the mature assets, PMC Mumbai rentals delivered 9% YoY growth, aided by upgrade measures implemented in the last few years.

* In 3QFY25, on a like for like basis (excluding the contribution from new malls), consumption rose 10% YoY. In 9MFY25, on an overall basis, jewelry/hypermarkets, the key categories, outperformed with 27%/11% YoY growth, while electronics stood at 1% YoY. The entertainment and multiplex segment declined 3% YoY. Overall LFL growth in 9M was at 7%.

* Gross retail collections at INR8.4b were up 21% YoY and the company reported rental income of INR5.1b, up 12% YoY. In 9MFY25, retail collections and rental income were at INR24.8b and INR14.7b, up 27% and 21%, respectively.

* Retail EBITDA was at INR5.1b, up 15% YoY in Q3.

* Weighted average trading occupancy was at 91% (v/s 87% in 4QFY24).

* Palladium Ahmedabad; Mall of the Millennium, Pune; and Mall of Asia, Bengaluru witnessed a push in trading occupancy to 97%/91%/81%, respectively (v/s 86%/76%/57% in 4QFY24). However, occupancy in Phoenix United, Lucknow was down 3pp YoY to 78%.

Office occupancies decline while Hospitality occupancies rise

* Hospitality: Occupancy was at 85% for St. Regis in 3QFY25 (v/s 83% in 3QFY24), whereas Marriott Agra was 83% occupied. In Q3FY25, St. Regis/Marriott reported ARR of INR22,343/INR7,468, up 11%/21% YoY.

* Total income in 3QFY25 for St. Regis and Marriott Agra was INR1,480m/INR200m, up 9%/16% YoY. EBITDA stood at INR720m/INR73m up 16%/22% YoY, with a margin of 49% at St. Regis and 37% at Marriott, Agra.

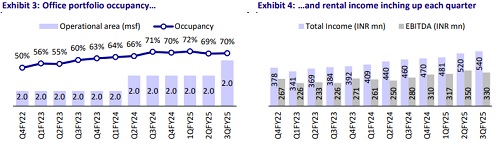

* Commercial performance: Occupancy in the office portfolio was at 70%. Gross leasing in Q3FY25 was ~0.17msf, with ~4msf area under development. Income from commercial offices in Q3FY25 increased 7% YoY to INR530m and EBITDA came in at INR330m, up 17% YoY. Gross rent in the portfolio stood at INR112/sf/month.

* Construction of Asia Towers – Bangalore has been completed, with OC received. The launch is expected in 4QFY25. PHNX is also expected to deliver 1.6msf of office assets across Pune and Chennai by the end of CY25. We expect a 42% CAGR in its office rental income over FY24-FY27.

Valuation and view

* While new malls continue to ramp up well, PHNX is taking measures to accelerate consumption at mature malls. These initiatives, along with a further increase in trading occupancy, will help sustain healthy traction in consumption.

* We have added Thane, Coimbatore, and Mohali malls to the estimates, assuming optimal rentals and valuing business at 25x EV/EBITDA further netted for CAPEX to be incurred on the malls. Additionally, we have given a discount of 30% to arrive at NAV of INR56.9b.

* That said, we remain confident in the long-term consumption growth, which should be at least ~7-8%. We value the mature malls at 20x EV/EBITDA and the new malls at 25x EV/EBITDA. Reiterate Neutral with a revised TP of INR1,810.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412