Buy 360ONE WAM Ltd For Target Rs.1350 by Motilal Oswal Financial Services Ltd

Acquires B&K Sec.; PAT beat led by TBR and other income

* 360 One WAM (360 ONE) reported net revenue of INR6b (7% beat), up 38% YoY in 3QFY25. For 9MFY25, net revenue grew 41% YoY to INR17.9b.

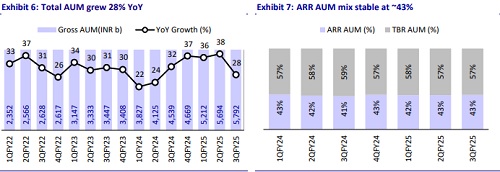

* Total AUM rose 28% YoY to INR5.8t (in line), driven by 33% YoY growth in ARR AUM to INR2.5t (in line) and 24% YoY growth in TBR AUM to INR3.3t (in line) during the quarter.

* Opex grew 38% YoY to ~INR3.2b, 7% higher than our estimate, due to higher-than-expected admin costs, while employee expenses were in line. The cost-to-income ratio was largely flat YoY at 52.8% in 3QFY25 (vs. our estimate of 52.4%).

* PAT came in at INR2.7b reflecting a growth of 42% YoY (17% beat). For 9MFY25, PAT came in at INR7.7b, growing 37% YoY.

* Management expects TBR contribution in the revenue mix to be in the range of 20-25%, NII at 20%, and core ARR income at 60% in the long run.

* The proposed acquisition of B&K Securities (B&K) will add a new research capability across all platforms of 360 ONE and also provide entry into the IB segment. Since the cost structure of B&K is aligned with 360 ONE, the acquisition will be EPS accretive.

* We raise our FY25E EPS by 5% considering its 3Q performance. However, we cut our FY26/FY27E EPS by 4%/3% to factor in the decline in transactional revenue. We reiterate our BUY rating with a one-year TP of INR1,350 (based on 38x Sep’26E EPS).

The new acquisition to enhance capabilities

* 360 ONE’s Board has proposed the acquisition of one of India’s leading brokerage and corporate advisory houses – B&K.

* B&K is highly rated in the institutional equity broking space with 55+ research analysts. The company also has a recently launched ECM segment offering merchant banking services and a corporate treasury business with an AUM of INR140b.

* The acquisition provides an opportunity to introduce research as a product offering across all segments in existing geographies as well as new market segments through B&K.

* The budding ECM segment provides an opportunity to (a) offer wealth plus IB services to HNIs/ UHNIs and (b) capture deal flow in the AMC segment.

* The corporate treasury business provides an opportunity to deepen the platform and acquire new corporate clients.

* The acquisition will result in a dilution of 4.2% for shareholders of 360 One WAM. However, according to our PAT forecasts for B&K and assuming an FY26E P/E of 15x (similar to DAM Capital), we expect a value accretion of INR184b.

Flows remain robust; core revenue in line

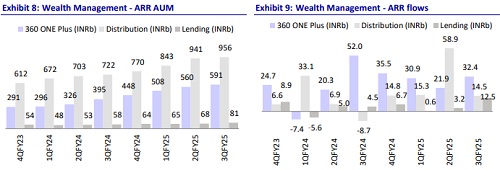

* 360 ONE’s ARR AUM at INR2.5t (in line) grew 33% YoY, driven by net ARR inflows of INR66.4b in 3QFY25. While wealth management ARR net flows grew 24% YoY, AMC net flows declined 38% YoY largely due to weak equity markets.

* Wealth Management ARR AUM grew 39% YoY to INR1.63t driven by 49%/32%/40% YoY growth in 360 One Plus/ Distribution/ Lending AUM.

* Asset Management AUM grew 23% YoY to INR852b driven by 29%/16%/34% YoY growth in discretionary/AIF/MF AUM. However, AUM declined slightly (-1%) on a sequential basis due to negative MTM in equities and redemptions in the matured PE funds.

* ARR yields declined YoY to 69bp (vs our est. of 68bp) largely due to a decline in retentions of the asset management segment. Wealth management yields declined YoY to 73bp (76bp in 3QFY24), while asset management yields declined to 65bp (72bp in 3QFY24).

* The decline in yields was offset by stable net flows, resulting in 26% YoY growth in ARR income to ~INR4.3b (in line). During 9MFY25, ARR income grew 24% YoY to INR12b.

* TBR income grew 76% YoY to INR1.8b (14% beat), driving the 7% beat in net revenue at INR6b. However, the current growth in TBR is not sustainable according to the management, and the contribution is expected to decline to 20-25% (from 30% currently).

* Employee costs jumped 40% YoY to INR2.4b (in line), and other admin costs grew 33% YoY to INR789m (22% higher than our estimate).

* Other income came in at INR732m (146% beat) owing to a higher proportion of unlisted equity in 360 ONE’s book, resulting in 42% YoY growth in PAT to INR2.7b (17% beat)

Highlights from the management commentary

* AMC AUM witnessed an MTM impact, which was offset by strong inflows, especially in the PE and multi-asset segments. Flows in the wealth management business remain robust, but some tiredness towards investing in equities is being witnessed.

* The company maintains the guidance of 20-25% AUM growth, with 10-12% of AUM added through net inflows.

* RM attrition in the Northern Belt may lead to a 5% reduction in revenue from the Delhi office, but new senior hires in that geography will take the strength higher than the old team, resulting in 40-50% higher revenue in the next 5-6 years.

Valuation and view

360ONE maintains a strong position in the industry, reflected by robust flows and consistent performance. The company’s plans to diversify across client segments (mass affluent) and geography (lower-tier cities) is gaining traction and the global platform has also seen green shoots. While we have not factored in incremental revenue from the acquisition of B&K, the transaction is likely to be value-accretive. We raise our FY25E EPS by 5% considering its 3Q performance. However, we cut our FY26/FY27E EPS by 4%/3% to factor in the decline in transactional revenue. We reiterate our BUY rating with a one-year TP of INR1,350 (based on 38x Sep’26E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)