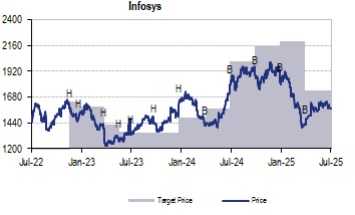

Buy Infosys Ltd For Target Rs. 1,840 By JM Financial Services

INFO reported 2.6% cc QoQ revenue growth (organic: 2.2% cc), ahead of JMFe: 1.8%. Quality of revenue improved too, reflected in 60bps QoQ decline in third-party cost. Ramp-up of deals previously won and seasonality (higher working days) helped. Impressively, INFO improved realisations further, on top of 3.5% increase in FY25. Project Maximus and improved adoption of its enterprise AI platform explain that. Productivity improvement from enterprise AI platform is not only helping INFO drive non-linear revenue, but also improve win ratio in vendor consolidation scenarios. 44% QoQ increase in deal wins (USD 3.8bn), including a mega deal, offers evidence. Despite these, INFO narrowed its organic growth guidance from 0-3% to 0.6-2.6%. Prima-facie, this (cut at the upper-end) appears negative. We view it otherwise though. Strong 1Q and a normal seasonality (1H>2H) means INFO’s guidance is not based on 2H recovery hope. Symbolically too, a narrow range indicates higher confidence. Moreover, ours (and Street’s) estimates were anyways not at the upperend. In fact, we now move our FY26E organic cc growth to 2.4%, closer to the (revised) upper-end. Marginal cut to margin estimates keep EPS largely unchanged. But improved confidence on numbers should drive re-rating. We retain BUY with INR 1,840 TP.

* 1QFY26 growth - higher and better: INFO reported 2.6% cc QoQ rev growth versus JMFe/Cons. est. of 1.8%/1.5%. Acquisitions contributed 40bps. Among verticals, EURS (+9% QoQ USD), Communications (+7.1%) and Manufacturing (+5.8%) led the growth. This was driven likely by lower base and mega deal ramps. Third-party items declined 60bps QoQ, implying c.3.2% Services growth, a positive. EBIT margins contracted 20bps to 20.8%, missing estimates (JMFe: 21.4%). Wage hike (-100bps), FX (-30bps) and Sales investments (-20bps) were headwinds. These were offset by Project Maximus benefits (+70bps), lower amortisation (+40 bps) and lower third-party costs (+20bps). PAT came in at INR 69.2bn beating Cons. est. of INR 67.8bn (JMFe : INR 70.2bn).

* FY26 guidance - narrowed: INFO revised its FY26 cc revenue growth guidance from 0-3% earlier to 1-3% now. Recent acquisitions – MRE and The Missing Link – will contribute c.40bps to this, implying organic guidance of 0.6-2.6%. 1-3% guidance translates into (0.4%)-1% CQGR through 2Q-4QFY26. Though weak, INFO’s pronounced seasonality makes CQGR maths irrelevant, in our view. We take comfort in the fact that INFO has not built any macro improvement even at the upper end. Further, a still front-loaded growth cadence (whose visibility should be higher) makes even the upper end achievable. Improved deal wins – INFO won USD 3.8 bn of TCV, +44% QoQ, healthy pipeline and its improved win ratio in vendor consolidation scenarios offer further comfort. Margin guidance was retained at 20-22%. With wage hike behind and lower third-party item ahead, we see gradual improvement in margins from hereon.

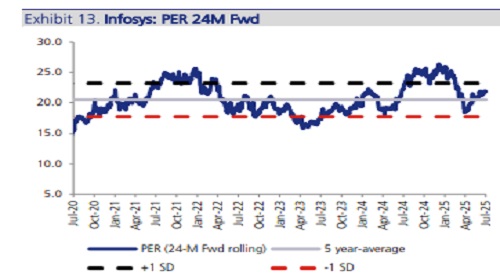

* EPS largely unchanged; Retain BUY: We now build 2.4% organic cc growth for FY26E (vs. c.1.5% earlier). We maintain our FY26E margin assumptions despite 1Q miss as we now assume next wage hike in 1QFY27 (vs 4QFY26 earlier). Though an EPS neutral results, improved confidence on estimates should drive better multiples. BUY.

Key Highlights from the call

* Demand: Revenue grew 2.6% QoQ in cc terms, with growth being broad-based across verticals and geographies, and 0.4% out of this grew due to acquisitions. Financial Services and Manufacturing posted strong YoY trends, though discretionary spending across Retail, High-tech, and Communication remained under pressure. Clients continued to engage in vendor consolidation, GCC setups, AI-transformation, and cost takeout initiatives, even as decision cycles stayed elongated. Despite cautious spending, leadership noted that the pipeline remains healthy, supported by traction in Enterprise AI and large deal activity.

* Outlook: Infosys revised its FY26 revenue growth guidance to 1-3% in cc terms (earlier: 0-3%), citing improved visibility for H1 but continued macro uncertainties including tariff overhangs and geopolitical tensions. Management noted that the guidance incorporates headwinds from lower third-party revenues and excludes recently announced acquisitions. Commentary suggests that H1 is likely to be stronger than H2 due to seasonality. Management indicated its readiness to re-assess guidance as the external environment evolves.

* Margin: Operating margin for Q1 stood at 20.8%, reflecting a sequential decline of 20bps. The drop was primarily driven by 100bps of headwinds from compensation increases and higher variable payouts, along with 30bps impact from currency movement and 20bps from incremental sales investments. These were partially offset by 70bps of benefits from improved realization (Project Maximus and seasonality), 40bps from lower amortization of intangibles, and 20bps from reduced third-party costs. Management reiterated margin guidance of 20–22% for FY26 and highlighted multiple levers – pricing, third-party cost optimization, and Maximus offset by transition costs from large deals and ramp-up related pressures.

* Bookings: Infosys reported 28 large deals in Q1 FY26, aggregating to a TCV of USD 3.8bn, with 55% classified as net new. The quarter included multiple vendor consolidation wins totaling USD 1bn+, including a mega deal. They highlighted that wins were broad-based across verticals, with 9 deals in communications, 6 in EURS, 5 in manufacturing, and 4 in financial Services, and 2 each in high-tech and retail. Regionally, 20 deals came from the Americas, 6 from Europe, and 2 from the rest of the world. Management emphasized the robustness of the pipeline and cited strong client interest in cost optimization and AI-led transformation, despite prolonged decision cycles and cautious discretionary spend.

* Segments: Leadership reported that Financial Services witnessed strong traction in Q1, driven by transformation programs across capital markets, commercial banking, and wealth management, with Infosys positioned as a preferred AI partner for 10 of its top 20 FS clients. Manufacturing delivered strong YoY growth in cc terms, aided by large deal ramp-ups and client focus on cost takeout, supply chain redesign, and footprint rationalization. While EURS posted mixed trends amid economic uncertainty, deal pipelines remained robust across energy transition and cloud transformation themes. Retail and Communication continued to face headwinds from elongated decision cycles and muted discretionary spend, whereas High-tech remained subdued due to cost pressures and GenAI-related budget reallocations.

* Gen AI: Infosys noted continued momentum in Enterprise AI programs, underpinned by 300+ deployed AI agents across business and IT functions. Client engagements spanned areas such as supply chain optimization, contract automation, dynamic pricing, customer service, and developer productivity, delivering tangible efficiency gains. The company reiterated its leadership positioning and emphasized AI as a key driver for consolidationled wins, revenue generation, and long-term differentiation.

* Wage hike: Leadership noted that wage hikes were fully rolled out in Q1 FY26, with the first phase implemented in January for junior and mid-level employees and the second phase effective April for the senior workforce. They highlighted that the impact of wage hikes along with higher variable payouts was absorbed during the quarter, contributing to a 100bps headwind on margins.

* Supply: Infosys closed Q1 FY26 with a headcount of 323,788, reflecting a flattish trend QoQ as the company prioritized utilization and productivity levers. They highlighted that attrition inched up marginally to 14.4%, while utilization (excluding trainees) improved by 30bps QoQ to 85.2% and including trainees rose 80bps to 82.7%, indicating improved deployment efficiency. 1QFY26 resul

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361