Buy Hindustan Aeronautics Ltd For Target Rs. 5,100 by Motilal Oswal Financial Services Ltd

Charting the next frontier in Defense!

Hindustan Aeronautics (HAL) is a market leader in aerospace defense. It boasts a strong order book of INR1.8t as of 31st Mar’25, along with a promising prospect pipeline of INR6t, which is likely to be awarded over the next few years. The company is transitioning from a traditional licensed model to an indigenized model and is currently working on marque projects such as Tejas Mk1, Tejas Mk1a, Su-30 upgrade, Dornier-25, and Light Utility Helicopter (LUH), et al. These projects are anticipated to fuel manufacturing revenue growth for HAL. Based on recent announcements and our discussions with industry experts, the supply of engines from GE for Tejas Mk1A is likely to commence during FY26. We expect HAL to benefit from 1) a strong pipeline of projects, 2) execution scale-up aided by large platform orders, 3) a stable stream of RoH revenues, 4) backward integration, and 5) a healthy 29%/33%/29% revenue/EBITDA/PAT CAGR over FY25-27. We initiate coverage on the stock with a BUY rating with a TP of INR5,100 based on average of DCF and 32x P/E on Mar’27 estimates. We believe that near-term catalysts will emerge when aircraft deliveries commence as engine supplies from GE resume, while medium- to long-term triggers will stem from the finalization of orders for 97 Tejas-Mk1A, Tejas MK-II, LUH, Advanced Medium Combat Aircraft (AMCA), et al.

Positive industry tailwinds to benefit HAL

The IAF continues to remain committed to upgrading and modernizing the existing fleet and strengthening its capabilities along the borders. In a recent development, the IAF has prioritized acquiring radars, combat aircraft, helicopters, and mid-air refuelers for FY25-26, focusing on indigenous upgrades and self-reliance under Aatmanirbhar Bharat. IAF listed low-level radars, light combat aircraft, light utility helicopters, multirole helicopters, and the leasing of mid-air refueler aircraft as its key priorities for acquisition for the coming financial year where HAL already is present. The IAF also plans to prioritize the indigenous upgrade of Russian-origin Sukhoi 30 fighter jets, along with acquiring signal intelligence and communication jamming aircraft and airborne early warning and control aircraft, which we believe again is positive for HAL.

Transitioning from a licensed model to an indigenized model

HAL is shifting its focus from a licensed business model to an indigenized model. The company started as a licensed player and has now transitioned towards manufacturing aircraft and helicopters. Major platforms of HAL across aircraft such as Light Combat Aircraft (LCA), Dornier-228 (Do-228), and Basic Trainer Aircraft (HTT-40), and across helicopters such as LCH, LUH, and Naval Utility Helicopter (NUH) are already part of the positive indigenization list of the Ministry of Defense (MoD). HAL is also continuously increasing the indigenized content across its platforms and expanding the SME network of vendors. We expect the company to continuously benefit from indigenization.

Working towards faster delivery of Tejas Mk1A from FY26

HAL is already expanding its facility in Nasik to scale up the production of aircraft, which is expected to be operational by 1HFY26. Along with this, the company has also outsourced a large number of structures and components to private players so that HAL can focus on the integration of sophisticated systems. HAL has outsourced the production of key fuselage modules to several private companies, including L&T, Alpha Tocol, Tata Advanced Systems, and VEM Technologies. Most of the avionics will be manufactured by BEL, and radars in the initial deliveries will be procured from ELTA Systems, Israel. Engines are procured from GE, while armament is either imported or will be manufactured domestically in the future. Once engine supplies resume from GE to around 12 deliveries per year, HAL will be able to fast-track deliveries of aircraft starting from FY26.

Strong order book and recent inflows underpin revenue visibility

HAL’s order book stood at ~INR1.8t as of Mar’25, providing visibility for the next three years. This year, the order book has strengthened, following inflows of ~INR1.2t during FY25. This growth has been driven by projects such as 12 additional Su-30 MKI aircraft (INR135b), 240 aero-engines (AL-31FP) for Su-30 MKI aircraft (INR260b), avionics upgrades of Dornier-228 transport aircraft, 156 helicopters for LCH Prachand etc. We believe that the manufacturing order book had bottomed out in FY24 and is poised for healthy growth as there is clear visibility for the various platforms manufactured by HAL. We expect an addressable market of INR6t for HAL over the next 3-4 years, which would materialize from the finalization of large-scale platforms such as 97 aircraft of Tejas Mk-1, Tejas Mk-II, AMCA, and Twin Engine Deck Based Fighter (TEDBF), as well as the RoH order book stemming from existing deliveries within the current order book.

Finalization of additional orders to be the next trigger

We believe the next trigger for HAL will come from the finalization of further orders related to 97 Tejas Mk-1A totaling around INR650b and commencement of aircraft deliveries. Company has alreade received contract for 156 helicopters for LCH Prachand worth INR627b. Moreover, decision-making on engine supplies for Tejas Mk-II from GE would result in the finalization of the Tejas Mk-II order for HAL worth INR600-700b by FY27/28. An incremental order of 187 LUH worth nearly INR90- 100b will also be in the works during FY27.

Execution ramp-up likely from FY26

With a strong order book of ~INR1.8t as of 31st Mar’25 and an addressable market of INR6t over the next 4-5 years, we project HAL’s revenue to record an 19% CAGR over FY24-27. We expect execution on large platforms such as Tejas Mk-1A to scale up from FY26 along with the execution of orders for LUH, LCH Prachand, ALH Dhruv, HTT-40, Dornier-25, Su-30 upgrade, 12 aircraft, and RD-33 engines.

New and advanced platforms to be the next long-term growth drivers

We believe that future opportunities for HAL will arise from AMCA and TEDBF. This is likely to be a long-term opportunity for HAL, and we expect it to reflect only after FY29. HAL has already been selected as the primary manufacturer for the AMCA, India's fifth-generation stealth fighter jet, and will be responsible for developing and producing the majority of the aircraft, including the prototypes. The TEDBF is being designed and developed by the Aeronautical Development Agency (ADA) and will be manufactured by HAL.

RoH will continue to provide revenue stability

HAL’s RoH revenue has recorded a 17% CAGR over FY16-24. Until manufacturing revenue ramps up, based on the delivery schedules of LCA Tejas Mk1A, LUH, ALH, AL-31FP, and RD-33, ROH will continue to provide secular growth visibility. Management has a stable growth guidance of 8-9% for this segment, with a higher uptick expected once the manufacturing segment ramps up.

Exploring MRO as the next big opportunity

HAL is exploring opportunities in MRO services within the civil sector and even beyond India. The company has already commenced operations at the Nashik facility and is negotiating arrangements with Airbus for its A320 aircraft. Additionally, HAL aims to capitalize on the growing fleet of aircraft in India, which will translate into an increase in demand for maintenance services and MRO facilities

Continuous focus on R&D and technology tie-ups

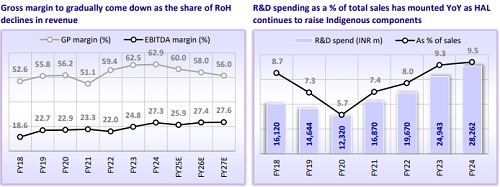

HAL has a strong emphasis on R&D, for which it has 10 dedicated R&D centers. During FY18-23, R&D expenses have clocked a CAGR of 9.0%, and the company has hiked R&D expenses as a % of sales to 9.5% in FY24 from 6.0% in FY20. This has resulted in a quantum jump in the cumulative number of IPRs held by HAL from 108 in FY18 to 1,026 in FY24. Along with in-house R&D, it also has collaborations with reputed institutions such as DRDO, IITs, and IISC, alongside partnerships with foreign OEMs for joint development of products and technology transfers.

Financial outlook

We expect the overall revenue to record a CAGR of 29% over FY25-27, primarily driven by a sharp scale up in manufacturing revenue and a 5% CAGR in RoH and spares. We project its EBITDA margin to remain strong at 25.9%/27.4%/27.6% for FY25/ FY26/FY27, fueled by indigenization efforts taken by the company. With an annual capex of INR30b/INR40b/INR50b and comfortable working capital, we expect PAT to register a 29% CAGR over FY25-27. With improving revenue and stable margins, we expect RoE/RoCE to remain comfortable, reaching 22.5%/23.2% by FY27.

Valuation and recommendation

HAL is currently trading at 31.9x/25.9x FY26E/FY27E EPS. We initiate coverage on the stock with a BUY rating and a TP of INR5,100 premised on average of DCF and 32x P/E on Mar’27E estimates.

Key risks and concerns

Key risks would include: 1) slower-than-expected finalization of large platform orders, 2) further delays in deliveries of key components such as engines for Tejas Mk1A, 3) delays in payments from MoD, and 4) increased involvement of the private sector.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412